Buy Coromandel International Ltd for the Target Rs. 2,600 by Motilal Oswal Financial Services Ltd

Broad-based growth across segments

Operating performance in line with estimates

* Coromandel International (CRIN) reported a robust operating performance in 4QFY25 (EBIT up 62% YoY), aided by strong growth in both the Crop Protection business (EBIT up 60% YoY) and the Nutrients and Allied business (Adj. EBIT up 38% YoY; includes INR509.4m toward an adjustment for the write-down of certain assets across plants). Margin expansion was driven by improved manufactured fertilizer volume (up 23% YoY), favorable operating leverage, and benign raw material prices.

* The company anticipates a positive FY26, supported by stabilizing agrochemical prices, improved inventory levels, favorable weather across key regions, and sustained momentum in the Fertilizer business. It expects strong revenue growth (high double-digit) and maintains guidance for a 40% rise in fertilizer EBITDA/MT over the next 2-3 years. Margin expansion will be driven by backward integration in the Fertilizer business, along with higher demand, new products, and a strategic shift to high-margin offerings in the Crop Protection business.

* We largely maintain our FY26/FY27 earnings estimates and value the company at ~28x FY27E EPS to arrive at a TP of INR2,600. Reiterate BUY.

Crop Protection business drives strong operating performance

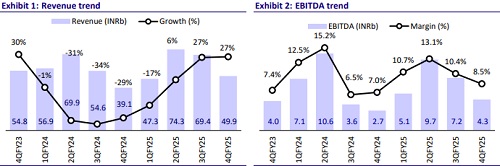

* CRIN reported total revenue of INR49.8b (est. in line) in 4QFY25, up 27.5% YoY, led by higher sales volume. Total manufacturing fertilizer volumes (NPK+DAP) grew 13% YoY to 0.6mmt and total phosphate fertilizer manufacturing volumes (including SSP) rose 23% YoY to 8.08mmt.

* Nutrient & Other Allied business revenue rose 28% YoY to INR43.2b, while Crop Protection business revenue grew 24% YoY to INR6.9b.

* EBITDA jumped 56% YoY to INR4.3b (est. in-line). According to our calculations, manufacturing phosphate EBITDA/mt (including SSP) stood at INR4,177 (up 45% YoY), while EBITDA/mt for phosphate fertilizers (DAP and NPK) stood at INR5,146 (up 58% YoY).

* EBIT for the Nutrient & Other Allied business grew 18% YoY to INR3b (if not adjusted for a write-down of INR509.4m for certain assets across plants, EBIT grew 38% to INR3.5b). EBIT for the Crop Protection business grew 60% YoY to ~INR1b, while margins expanded 330bp YoY to 14.5%. ? Adjusted PAT stood at INR3b (est. INR2.8b), up 89% YoY.

* For FY25, revenue/EBITDA grew 9%/10% YoY to INR240b/INR23.9b, while adj. PAT rose 9.8% YoY. We are building in 12%/18%/23% revenue/EBITDA/Adj. PAT CAGR over FY25-27.

Highlights from the management commentary

* Baobab Mining and Chemicals Corporation (BMCC), Senegal: The company has increased its stake in BMCC to 54%, making it a subsidiary. Going forward, the company expects consistent supply of rock phosphate from BMCC, which can meet one-third of the total requirements.

* NACL: CRIN is awaiting regulatory approval for the acquisition, which is expected to help restore NACL’s margins back to 10-11% from 4-5%. Backed by strong manufacturing capabilities and full capacity utilization, especially at the Dahej plant, the company also anticipates improved cash flow and gradual debt reduction, supported by strategic opportunities.

* NanoDAP: During the year, the company marketed 2.6m bottles and maintained a market share of 33%, achieving nearly 80% liquidation of the stock. The company is also exploring export opportunities for Nano DAP across various countries.

Valuation and view

* The company remains confident in its growth trajectory for FY26, backed by favorable market dynamics, better product mix, and operational efficiencies across segments. With expectations of strong revenue growth (high double digit) and improvement in margins, including a targeted recovery in NACL's profitability, the company is well-positioned to deliver sustained performance going ahead.

* CRIN’s longer-term outlook is further supported by: 1) backward integration (full integration of the Kakinada facility by CY26; 2) product diversification (nano fertilizers and new products across Fertilizer and Crop Protection); 3) the scale-up of CDMO business; and 4) the acquisition of BMCC.

* We expect a CAGR of ~12%/18%/23% in revenue/EBITDA/adj. PAT over FY25-27. We value CRIN at ~28x FY27E EPS to arrive at our TP of INR2,600. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)