Buy Shriram Finance Ltd for the Target Rs.780 by Motilal Oswal Financial Services Ltd

Elevated surplus liquidity impacts NIM again; credit costs benign

Earnings in line; NIM contracted ~15bp QoQ; increased slippages into Stage 2

* Shriram Finance’s (SHFL) 1QFY26 PAT rose ~9% YoY to ~INR21.6b (in line). NII in 1QFY26 grew ~10% YoY to INR57.7b (in line). Credit costs were benign at ~INR12.9b (~18% lower than MOFSLe) and translated into annualized credit costs of ~1.9% (PQ: 2.4% and PY: 2.1%). PPoP grew ~9% YoY to ~INR41.9b (in line).

* Other income grew ~57% YoY to INR3.7b, driven by higher investment income of INR1.3b. Opex rose ~21% YoY to INR19.5b (~5% higher than MOFSLe), due to higher employee expenses driven by annual increments and incentives.

* Yields (calc.) were stable QoQ at 16.7%, while CoB declined ~8bp QoQ to 9.05%, resulting in spreads increasing by ~10bp QoQ to ~7.65%. Reported NIM contracted ~15bp QoQ to ~8.1%, primarily due to elevated surplus liquidity on the balance sheet, driven by strong mobilization of retail deposits during the quarter. Current surplus liquidity stood at ~INR280b (five months of debt repayments); however, it is expected to gradually reduce and normalize to ~INR18b (three months of debt repayments) over the next two to three quarters.

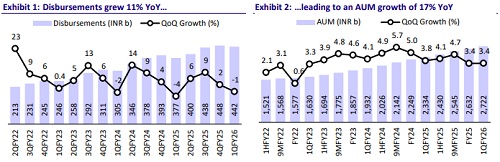

* AUM stood at INR2.63t, growing 16.6% YoY/3.4% QoQ. Management indicated that demand in rural areas remains healthy, with segments such as used CVs and MSME continuing to perform well and showing no significant stress, particularly in rural and semi-urban regions. Although demand was slightly soft during the quarter due to seasonal factors (such as early monsoons), it is expected to improve going forward, driven by a recovery in rural markets.

* Asset quality (GS3) remained broadly stable during the quarter, with net slippages well contained and credit costs exhibiting sequential moderation. While there was a slight increase (of ~40bp QoQ) in Stage 2, management attributed it to seasonality and the early onset of monsoon and was confident of rolling them back in the next quarter.

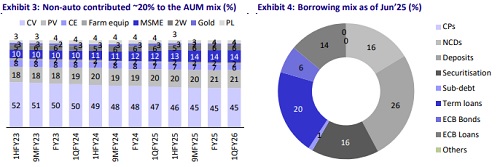

* SHFL has positioned itself to capitalize on its diversified AUM mix, improved access to liabilities, and enhanced cross-selling opportunities. The company has yet to fully utilize its distribution network for nonvehicle products. SHFL is our Top Idea (refer to the report) in the NBFC sector for CY25, as we find its valuations of 1.6x FY27E P/BV attractive, given its strong franchise and the potential to deliver a ~16%/~17% AUM/PAT CAGR over FY25-27E, along with an RoA/RoE of ~3.2%/16% by FY27. Reiterate BUY with a TP of INR780 (premised on 2x FY27E BVPS).

Asset quality broadly stable; stage 2 rises ~40bp QoQ

* GS3 was largely stable QoQ at 4.55%, while NS3 improved 5bp QoQ to 2.6%. Net slippages were higher YoY and stood at INR9b (PY: INR8b and PQ: INR14b). PCR on Stage 3 rose ~1pp QoQ to ~44%. (PQ: ~43%). PCR on Stage 1 was stable QoQ at 3.5%, while on Stage 2, it rose 30bp QoQ to ~8.3%.

* Stage 2 assets rose ~40bp QoQ to 7.3%. (PQ: 6.9% and PY: 6.7%).

* Management guided for credit costs (as % of assets) of <2% for FY26, and we estimate credit costs of ~1.95%/2.0% (as % of assets) in FY26/FY27.

Potential NIM expansion on liquidity normalization and lower CoB

* Management indicated that it plans to reduce ~INR100b of excess liquidity on its balance sheet over the next 2 to 3 quarters. Normalization in surplus liquidity and a decline in the overall cost of borrowings (where incremental CoF was down ~40bp QoQ) are expected to result in NIM expansion in subsequent quarters.

* SHFL is well-positioned to benefit from a declining interest rate environment, and we model NIMs of 8.0%/8.4% (as % of total assets) in FY26/FY27

Highlights from the management commentary

* MSME loans are now offered across two-thirds of the branch network, with plans to extend coverage to the remaining branches over time. Within the MSME segment, lending is primarily focused on trading and services businesses such as wholesalers and shopkeepers. Notably, the company does not have any exposure to the manufacturing segment within MSME. SHFL’s MSME asset quality remains strong with no visible signs of stress.

* Management highlighted that LCVs, which underperformed last year amid a weak rural economy, are expected to witness stronger growth than SCVs going forward, driven by an improvement in rural activity. Meanwhile, trucking activity continues to remain healthy, supported by stable freight rates and no excess capacity in the market.

Valuation and view

* SHFL reported an operationally weak quarter, with disbursement volumes weaker than expected. NIM continued to contract due to elevated surplus liquidity, while the increase in Stage 2 (despite stable Stage 3) suggests ongoing forward flows. However, a key positive was the benign credit costs (which were at an eight-quarter low). Though currently weighed down by surplus liquidity, NIM is expected to revert to previous levels and expand further as liquidity normalizes over the coming quarters. * SHFL is effectively leveraging cross-selling opportunities to reach new customers and introduce new products, which will lead to improved operating metrics and a solid foundation for sustainable growth. The current valuation of ~1.6x FY27E P/BV is attractive for ~17% PAT CAGR over FY25-27E and RoA/RoE of ~3.2%/ 16% in FY27E. Reiterate BUY with a TP of INR780 (based on 2x FY27E BVPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412