Neutral Manappuram Finance Ltd for the Target Rs. 305 by Motilal Oswal Financial Services Ltd

Gold loan growth strong but NIM compression continues

Gold tonnage growth weak; asset quality weakens in non-gold segments

* MGFL reported consol. PAT of INR2.2b in 2QFY26 (12% beat). NII declined ~16% YoY to ~INR13.8b (in line) and PPoP declined ~35% YoY to ~INR6.7b (in line). Operating expenses grew 6% YoY to ~INR7.4b (in line).

* Consol. credit costs declined QoQ to ~INR3.7b. Annualized credit costs for the quarter declined ~185bp QoQ to 3.3% (PQ: ~5.1%).

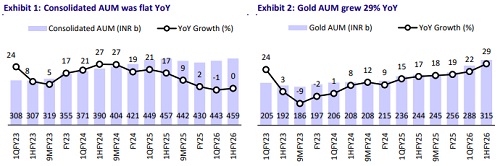

* Consol. total AUM rose ~4% QoQ and was flat YoY. Consol. Gold AUM grew ~9% QoQ and ~29% YoY to ~INR315b.

* Gold loan yields declined to ~19.7% (PQ: 20.5%). Standalone CoB declined ~12bp QoQ to ~9.1%, resulting in a ~70bp decline in spreads. Consol. NIM (calc.) declined ~45bp QoQ to ~12.4%

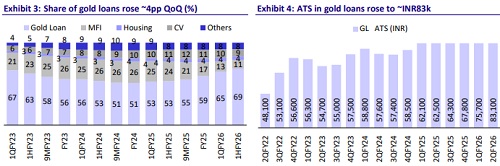

* Management shared that it will continue to focus more on gold loans, targeting higher-ticket size customers, while the non-gold businesses will resume their growth trajectory once they stabilize. The company guided for a 20-25% CAGR in gold loans over the medium term irrespective of any volatility in gold prices. This is in alignment with the management’s strategy of deriving volume-led growth.

* MGFL continues to align the gold loan interest rates with its large peers, which has resulted in a sharp moderation in its gold loan yields. However, the impact will be partially mitigated by declining CoF, which fell by ~12bp in 2QFY26 and is expected to further trend downward in the coming quarters.

* Standalone (Gold +Vehicle + Onlending + MSME) GNPA/NNPA remained stable QoQ at 3.0%/2.6%. Stress was observed in the farm equipment and 2W segments, leading to higher delinquencies in Vehicle Finance business. However, management has ramped up the collection infrastructure and expects asset quality to stabilize and then improve in the subsequent quarters.

* We raise our FY26 EPS estimate by 8% to factor in higher gold loan growth, lower opex and credit costs and keep our FY27 estimates largely unchanged. Over FY25-28, we estimate a CAGR of 24%/16% in gold/consolidated AUM and ~29% in consolidated PAT, with consolidated RoA/RoE of ~3.7%/13% in FY28. Reiterate our Neutral rating on the stock with a TP of INR305 (based on 1.6x Sep’27E consolidated BVPS).

Strong gold loan growth of 29% YoY; co-lending to further boost growth

* Gold AUM grew ~9% QoQ and ~29% YoY to ~INR315b. Gold tonnage rose ~1% QoQ to ~57.2 tons. Within gold loans, LTV was stable QoQ at ~56% and the average ticket size (ATS) rose to INR83k (PQ: INR76k). Gold loan customer base was broadly stable at ~2.6m.

* Management highlighted that the RBI’s recent initiatives have opened up opportunities for the company to pursue co-lending partnerships in gold loans. Additionally, the culture of availing gold loan is improving across the country, with borrowers now increasingly preferring organized lenders over unorganized lenders..

Asirvad MFI: AUM declines ~49% YoY; asset quality deteriorates

* MFI GNPA rose ~40bp QoQ to 4.8%, while NNPA rose ~60bp QoQ to ~2.0% and credit costs stood at ~INR2.5b (PQ: ~INR4.8b).

* Asirvad AUM declined ~49% YoY and ~8% QoQ to ~INR62b. Asirvad reported 2QFY26 loss of INR1.7b (vs. loss of INR2.7b in 1QFY26).

* Asirvad received ~INR5b equity infusion from MGFL to improve the resilience of its balance sheet.

Highlights from the management commentary

* The new CEO has prioritized certain facets of the business such as accelerating loan growth through branch expansion and co-lending. The company aims to increase efficiency while revamping non-gold business and subsidiaries, with strong collections and prudent risk management.

* Management shared that the Bain Capital transaction is in its final stages and it might get the RBI’s approval within a month.

Valuation and view

* MGFL reported a soft quarter, with asset quality weakening across the non-gold business and profitability remaining under pressure from persistent NIM compression. The only bright spot was strong growth in the gold loan portfolio, even as this was tempered by significant yield compression. Asirvad MFI’s net loss declined sequentially, driven mainly by lower credit costs; however, the MFI portfolio continues to exhibit a substantial run-down.

* MGFL trades at 1.5x FY27E P/BV, and we believe that there could be a near-term impact on profitability and consolidated AUM growth due to the lingering stress in the MFI, 2W and farm equipment segments. Gold loan is expected to exhibit healthy growth with an AUM CAGR of ~24% over FY25-28, but will be accompanied by a compression in yields. Reiterate our Neutral rating on the stock with a TP of INR305 (based on 1.6x Sep’27E consolidated BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412