Buy Dalmia Bharat Ltd For Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Strong cost control; strategic expansion to drive growth

Expects industry volume growth at ~7%-8% YoY in FY26

* Dalmia Bharat (DALBHARA)’s 4QFY25 EBITDA increased ~21% YoY to INR7.9b (6% miss, due to lower-than-estimated volume). EBITDA/t was up ~24% YoY at INR922 (est. INR946). OPM surged 4.2pp YoY to ~19% (est. ~20%). Profit (adj. for prior-period tax reversals) grew ~41% YoY to INR3.6b (~28% beat, led by higher other income, and lower depreciation/ETR than expected).

* Management indicated that cement demand saw a recovery in 4QFY25 with industry growth rate estimated at 7-8% YoY v/s 3-3.5% YoY in 9MFY25. It expects cement demand to grow ~7-8% YoY in FY26, led by increased government spending and pent-up demand. Management refrained from giving any company-specific guidance for FY26; though the focus would be on balancing the volume growth and profitability. Recently, cement prices have surged in South India (INR30-40/bag), while blended average price increase in company’s markets is INR10-15/bag.

* We raise FY26/27E EBITDA estimates by ~2%/6% on higher realization assumptions. EPS estimates increased by ~22%/8% for FY26/27, aided by lower depreciation estimates. We value DALBHARA at 12x FY27E EV/EBITDA to arrive at a revised TP of INR2,300 (earlier INR2,150). Reiterate BUY.

EBITDA/t increases 24% YoY to INR922 (vs. est. INR946)

* Consolidated revenue/EBITDA/adj. PAT stood at INR40.9b/INR7.9b/INR3.6b (-5%/+21%/+41% YoY and -4%/-6%/+28% vs. our estimate) in 4QFY25. Sales volumes declined ~2% YoY to 8.6mt (volume ex-JPA up ~5% YoY; 3% below est.). Realization declined 3% YoY to INR4,757/t (flat QoQ; in line).

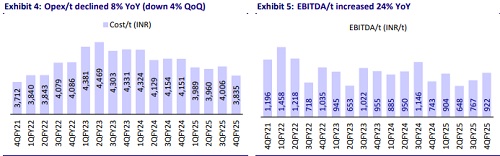

* Variable cost/t declined ~11% YoY (4% above est.). Other expenses/freight cost per ton fell ~12%/2% YoY. Opex/t was down ~8% YoY (in line). EBITDA/t increased ~24% YoY to INR922 and OPM surged 4.2pp YoY to ~19%.

* In FY25, consol. revenue/EBITDA/PAT declined 5%/9%/ 9% YoY. Volume was up ~2% YoY at 29.4mt, while realization fell ~7% YoY. OPM dipped 80bp to ~17% and EBITDA/t declined 11% YoY to INR820. CFO declined ~20% to INR21.2b due to lower profitability and increase in WC. Capex stood at INR26.3b vs. INR27.2b in FY24. It posted cash outflow of INR5.1b vs. cash outflow of INR880m in FY24.

Highlights from the management commentary

* The blended fuel consumption cost stood at INR1.30/kcal vs. INR1.31/Kcal in 3QFY25. Spot fuel prices are very volatile due to the ongoing global macroeconomic uncertainty.

* It has been actively strengthening dealer network and distribution channels while investing in brand building, including the rebranding of Dalmia Cement as RCF Expert and rolling out new cement packaging across all locations.

* Capex pegged at INR35.0b for FY26 for expansion projects in Karnataka and Maharashtra and a clinker line in Assam. The company will update on its expansion strategy in the coming quarter after evaluating market, cost competitiveness, and opportunities for diversification in new geographies.

Valuation and view

* DALBHARA’s reported EBITDA was below our estimate, though in line with the consensus. Management expects healthy demand growth in FY26 and is cautiously optimistic about sustainability of recent price hikes. We estimate Revenue/EBITDA/PAT CAGR of 10%/25%/37% over FY25-27, albeit on a low base. We estimate a volume CAGR of ~7% over FY25-27 and EBITDA/t of INR980/INR1,100 in FY26/FY27 vs. INR820 in FY25 (average EBITDA/t of INR1,070 over FY20-24).

* DALBHARA was lagging behind peers in terms of capacity expansion. We believe the recent capacity expansion announcement in Karnataka and Maharashtra addresses the company’s growth concern to some extent. Further, the recent price hikes in its core markets may help to improve margins. DALBHARA is among the low-cost producers in the industry, backed by a higher blending ratio, green power share, and lower freight costs. At CMP, the stock is trading attractively at 12x/10x FY26E/FY27E EV/EBITDA and USD85/USD79 EV/t. We value DALBHARA at 12x FY27E EV/EBITDA to arrive at our revised TP of INR2,300 (vs. earlier TP of INR2,150). Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412