Buy Rural Electrification Corp Ltd for the Target Rs. 460 by Motilal Oswal Financial Services Ltd

Weaker loan growth guidance; pre-payments remain elevated

Higher standard asset provisions on DISCOMs with rating downgrades? Rural Electrification Corp’s (RECL) 4QFY25 PAT grew ~5% YoY to INR42.4b (~21% beat). This earnings beat was aided by one-offs in interest income from higher (than outstanding) recoveries from the resolution of KSK Mahanadi. FY25 PAT grew ~12% YoY to INR157b. 4Q NII grew ~37% YoY to ~INR61.7b (~18% beat). Other income declined ~8% YoY to ~INR2.4b.

* Opex declined ~23% YoY to ~INR2.4b and cost-income ratio stood at ~3.1% (PQ: 5% and PY: ~5.6%). The decline in opex was driven by lower CSR and other expenses during the quarter. PPoP grew ~39% YoY to INR61.6b.

* Yields (calc.) rose ~50bp QoQ to ~10.5%, while CoB declined ~20bp QoQ to ~7.1%, resulting in spreads (calc.) increasing ~70bp QoQ to ~3.4%. Reported NIM for FY25 was largely stable at ~3.63% (9MFY25: 3.64%).

* GS3 improved ~60bp QoQ to ~1.35%, while NS3 improved ~35bp QoQ ~0.4%. PCR on Stage 3 rose ~10pp QoQ to ~72%. The improvement in asset quality was driven by the resolution of two large stressed assets (KSK Mahanadi and Corporate power) worth INR34b in 4QFY25.

* Credit costs stood at INR7.8b, which translated into annualized credit costs of 14bp (PY: -14bp and PQ: -2bp). The company has ~12 projects (PQ: 14 projects) that are classified as NPAs. Resolutions in ~11 NPA projects (PCR: 77%) are being pursued under NCLT, and 1 NPA project (PCR: 50%) outside NCLT. RECL guided for recoveries of INR8-10b in FY26 from the resolution of NPAs and has set a target to become a net zero NPA company by FY26 end.

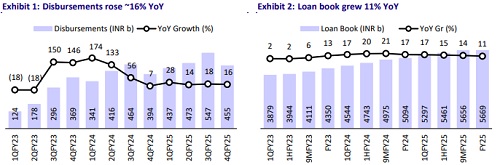

* AUM stood at INR5.67t, up 11% YoY and flat QoQ. Loan growth was weak because of higher rundowns, which stood at ~31% (PQ: 26% and PY: 22%). Management guided for loan growth of ~12-13% (vs. earlier guidance of 15- 16%) and disbursements of INR2.0-2.1t in FY26.

* We cut our FY26 EPS estimates by ~5% to factor in lower loan growth and higher provisions. We model a CAGR of 11%/13%/11% in disbursement/ loans/PAT over FY25- FY27E. We estimate RoA/RoE of 2.6%/20% and a dividend yield of ~5.7% in FY27. Reiterate BUY with a TP of INR460 (premised on 1.2x Mar’27E BVPS).

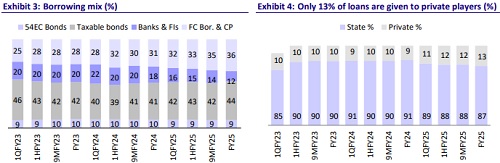

* Key risks are: 1) weaker loan growth from elevated pre-payments and business loss to peers from refinancing; 2) increasing exposure to the highrisk power projects without PPAs; and 3) compression in spreads and margins due to intensified competition.

Key highlights from the management commentary

* Management shared that the company’s interest rates are highly competitive across generation, transmission, and distribution, even against bank financing. It offers post-construction discounts, strengthening its market positioning.

* Management highlighted that the company only finances renewable projects with signed PPAs, mitigating risk from unsigned PPAs

Valuation and view

* RECL reported a mixed quarter, with disbursements broadly in line; however, AUM growth was muted due to elevated repayments during the quarter. This has prompted a downward revision in loan growth guidance for FY26. However, asset quality continued to improve, aided by the resolution of stressed assets. The company has set a target to become a net zero NPA entity by FY26 end.

* RECL trades at 1x FY27E P/ABV, and we believe that valuations are attractive for this franchise, which offers decent earnings growth and ~20% RoE.

* The company is well equipped to achieve a loan book CAGR of ~13% and a PAT CAGR of ~11% over FY25-FY27. We estimate RoA/RoE of 2.6%/20% and a dividend yield of ~5.7% in FY27. Reiterate BUY with a TP of INR460 (premised on a target multiple of 1.2x Mar’27E P/ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412