Neutral Zydus LifeSciences Ltd for the Target Rs. 990 by Motilal Oswal Financial Services Ltd

In-line operational show in 2Q

Work-in-progress on diversified growth drivers – pharma/OTC/med-tech

* Zydus Lifesciences (ZYDUSLIF) delivered in-line revenue/EBITDA in 2QFY26. There was a marginal miss on earnings due to higher depreciation, lower other income and a higher tax rate.

* In addition to superior execution in generics segment in the US market, ZYDUSLIF has strengthened its 505b2 portfolio with the launch of Beizray. It is also preparing to file NDA for its NCE (Saroglitazar Magnesium) in 4QFY26.

* It outperformed in domestic formulation (DF) segment through steady traction in innovative products and pillar brands. In fact, the chronic therapies’ share has also increased by 500bp over the past three years.

* With established presence in India in the consumer wellness segment, it has forayed into international markets through the Comfort Click acquisition, particularly in VMS space.

* ZYDUSLIF is also enhancing its med-tech segment through Amplitude Surgical, thereby adding a new growth lever in addition to pharma and consumer wellness.

* We raise our earnings estimates by 6%/3% for FY27/FY28, factoring a) the addition of business from Comfort Click, b) healthy ANDA launches, c) superior growth in DF segment. We value ZYDUSLIF at 22x 12M forward earnings to arrive at a TP of INR990. While ZYDUSLIF is building additional growth levers, a higher base of g-Revlimid in FY25 is expected to keep growth in check over FY25-28. Maintain Neutral stance on the stock.

Product mix outweighed by higher opex YoY

* Sales grew 17% YoY to INR61.2b (our est. INR60b).

* India sales (37% of sales), comprising DF and consumer businesses, grew 14.7% YoY to INR22.3b. Within India sales, branded formulations grew 9.3% YoY to INR15.9b. Consumer wellness grew by 31% YoY to INR6.4b.

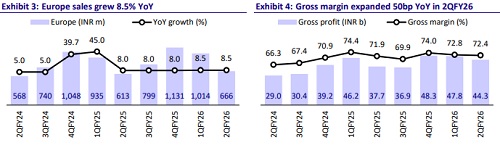

* International market sales grew 39.4% YoY to INR7.5b (12% of sales). US sales grew 13.5% YoY (8.7% YoY in CC terms) to INR27.4b (USD313m; 45% of sales).

* API sales grew 23% YoY to INR1.5b (2% of sales).

* Gross margin expanded 50bp YoY to 72.4%, aided by a better product mix.

* EBITDA margin contracted 90bp YoY at 26.2% (our est. 31.2%) due to higher opex (other expenses up 260bp YoY each as % of sales), partly offset by lower R&D spending (down 130bp YoY as % of sales).

* EBITDA grew 13% YoY to INR16b (our est. INR16.5b).

* Forex gain stood at INR4b.

* Adjusting for forex gain, PAT grew 15.5% YoY to INR10b (our est.: INR10.8b).

Highlights from the management commentary

* ZYDUSLIF maintained its EBITDA margin guidance of 26% for FY26.

* The company saw positive revenue numbers from the pivotal EPICSTM-III Phase 2(b)/3 clinical trial of Saroglitazar Magnesium in patients with PBC for the US market. About 60-80 MRs would be required for marketing/promotional activities for this product after USFDA approval.

* Comfort Click has the largest market share in the online channel in EU for VMS segment. It has strong brand recognition, which can enable ZYDUSLIF to extend the offering to other markets as well.

* The operational cost related to Amplitude is largely in place. ZYDUSLIF is working on not only improving sales of existing products, but also adding new products in cardiology/nephrology segment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)