Buy LT Foods Ltd for the Target Rs.600 by Motilal Oswal Financial Services Ltd

Healthy volume growth drives revenue

Earnings in line

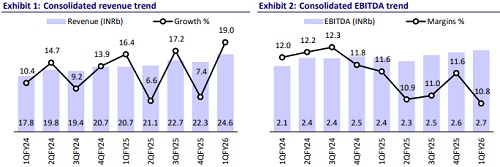

* LT Foods (LTFOODS) reported a strong quarter with revenue growth of 19% in 1QFY26, led by 18% YoY growth in Basmati and Other Specialty Rice (branded business volume up 22% YoY) and 32% YoY growth in Organic Foods. Gross margin expanded 70bp YoY, aided by lower input prices, largely offset by higher other expenses (up 120bp YoY due to increased ad spending). Hence, its EBITDA margin contracted 90bp YoY.

* Demand remained strong across regions, with volume likely to grow in the lower double-digits for FY26. With basmati prices stabilizing, we expect its margins to improve despite higher brand spending. We broadly retain our EPS estimates for FY26/FY27. We reiterate our BUY rating on the stock with a TP of INR600 (premised on 21x FY27E EPS).

Margins under pressure due to higher SG&A expenses

* In 1QFY26, LTFOODS‘s consolidated revenue stood at INR24.6b (19% YoY, +11% QoQ), in line with our estimate.

* EBITDA grew 10%/3% YoY/QoQ to INR2.7b (in line). EBITDA margin contracted 90bp/80bp YoY/QoQ, to 10.8% (est. 11.9%). Higher ad spending (+120bp YoY) was only partially offset by better gross margin (+70bp YoY) and lower freight costs (-90bp YoY).

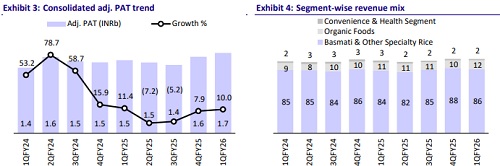

* Adj. PAT grew 10% YoY/5% QoQ to INR1.7b (in line) for the quarter.

* The Basmati & Other Specialty Rice segment’s revenue grew 18% YoY, led by strong growth in the branded business (up 22% YoY) and strong demand across geographies. Gross margin expanded 160bp YoY to 34%, and EBITDA margin expanded 10bp YoY to 13%. India business grew 10% YoY, while the International business grew 15% YoY (excl. Golden Star).

* Organic Foods' revenue grew 32% YoY, driven by enhanced distribution in Europe and the US. While gross margin contracted 680bp to 35% due to the change in product mix, EBITDA margin dipped 170bp YoY to 10%.

* The Convenience & Health segment’s revenue declined 16% YoY, primarily due to the discontinuance of Daawat Sehat. Gross margin remained flat at 37%, and operating loss stood at INR24m.

Highlights from the management commentary

* Basmati industry: India leads the global basmati market with a 90% supply share, producing 10 MMT annually and exporting 6MMT (up 15% YoY). With an 80% share in global exports, India’s position grows stronger each year. The global basmati market is just 12MMT vs. 500MMT for overall rice.

* International business: The UK market outlook is robust, with the commercialization of the new plant and partnership with four top retailers. The North American business (ex-acquisition of Golden Star) is also performing well. Management expects a double-digit growth in this geography.

* Guidance: The company is targeting an EBITDA margin of 12.5–13.0% and an RoCE of over 23%, with a strong focus on improving the same

Valuation and view

* LTFOODS reported a healthy start to FY26, fueled by growth in both India and International markets. We expect this momentum to continue, led by 1) India’s leading position in the global basmati market (80% global export market share), 2) continued shift from unorganized to organized players in the domestic market, 3) margin expansion supported by stabilization in input prices, 4) new plant and partnerships with top four retail chains in the UK, and 4) the rising global adoption of basmati rice.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 16%/23%/28% over FY25-FY27. We reiterate our BUY rating with a TP of INR600 (based on 21x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)