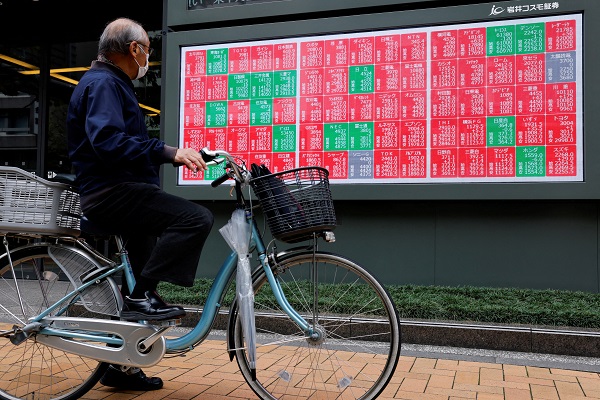

Asian stocks clock weekly gains on rate cut wagers, AI fervour

Asian stocks were poised for solid weekly gains on Friday as rising odds of the Federal Reserve cutting rates in the near-term helped cushion jitters around a U.S. government shutdown that have pushed gold to record highs and weighed on the dollar.

Investors have mostly shrugged off the government shutdown, the 15th since 1981, even as it resulted in suspension of scientific research, financial oversight and delayed crucial economic data, including the jobs report on Friday.

Part of the reason for the lack of market reaction is because historically shutdowns have had limited impact on economic growth and market performance.

Weiheng Chen, global investment strategist at J.P. Morgan Private Bank, said investors appear willing to give Washington time to resolve its disagreements, though a prolonged shutdown may start to move markets.

"For now, investors remain more focused on the potential impacts of the Fed’s rate-cutting cycle, trade and immigration policy, economic data, and corporate earnings," Chen said.

MSCI's index of Asia-Pacific shares was up 0.14%, just shy of the record high it touched on Thursday. The index was set for an over 2% gain for the week and has risen 23% so far this year. With China and parts of Asia closed for a long holiday, volumes are likely to be thin in the region.

Japan's Nikkei was up 0.75% in early trading, not far from the record high it touched last month ahead of the crucial weekend vote that will determine the next prime minister and set the tone for fiscal and monetary policy outlook.

Asian markets were taking cues from Wall Street, where all three major indexes closed at record highs buoyed by technology stocks as investor enthusiasm for all things AI remains unchallenged.

NO OFFICIAL DATA

With no government reports on the labour market to take cues from, investors have turned to alternative data from public and private sources and so far they point to a sluggish U.S. labour market.

Blerina Uruci, chief U.S. economist at T. Rowe Price, said the potential delay of critical economic data is a problem for a data-dependent Fed, leaving the central bank reliant on less comprehensive indicators like ADP and jobless claims.

"The lack of clarity could fuel short-term volatility and make it harder for markets to position with confidence," Uruci said, noting some investors are already looking to reduce risk as the outlook becomes harder to navigate.

Still, markets are becoming more confident of the Fed sticking to its rate cutting path and are almost fully pricing in a 25 basis point rate cut in October. Traders are pricing in 114 bps of easing by the end of 2026.

That has left the U.S. dollar under pressure. The dollar index, which measures the U.S. currency against six other units, was steady on the day but on course for a 0.35% weekly decline, the biggest drop since early August.

The Japanese yen has been the biggest beneficiary of the dollar weakness this week and is set to clock a 1.5% gain, its biggest weekly gain since mid-May. It was last little changed at 147.34 per U.S. dollar.

In commodities, gold was steady at $3,857 a ounce, stuck near the record high it touched on Thursday. The yellow metal is on course for a 2.6% weekly gain, its seventh straight week of gains.

Gold, viewed as a safe-haven asset during times of uncertainty, thrives in a low-interest-rate environment. It has risen 47% so far this year.[GOL/]

Oil prices, on the other hand, were on track for their steepest weekly decline since late June due to market expectations that the OPEC+ group could hike output further despite oversupply concerns. [O/R]