Neutral Aegis Logistics Ltd for the Target Rs. 770 by Motilal Oswal Financial Services Ltd

Strong gas division performance drives beat

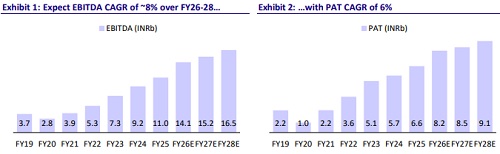

* In 2QFY26, Aegis Logistics (AEGIS) reported EBITDA of INR2.9b, beating our estimate by 13%, as the normalized EBITDA of the gas division came in 68% above our estimate, while that of the liquid division stood 15% below estimates. Management has reiterated its PAT guidance of 25% CAGR over the next few years, primarily led by robust upcoming capacities.

* We reiterate our Neutral rating on the stock with a TP of INR770, as we now value the company at 30x Dec’27E EPS (earlier 30x FY27E) of INR25.6.

Strong 2Q performance

* 2QFY26 revenue came in above our expectations at INR22.9b, while EBITDA came 13% above our estimates at INR2.9b.

* EBITDA margin stood at 12.7% (2QFY25 margins: 12.8%).

* APAT came in at INR1.8b, 40% above our estimate.

* Segmental performance during the quarter:

* The Liquid division’s revenue was INR1.5b (+19% YoY, +7% QoQ), and EBIT was INR0.9b (+31% YoY, +14% QoQ).

* The Gas division’s revenue stood at INR21.4b (+32% YoY, +36%QoQ), and EBIT was INR2b (+52% YoY, 48% QoQ).

* In 2QFY26, standalone revenue stood at INR10.3b (+56% YoY, +22% QoQ).

* Standalone PAT came in at INR1.7b (+131% YoY, +141% QoQ).

Valuation and view: Reiterate Neutral

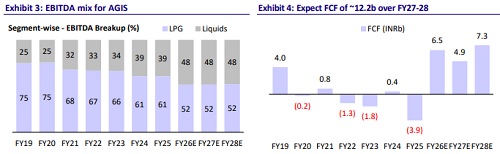

* AEGIS has reiterated its ambitious capex plan of: 1) commissioning 64,000kl of liquid capacity at Mumbai port by 1QFY27, 2) adding liquid, LPG, and LPG bottling capacity at JNPA (INR16.8b); 3) developing 94kcbm of LPG capacity at Kandla by FY27; 4) commissioning 36,000 mt of ammonia capacity at Pipavav by 1QFY27, and 5) expanding terminal capacity at Haldia, for which 3 acres of land has been acquired.

* While we estimate an 11% CAGR in PAT over FY25-28, we believe that the current valuations at 24.3x FY27E EPS already factor in the strong expansion in capacity and earnings. We value the stock at 30x Dec’27E EPS of INR25.6 to arrive at our TP of INR770. We reiterate our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412