Neutral Zydus LifeSciences Ltd for the Target Rs. 930 by Motilal Oswal Financial Services Ltd

Earnings growth led by US/consumer wellness and margin leverage

Strong finish to FY25, but FY26 growth hurdles prompt our Neutral stance

* Zydus LifeSciences (ZYDUSLIF)’s financial performance was better than expected (8%/19%/15% beat on sales/EBITDA/Adj. PAT) for 4QFY25. Strong traction in the US and consumer wellness segments contributed to its healthy performance during the quarter.

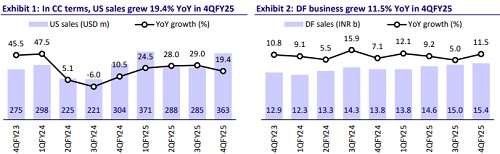

* Despite stable g-revlimid sales and competition in g-Asacol, ZYDUSLIF’s sales grew USD78m QoQ in the US segment to reach USD363m. The growth was led by products like g-Myrbetriq and improved traction in the base portfolio.

* Interestingly, ZYDUSLIF achieved the highest quarterly turnover of INR9b in consumer wellness, fueled by superior execution/favorable seasonality.

* Improved traction in pillar brands and innovative products led to the industry outperformance in the domestic formulation (DF) business.

* Having said this, we cut our FY26 estimates by 7%, factoring in 1) higher R&D expenses on the innovative portfolio (comprising Saroglitazar), 2) increased competition in g-Revlimid and marketing expenses for GLP products. We value ZYDUSLIF at 21x 12M forward earnings to arrive at our TP of INR930.

* Following a muted FY23, ZYDUSLIF has delivered 42% earnings CAGR over FY23-25, driven by strong traction in the US generics and renewed efforts in the DF segment. However, we expect earnings to remain stable over FY25- 27 as higher competition is anticipated in select products in the US generics segment. This would outweigh the improved business prospects in the DF and consumer wellness segments. The higher R&D expenses would also keep profitability in check. The current valuations (at 19x FY26E earnings/ 21x FY27E earnings) also provide limited upside. Reiterate Neutral.

Business mix and operating efficiency drive earnings

* ZYDUSLIF’s sales grew 18% YoY to INR65.3b (our est. INR61b).

* US sales grew 24% YoY (+19% YoY in CC terms) to INR31b (USD363m; 48% of sales). India sales (38% of sales), comprising DF and consumer businesses, grew 13.5% YoY to INR24.4b. Within India sales, branded formulations grew 11.5% YoY to INR15b. Consumer wellness grew by 17% YoY to INR9b.

* The EM/EU sales grew 11.8% YoY to INR5.5b (8% of sales). API sales declined 10% YoY to INR1.3b (2% of sales).

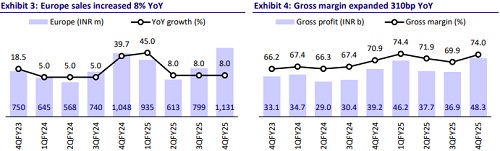

* Gross margin expanded 310bp YoY to 74%, due to better product mix.

* EBITDA margin expanded 380bp YoY at 33.2% (our est. 30%), due to better GM and lower other expenses (down 140bp YoY). This was partly offset by higher R&D (up 100bp YoY as % of sales).

* EBITDA grew 33% YoY to INR21.6b (our est. INR18b)

* ZYDUSLIF had exceptional items of a) forex loss of INR400m, b) goodwill impairment (INR1.4b), and c) product-related impairment (INR846m).

* Adjusting for the same, PAT grew 16% YoY to INR13.6b (our est.: INR12b).

* For FY25, its revenue/EBITDA/PAT grew 19%/32%/23.5% YoY to INR232b/ INR70b/INR47b.

Highlights from the management commentary

* ZYDUSLIF aims to grow its US business at a high single-digit rate in FY26.

* Overall, ZYDUSLIF intends to grow its business at a double-digit rate on a YoY basis for FY26. Its EBITDA margin guidance stands at 26% for FY26E.

* The litigation trial for Mirabegron is scheduled for Feb’26. ZYDUSLIF continues to sell the product in the US market.

* ZYDUSLIF has witnessed interest in its vaccines from UNICEF/PAHO. It is also registering the products in other countries.

* The product-related impairment is for the g-rotigotine transdermal patch.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)