Neutral National Securities Depository Ltd for the Target Rs. 1,270 by Motilal Oswal Financial Services Ltd

Revenue growth driving PAT beat

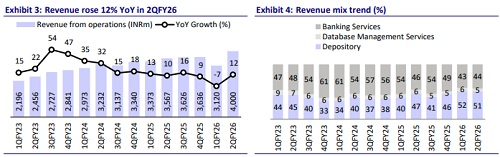

* NSDL’s operating revenue grew 12% YoY/28% QoQ to INR4b (20% beat), led by 21%/7% YoY growth in Depository/Banking segments. For 1HFY26, revenue grew 3% YoY to INR7.1b.

* Operating expenses grew 12% YoY to INR2.7b, driven by a 26%/9% YoY increase in employee costs/other expenses. EBITDA rose 13% YoY/34% QoQ to INR1.3b, resulting in an EBITDA margin of 32% (vs. 31.6% in 2QFY25 and 30.5% in 1QFY26). For 1HFY26, EBITDA grew 15% YoY to INR2.2b

* PAT for the quarter rose 15% YoY/23% QoQ to ~INR1.1b (12% beat due to higherthan-expected top-line growth). PAT margins came in at 27.6% vs 27% in 2QFY25 and 28.7% in 1QFY26. For 1HFY26, PAT grew 15% YoY to INR2b.

* Management reaffirmed its confidence in maintaining double-digit revenue and PAT growth, driven by the rising retail participation in capital markets, growing digital adoption, continued market formalization, and a capital-light, cashgenerative business model with stable margins.

* We have raised our FY26 earnings estimate by 8%/9%/9% in FY26/FY27/FY28 to reflect higher custody fee growth and revenue from the banking segment, while maintaining our assumption of elevated costs. We expect NSDL to post a revenue/EBITDA/PAT CAGR of 9%/19%/18% over FY25-28. We reiterate our Neutral rating on the stock with a one-year TP of INR1,270 (premised on a P/E multiple of 45x on FY28E earnings).

Strong growth in the depository and banking business

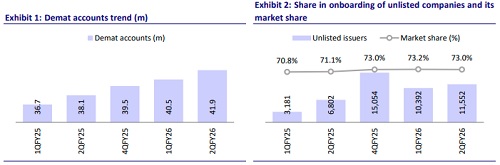

* On the revenue front, the depository income (51% share) grew 21% YoY/27% QoQ to INR2b. Within this, the annual issuer charges (recurring portion) rose 44% YoY to INR887m, driven by the higher onboarding of unlisted companies (~11.5k), and incremental revenue from distributed ledger technology (DTL) fees (commenced from Jun’25).

* The non-recurring portion, which accounts for ~57% of total revenue, grew 7% YoY to INR1.6b. This includes corporate action fees (including IPOs) rising 6% YoY, e-voting charges rising 25% YoY, and other transaction charges rising 23% YoY. Meanwhile, the settlement fee declined 36% YoY.

* Under the subsidiaries, the NPBL segment grew 7% YoY/33% QoQ to INR1.8b, driven by an increase in quality customers (3m vs ~1.5m in 2QFY25). This led to growth in CASA and strong traction in the UPI acquisition business through the onboarding of high-quality partners.

* The NDML segment, however, recorded a 16% YoY decline, though it improved 6% sequentially in 2QFY26.

* Other income rose 12% YoY but declined 7% QoQ to INR322m.

* Total expenses surged 12% YoY to INR2.7b, led by a 26%/9% YoY increase in employee and other expenses. CIR stood at 68% vs 68.4% in 2QFY25 and 69.5% in 1QFY26.

* Management indicated that it will continue to invest in technology infrastructure (accelerated capex deployment of INR300m in 1HFY26 compared to INR350m in FY25), along with a focus on building strong workforce capacity.

* Total demat accounts stood at 41.9m vs 38.1m in 2QFY25, with additions during the quarter remaining stable at 1.4m YoY (incremental market share at 17.6% vs 9.9% in 2QFY25).

Key takeaways from the management commentary

* Future growth in custody fees is expected to be driven by continued issuer and demat account onboarding, wider DLT adoption among corporates (~600 currently).

* Issuer joining fees are contributing modestly to non-recurring income. Management indicated that the sharp increase in unlisted company onboarding has likely peaked, with some moderation expected going forward, which could temper fee growth.

* On the broker onboarding front, a Bangalore-based fintech broker has started scaling its operations, while a Gurgaon-based fintech broker was recently onboarded and is expanding rapidly. Meanwhile, a large Mumbai-based broker has submitted its integration application, with the impact expected to materialize in the upcoming quarters.

Valuation and view

* NSDL continues to deliver healthy growth across its depository and banking segments, driven by steady expansion in issuer and demat account onboarding, growing DLT adoption, customer onboarding, and increasing traction with fintech partnerships. Sustained momentum in demat account additions and the successful onboarding of new fintech partners will remain key monitorables for future growth.

* We have raised our FY26 earnings estimate by 8%/9%/9% in FY26/FY27/FY28 to reflect higher custody fee growth and revenue from the banking segment while maintaining our assumption of elevated costs. We expect NSDL to post a revenue/EBITDA/PAT CAGR of 9%/19%/18% over FY25-28.

* We reiterate our Neutral rating on the stock with a one-year TP of INR1,270 (premised on a P/E multiple of 45x on FY28E earnings).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412