Neutral IOCL Ltd for the Target Rs. 150 by Motilal Oswal Financial Services Ltd

Petchem, gas and renewables anchor growth

Indian Oil Corp. (IOCL) hosted its annual investor meet, attended by Chairman Mr. Arvindar Sahney and CFO Mr. Anuj Jain, outlining strategic priorities in refining, petrochemicals, gas, and new energy. Management highlighted strong execution momentum, a balanced capex pipeline, and diversification into growth verticals, positioning IOCL for sustained market leadership.

Key highlights:

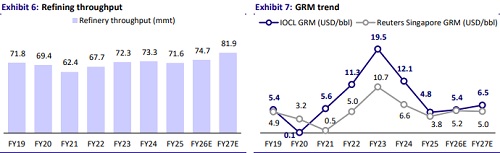

* Refining capacity to expand ~20% by CY26 end: IOCL’s refining capacity is set to expand from 81mmt to 98mmt by CY26 end, with INR900b capex currently under execution.

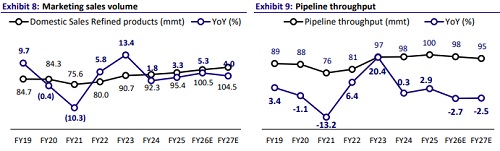

* LPG - Strong market position, growth levers ahead: IOCL holds ~45% share in India’s LPG market, delivering ~3m cylinders daily across ~150m connections. With penetration now at 100% under PMUY, growth will hinge on higher refill frequency per user (4.5x to 8x p.a.) and rising industrial demand.

* Petrochemicals to drive growth: Petchem capacity will rise from 4.3mmt to 13mmt over the next five years. Paradip complex is slated to be IOCL’s largest integrated site with mixed feed flexibility (naphtha, C3-C4 and ethane). An ethane cracker in South India is also planned. India’s petchem demand is expected to reach 80mmt by FY40-45 (currently: 30mmt with ~25% imports), reinforcing IOCL’s growth optionality.

* SPRINT program: Launched Apr’25, it is designed to (i) support core business, (ii) drive 20% cost optimization, (iii) reinforce customer centricity, (iv) integrate tech/innovation, (v) nurture leadership, and (vi) ensure transition readiness. Notably, budgeted FY26 capex has already been reduced by 20% and the target has been met successfully in the first five months.

* Gas and energy transition: IOCL’s gas business has clocked a 35% CAGR in volumes over the past two years, and the company has 80% LNG fueling market share in India. Transition-focused projects include India’s largest green hydrogen plant (10ktpa, Panipat, FY27), sustainable aviation fuel (SAF) rollout from FY27 (1% blending rising to 5% by FY30 globally), and an 18GW renewable portfolio target by CY30 (15%+ RoE). A potential renewable IPO (Terra Clean) may be explored by CY28.

Valuation and view:

* Maintain our Neutral rating on IOCL: We recently downgraded IOCL to Neutral (link) as earnings remain highly volatile due to large refining inventory swings and limited visibility. The petrochemical segment continues to post losses, and spreads are likely to remain muted given the significant upcoming capacity additions in China. Further, we maintain a bearish view on refining, expecting spreads to stay range-bound amid substantial global net capacity additions (IEA est. of ~2.6mb/d) and weak demand growth for refined products over CY24-30. With a modest RoE of ~7%-8.5% over FY26/27, returns remain unattractive compared to peers.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412