Neutral NSDL Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

Shaping Tomorrow’s Capital Markets

Building strong relationships with overlay of robust technology

* The opportunities for the entire Indian capital market ecosystem over the next decade, with a rising financialization trend but low penetration (demat penetration at 15% vs 60%+ in the US), continue to be immense (highlighted in our capital market thematic report). NSDL – the first depository of the country – is uniquely positioned to benefit from this trend, capturing both the breadth of new retail investors entering the system and the depth of rising custody value from institutional and corporate issuers.

* NSDL dominates in institutional, custodian, and large corporate accounts, resulting in revenue per active account at ~INR157 in FY25 — nearly 3x that of CDSL. The institutional skew offers more stable revenue pools linked to custody value rather than purely transaction volumes, underpinning resilience across market cycles.

* NSDL services the widest base of issuers in India, including ~70%+ of unlisted corporates mandated to dematerialize. This not only generates stable, recurring issuer charges but also creates a sticky moat, as issuers rarely migrate once demat systems are embedded. The potential growth for this is large, as the unlisted market in India continues to grow at a healthy pace.

* NSDL has stepped up its focus on investor engagement by expanding partnerships with fintech brokers, enabling digital onboarding and account opening in tier 2/3 cities, which has resulted in a rise in incremental demat market share over the past few months (10% in Aug’24 to 17% in Aug’25). However, it is still lower than the demat account market share of ~20%, indicating further headroom for market share expansion and growth.

* NDML (KRA, insurance repository) and NPBL (payments bank) position NSDL beyond a pure-play depository. While the contribution to net profit from these subsidiaries is currently less than 10%, these adjacencies provide accretive growth drivers and diversification opportunities from the core depository business.

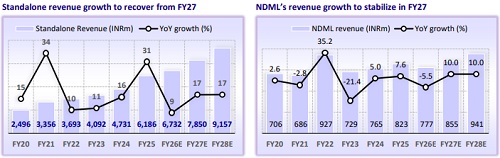

* We expect a revenue/EBITDA/PAT CAGR of 5%/14%/15% over FY25-28. Given the duopoly nature of the industry and NSDL’s superior pricing power, depositories deserve premium valuations. However, we believe the stock is fairly valued, and all the positives are priced in at current levels. Hence, we initiate coverage on NSDL with a Neutral rating and a one-year TP of INR1,200 (premised on ~45x FY28E P/E).

Depositories – catalysts to the transformation of India’s capital markets

* The depository industry has been at the core of India’s capital market transformation. Since the advent of dematerialization in the mid-1990s, it has enabled a seamless shift from paper-based securities to a fully digital ecosystem, enhancing transparency, efficiency, and investor confidence.

* Continuous technology upgrades and the surge in retail participation driven by fintech-led discount brokers, digital KYC, and UPI-enabled IPO applications have propelled demat accounts from ~40mn in FY20 to over 205mn by Aug’25. Yet penetration remains only ~15% of India’s population, far below the US (~60%+) and China (~15–20%), underscoring the long runway ahead.

* Cash market ADTO expanded structurally, rising from ~INR213b in FY15 to over INR1t in FY25, supported by robust retail flows and a healthy IPO pipeline. Elevated delivery-based volumes provide a durable uplift to transaction-linked revenues. At the same time, with household equity allocation still just ~6% in FY25, the industry stands to benefit from further financialization of savings in an underpenetrated market.

* Apart from underpenetration, issuer activity adds another structural lever for the industry. SEBI’s 2018 mandate requiring unlisted public companies to dematerialize their securities has expanded the issuer universe significantly, while IPO activity continues to funnel new companies and investors into the system.

* At the intersection of household financialization and capital market deepening, the depository industry is poised for sustained growth. Low penetration, expanding regulatory scope, elevated cash market volumes, and technology-led service innovation ensure a resilient and scalable operating environment for depositories over the coming decade.

Structural levers of the core depository business

* NSDL’s core depository business benefits from multiple structural drivers that underpin both revenue growth and profitability. These levers are anchored in account growth, issuer expansion, custody value, and sustained transaction activity.

* In terms of demat accounts, NSDL has a market share of ~20% as of Aug’25, which has declined from 48% in FY20. However, with its continuous engagement with discount brokers and strengthening foothold amongst traditional/bank-based brokers, the incremental market share has moved up from 10% in Nov’24 to 17% in Aug’25. We expect the momentum to be sustained over the medium term.

* Custody fees and annual issuer charges – which are linked to value under custody and number of issuers – contributed ~48% of standalone revenue in FY25, providing predictable and recurring income streams. With ~79,700 unlisted companies registered on its platform (versus ~35,900 for CDSL), NSDL enjoys a wide issuer base that further enhances revenue stability.

* NSDL has been a direct beneficiary of the strong expansion in cash market volumes as well as the rise in IPO activity through transaction-linked revenues such as trade settlement, pledge/hypothecation, and corporate action processing. These revenues contributed ~58% of standalone income in FY25, and we expect the contribution to remain in a similar range going forward.

* The business exhibits strong operating leverage, as incremental revenues from custody value, issuers, and transactions flow through with minimal cost addition. Standalone EBITDA margin stood at ~53% in FY25, and we expect the same to improve to ~58% in FY28

Subsidiaries provide diversification and earnings optionality

* Beyond its core depository business, NSDL has developed meaningful adjacencies through its subsidiaries - NSDL Database Management Ltd. (NDML) and NSDL Payments Bank Ltd. (NPBL). Together, these entities contributed ~55% of consolidated revenues in FY25, underscoring their rising importance in NSDL’s overall business mix.

* NDML is one of the leading KYC Registration Agencies (KRAs) in India, playing a pivotal role in investor onboarding across capital markets. With SEBI tightening KYC norms and enforcing centralized validation, KRAs are expected to see rising volumes and increased compliance-linked revenues, benefiting NDML disproportionately, given its scale.

* NDML also manages the insurance repository business, enabling policyholders to hold insurance policies in electronic form. While the contribution to revenue is not meaningful, the company is one of the four players in the industry. These businesses diversify NDML’s revenue pool and leverage its expertise in secure data management. In FY25, NDML delivered strong profitability, with EBITDA margin exceeding 35%, highlighting its high operating leverage and scalability.

* NSDL launched NPBL in 2018 to strengthen its role in India’s digital payments ecosystem. NPBL is authorized to provide basic banking services, digital wallets, and payment solutions, while also acting as the nodal bank for the UPI-based IPO applications – a fast-growing use case directly linked to NSDL’s core business.

* Profitability in NPBL remains a work in progress, given the competitive and thinmargin nature of payments and continued investments in building scale and technology. The company became profitable in FY23 and maintains a <1% PAT margin. Nevertheless, its strategic relevance is significant: by acting as the banking backbone for IPO subscriptions and other market-linked payment flows, NPBL reinforces NSDL’s systemic integration within capital markets.

Valuation and view

* With its leadership in depository services, robust infrastructure, scale advantages, affluent client base, and strategic subsidiaries, NSDL is wellpositioned to capitalize on market growth.

* We expect NSDL to deliver a revenue/EBITDA/PAT CAGR of 5%/14%/15% over FY25-28, reflecting the company’s strong market position, diversified revenue streams, and growth potential in India’s expanding capital markets. The company’s operational efficiencies and tech-led scale-up are expected to improve its EBITDA margin over the same period.

* Given the duopoly nature of the industry and NSDL's superior pricing power, depositories deserve premium valuations. However, we believe the stock is fairly valued, and all the positives are priced in at current levels. Hence, we initiate coverage on NSDL with a Neutral rating and a TP of INR1,200 (premised on ~45x FY28E P/E).

* Prolonged weak market sentiment or tighter regulatory interventions on fee structures could weigh on transaction volumes and pressure monetization, leading to lower-than-expected earnings growth. However, a sharper-thanexpected rise in retail participation, stronger IPO activity, or any favorable regulatory stance on pricing could accelerate revenue and drive faster earnings growth than our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)