Buy Equitas Small Finance Bank Ltd for the Target Rs. 77 by Motilal Oswal Financial Services Ltd

High provisions remain an overhang on earnings

Margin contracts 26bp QoQ; estimate RoA to recover to 1.5% by FY27E

* Equitas SFB (EQUITASB) reported 4QFY25 PAT of ~INR421m, down 37% QoQ and 43% below our est., due to lower other income and higher-thanexpected provisions.

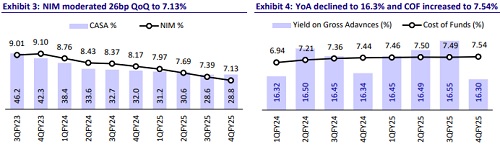

* NII grew 5.5% YoY/1.3% QoQ to INR8.3b (in line). NIMs contracted by 26bp QoQ to 7.13% in 4QFY25, mainly due to a drop in the MFI portfolio.

* Advances growth was muted at 16.9% YoY/2.3% QoQ owing to a sharp decline in MFI portfolio (down 15.7% QoQ). Deposit growth was healthy at 19.3% YoY/5.8% QoQ, led by CASA deposit growth of 7.4% YoY/6.4% QoQ. CASA mix thus improved by 15bp QoQ to 28.8%.

* Slippages declined by 5.3% QoQ, although still elevated. Higher recovery and elevated write-offs led to 8bp QoQ decline in GNPA ratio to 2.89%, while NNPA ratio inched up 2bp QoQ to 0.98%. PCR declined 145bp QoQ to 66.8%.

* We cut our estimate by 27% for FY26E and estimate FY27E RoA/RoE of 1.5%/15.2%. Reiterate BUY with a TP of INR77 (1.3x FY27E ABV)

Asset quality concerns persist; credit cost to improve from 2HFY26

* 4Q PAT plunged 79.7% YoY to ~INR421m (43% below our est.), dragged down by lower other income and higher-than-expected provisions.

* NII grew 5.5% YoY/1.3% QoQ to INR8.3b (in line). Margins declined by 26bp QoQ to 7.13%. Other income declined by 5% QoQ to INR2.2b (15% miss), affected by a 5% QoQ decline in fee income and tepid treasury income.

* Opex grew 2.7% QoQ to INR7.4b (in line). As a result, C/I ratio increased to 70.5% (up 200bp QoQ and 700bp YoY). PPoP thus declined by 17% YoY/ 6.5% QoQ to INR3.1b.

* Advances grew modestly by 16.9% YoY (2.3% QoQ) to INR362.1b, due to a decline in MFI business (down 15.7% QoQ). SBL and HF grew at a healthy pace of 5.3% QoQ and 4.5% QoQ. VF loans grew by a modest 13.6% YoY/ 2.1% QoQ, affected by a decline in New CV loans by 7.4% QoQ. Used CV grew by 6.8% QoQ.

* Disbursements stood at INR42.7b in 4QFY25 (down 16% YoY/17% QoQ), with MFI disbursements falling sharply by 76% YoY and 69% QoQ. The share of MFI AUM decreased to 11.9% from 14.4% in 3QFY25, as the bank follows a more cautious approach in MFI and plans to target only well-performing clients. Further, the bank targets to reduce the MFI share to mid-single digits by Mar’26.

* Deposits grew by a healthy 19.3% YoY/5.8% QoQ to INR431b. CASA mix improved by 15bp QoQ to 28.8%. CD ratio declined by 170bp YoY and 285bp QoQ to 84%.

* On the asset quality front, slippages declined 5% QoQ to INR5.5b, although still elevated. GNPA declined by 8bp QoQ to 2.89%, while NNPA ratio inched up 2bp QoQ to 0.98%. PCR declined by 145bp QoQ to 66.8%.

Highlights from the management commentary

* 48% of existing MFI customers are no longer eligible for fresh funding due to strict guardrail implementation starting Jan 25. Going forward, MFI disbursements will primarily target well-performing existing clients only.

* MFI collection efficiency is back to normal; credit cost expected to normalize by 3QFY26.

* MFI book is expected to decline to INR30b by Mar’26; share in total advances to fall to mid-single digits.

* SBL (45%) and housing (12–15%) will see proportional increases as MFI shrinks.

Valuation and view: Reiterate BUY with a TP of INR77

EQUITASB reported another modest quarter amid slower loan growth, high slippages, and a further 26bp QoQ contraction in margins. Deposit growth was healthy and CASA ratio improved. Loan growth was relatively modest given the bank’s cautious approach to MFI business and the bank aims to further reduce the MFI mix to mid-single digits by Mar’26. Meanwhile, SBL and housing book are expected to see a proportionate increase as MFI shrinks. Credit cost remains high and may ease only from 2HFY26 onward. Tamil Nadu ordinance can impact its collection efficiency, though the situation is under control as of now. With MFI mix decreasing at a faster pace, the bank’s margins may see a downward bias, but with much more stable asset quality. We cut our earnings estimates by 27% for FY26 and estimate FY27E RoA/RoE of 1.5%/15.2%. Reiterate BUY with a TP of INR77 (1.3x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412