Buy Varun Beverages Ltd for the Target Rs.620 by Motilal Oswal Financial Services Ltd

Resilient performance despite early onset of monsoon

In-line operating performance

* 2QCY25 was a muted quarter for Varun Beverages (VBL) as its revenue declined 2% YoY due to the early onset of monsoon in the peak summer months of India. Consolidated volumes declined by ~3% YoY (India volumes down 7.1% YoY while international volumes up 15%).

* Despite temporary headwinds in the domestic market, VBL reported an EBITDA margin expansion of ~80bp YoY, led by operating efficiencies and healthy growth in the international markets (led by volume growth, positive currency movement in Africa territories; and increased operational efficiencies).

* Going forward we expect annual EBITDA margins to sustain around the current levels, supported by further backward integration, the ramp-up of newly opened facilities and an improved product mix. We largely maintain our CY25/CY26 earnings estimates and reiterate our BUY rating on the stock with a TP of INR620 (54x CY26E EPS).

Healthy international performance partially offsets domestic headwinds

* Revenue declined 2% YoY to INR71.6 (in line) on account of a 3% YoY decline in volume to 390m cases. Realization was flat YoY at INR180/case.

* EBITDA margins expanded 80bp YoY to 28.5% (est. 27.3% | 27.7% in 2QCY24) despite an increase in fixed overheads due to the commissioning of new capacity at four greenfield plants in India.

* EBIDTA per case grew 3% YoY to INR51, while EBITDA was flat YoY at ~INR20b (in line).

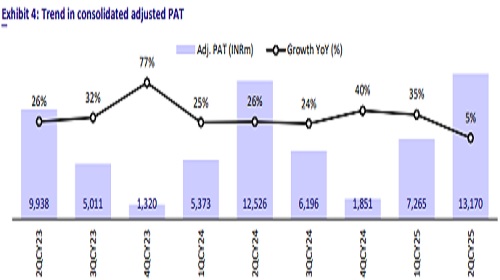

* Adj. PAT grew 5% YoY to INR13.2b (est. INR13.1b), driven by operational efficiencies and lower finance costs (down 72% YoY).

* Subsidiary (consolidated minus standalone) revenue/EBITDA/adj. PAT grew 23%/41%/53% YoY to INR17.1b/INR3.6b/INR1.6b in 2QCY25.

* CSD/Juice volumes declined by 9%/12.5% YoY to 255m/28m unit cases, while water volumes grew 13% YoY to 71m unit cases in 2QCY25.

Highlights from the management commentary

* Domestic demand outlook: Consumer demand is expected to remain strong, and the company has strengthened its go-to-market strategy by increasing visi cooler placements (up 50% YoY). Management anticipates a better performance in 3QCY25 on the back of a low base and improved weather conditions.

* Capital allocation: VBL does not plan to expand capacity in India, as capacity utilization currently stands at ~70% and management plans to use cash on the books for new acquisitions and expansion in international markets.

* Strategic development: VBL has acquired 50% equity share capital of Everest Industrial Lanka, which is engaged in the business of production, manufacturing, distribution and selling of commercial visi-coolers and related accessories.

Valuation and view

* VBL delivered a stable performance despite the challenges posed by unseasonal rains during the quarter. Going ahead we expect VBL to maintain its earnings momentum, aided by: 1) a scale-up in the international market, 2) strengthening on-ground execution, 3) enhanced product visibility with an increase in the number of visi coolers, and 4) an expanding product portfolio.

* We largely maintain our CY25/CY26 earnings estimates and introduce CY27 estimates. We expect a CAGR of 15%/14%/19% in revenue/EBITDA/PAT over CY25E-27. We value the stock at 54x CY26E EPS to arrive at a TP of INR620. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)