Buy Anant Raj Ltd for the Target Rs.807 by Motilal Oswal Financial Services Ltd

RE on strong footing; DC business ramping up

Data center’s 26MW IT load to be commissioned by 1HFY26

P&L performance: 1QFY26

* Anant Raj (ARCP)’s revenue came in at INR5.9b, up 26% YoY/10% QoQ (35% above our estimate).

* EBITDA stood at INR1.5b, up 46% YoY/6% QoQ (in line). EBITDA margin was 25.4%, up 3.6pp YoY for the quarter.

* The company’s adj. PAT came in at INR1.3b, up 38% YoY/6% QoQ (23% above our estimate). Its PAT margin was 21%, up 2pp YoY.

Key operational highlights

* Real estate: ARCP launched a new version of independent floors under the brand "The Estate Apartments" at Anant Raj Estate, Sector 63A, Gurugram. The offering received a strong customer response, reaffirming market confidence in the brand and its product.

* The company secured approvals and commenced development of a community center and commercial tower at its "Ashok Estate" project in Sector 63A, Gurugram, with a total area of 0.16msf.

* Preparations for the Group Housing-2 project at Anant Raj Estate, Sector 63A, Gurugram, with a planned area of 1.09msf, are in advanced stages, and the project is anticipated to be launched soon.

* Data centers: The second data center facility at Panchkula is being operationalized, with a special event titled "BHARAT BUILT: Soil to Server" scheduled for 1 st -2 nd Aug’25, to showcase the expanded capacities at both Manesar and Panchkula.

* This development enhances the company’s presence in the data center space, with both sites capable of functioning as data centers and disaster recovery units for each other.

* The integration of cloud services across the Panchkula and Manesar facilities has commenced, in collaboration with Orange Business as the technical partner.

* The company has secured a major private sector client for co-location and cloud services at its Manesar facility, with an estimated IT load capacity of ~3 MW, supplementing its existing client base.

Changes in data center capex plan; co-lo intact, but cloud bit deferred

* ARCP initially planned to build the 28MW project by FY25, primarily with the help of fundraising. However, it now plans to incur capex through internal accruals. As per the current plan, ARCP will develop 63MW of IT load by FY26, wherein the earlier 49MW was co-location and 14MW was cloud services.

* ARCP decided to keep 49MW of co-location commissioning intact, while the 14MW cloud will take six more months. By 1HFY26, the company would commission and lease a 4MW IT load for cloud, wherein 3MW will be operationalized by 1st Aug’25. However, ARCP would keep 2MW vacant for future ramp-ups out of 6MW in the first phase

* For 2MW, the company will build the system until the rack and will not lease it until the company incurs the capex for the cloud.

* Similarly, for a total of 14MW until 1HFY27, ARCP has plans to commission 6MW of IT load for cloud service, while it will keep 8MW vacant until the racks.

* Changes in plans have been made to fund the capex from internal accruals, as 49MW of co-location will be operational by FY26 and start garnering strong cash flows. This will be redeployed in the vacant cloud capacity.

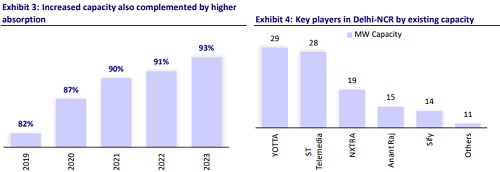

* ARCP initially had two clients, TCIL and Railtel, and onboarded BSNL and CSC for the newly commissioned capacity. Additionally, the company onboarded one big private client, which clearly reflects ARCP’s product acceptability

Valuation and view

* ARCP’s residential segment is expected to deliver 14msf over FY25-30, generating a cumulative NOPAT of INR72b.

* The residential business cash flow, discounted at an 11.6% WACC with a 5% terminal growth rate, accounts for INR2.5b in annual business development expenses, yielding a GAV of INR87b, or INR253/share.

* The annuity business cash flow is discounted at a capitalization rate of 9.5%, valuing it at INR10b or INR30/share.

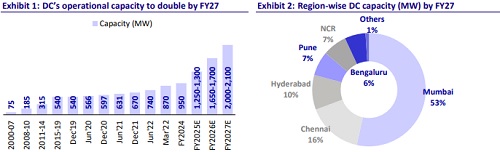

* We expect ARCP’s DC revenue to grow materially, with capacity increasing from 6 MW in FY24 to 307 MW by FY32, along with a shift towards cloud services, which will expand from 0.5 MW to 77 MW over the same period.

* We model the free cash flows for the data center business till FY32, using a discount rate of 11.6%, a rental escalation of 3%, and a terminal growth rate of 3%, resulting in an EV of INR149b or INR435/share post deferral of the cloud capex in initial years.

* We reiterate our BUY rating on the stock with the revised TP of INR807 (earlier INR1,085) based on our SoTP valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)