Neutral Can Fin Homes Ltd For Target Rs. 770 by Motilal Oswal Financial Services Ltd

Disbursement momentum accelerates; earnings in line

Management overlay buildup a negative surprise

* Can Fin Homes (CANF)’s 4QFY25 PAT grew ~12% YoY to ~INR2.3b (in line). FY25 PAT grew ~14% YoY to INR8.6b. 4Q NII grew ~6% YoY to ~INR3.5b (in line). Fees and other income stood at ~INR168m (PY: INR159m).

* Opex declined ~2% YoY to INR707m (~6% higher than MOFSLe). The costincome ratio stood at ~19.4% (PQ: 16.9%, PY: 20.9%). PPoP grew ~8% YoY to INR2.95b (in line). The effective tax rate for the quarter was lower at ~16% (PQ: ~21% and PY: ~23%) because of tax provision reversal from the prior years. CANF’s 4QFY25 RoA/RoE stood at ~2.6%/~18.5%.

* Management guided a disbursement growth of ~20% and loan growth of ~15% in FY26. The company has begun witnessing signs of recovery in Karnataka, with disbursements picking up in Feb’25 and Mar’25, supported by a gradual improvement in e-Khata issuances. Additionally, the management indicated that disbursement volumes in Telangana have bottomed out and would only improve from hereon.

* We estimate an advances/PAT CAGR of ~13%/11% over FY25-27, with an RoA/RoE of ~2.2%/~17.0% in FY27. CANF, in our view, is a robust franchise with strong moats on the liability side. However, we await: 1) execution on loan growth guidance and 2) disruptions (if any) from the tech transformation that the company will embark on in the current calendar year, before turning constructive on the stock. The stock’s valuation of 1.4x FY27E P/BV suggests management’s inability to deliver on its loan growth guidance because of recurring external events that impede business momentum. We reiterate our Neutral rating with a TP of INR770 (premised on 1.5x Mar’27E P/BV).

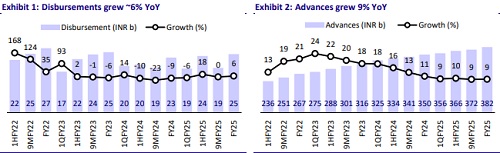

Disbursement momentum picks up; advances rise ~9% YoY

* CANF’s 4QFY25 disbursements grew ~6% YoY and ~30% QoQ to INR24.5b. Disbursements clocked healthy momentum during the quarter.

* Advances grew ~9% YoY to ~INR382b. Annualized run-off in advances stood at ~15% (PQ: 14% and PY: ~16%).

Reported NIM dips ~10bp QoQ; debt market borrowings pickup

* NIM (reported) dipped ~10bp QoQ to ~3.64%. Reported spreads declined ~13bp QoQ due to a decline in yields and an increase in CoB. We model largely stable NIMs of ~3.7% each in FY26-FY27.

* The bank term loans declined to ~52% in the borrowing mix (PQ: 60%). The majority of the borrowings were through NCDs during the quarter.

* The company expects the repo rate cut of ~25bp in Feb'24 to translate into ~10bp decline in its CoB. The company will, in its next ALCO meeting, decide how much of this benefit in CoB it will pass on to the customers.

Minor improvement in asset quality; GS3 declines ~5bp QoQ

* Asset quality improved slightly, with GS3 declining ~5bp QoQ to ~0.87% and NS3 declining ~4bp QoQ to ~0.45%. PCR on stage 3 loans rose ~260bp QoQ to ~48%.

* Credit costs stood at INR154m (vs. est. INR69m), resulting in annualized credit costs of ~16bp (PQ: ~24bp and PY: ~2bp).

* While there was a minor decline in PCR on standard loans, CANF increased the management overlay provisions to INR590m (PQ: ~INR340m). In 4QFY25, the company recorded provision write-backs of INR100m, while simultaneously creating an additional INR250m in management overlay. Management highlighted that the increase in overlay reflects a prudent approach and clarified that it is not driven by any specific concerns or emerging risks.

* CANF guided for credit costs of ~15bp in FY26 but suggested that it could be lower than that. We model credit costs of ~15bp each for FY26/FY27.

Highlights from the management commentary

* Karnataka disbursements, which stood at INR4.5b-4.75b in 3QFY25, increased to ~INR7b in 4QFY25. CANF disbursed ~INR2b, INR2b, and INR3b in each of Jan'25, Feb'25, and Mar'25 in the State of Karnataka.

* Management guided a cost-to-income ratio of ~17% in FY26, which will increase to ~18% in FY27. This increase will be driven by IT transformation expenses, which are set to commence from Apr’26 and will begin impacting operating expenses from FY27 onwards.

* Bank borrowings, which constitute 52% of the company’s liability mix, are linked to the repo rate and are expected to benefit from the anticipated decline in interest rates. However, the impact of the Apr’25 Repo rate cut on CANF’s cost of borrowings will reflect only towards the end of Jun’25.

Valuation and View

* CANF reported a decent quarter as earnings were in line with estimates, driven by a lower effective tax rate. Disbursements saw strong sequential momentum, asset quality improved marginally, while NIMs contracted by ~10bp QoQ.

* CANF has successfully demonstrated its ability to maintain its pristine asset quality for several years, and we expect the same to continue. However, CANF will have to accelerate its disbursements in the next year to deliver on its guided loan growth. We estimate a CAGR of 11% each in NII/PPOP/PAT over FY25-27, with an RoA of 2.2% and RoE of ~17% in FY27. Reiterate Neutral with a TP of INR770 (premised on 1.5x Mar’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412