Buy Aurobindo Pharma Ltd for the Target Rs. 1,360 by Motilal Oswal Financial Services Ltd

Diversification and differentiation backed by capacity

* Aurobindo Pharma (ARBP) is actively investing across multiple high-potential segments to drive sustained growth over the next 3-5 years.

* The company’s Penicillin G (PEN-G) project is scaling up meaningfully, effectively curbing operational losses, and is expected to contribute materially to profitability in FY26 and FY27.

* In the US generics market, ARBP continues to strengthen its position by consistently adding limited competition products to its portfolio.

* Beyond generics, the company is expanding into peptides and biosimilars, while simultaneously building the necessary manufacturing capacities to support long-term growth.

* We raise our earnings estimate by 4%/3% to factor in: a) a faster scale-up in PEN-G, b) niche launches, and c) improved operating leverage. We value ARBP at 16x 12M forward earnings to arrive at a TP of INR1,360.

* ARBP stands out for having the most diversified US generics portfolio, demonstrating resilience against pricing pressure despite a robust USD2.1b revenue base. Additionally, its investments in differentiated capabilities and facilities for regulated markets position the company well for continued momentum.

* We project a 17% earnings CAGR over FY25-27. With the stock correcting 12- 13% over the past six months, current valuations appear attractive. We upgrade the stock to BUY.

PEN-G: From operational loss in FY25 to EBITDA contributor going forward

* Following an investment of ~INR30b, ARBP is implementing efforts to improve the yield of the manufacturing process.

* ARBP has worked comprehensively on this project, from raw material sourcing to establishing a manufacturing presence, at both the KSM and bulk drug levels. The company’s formulation capacity has strengthened its presence across the entire value chain.

* In addition to building an uninterrupted power supply, ARBP has also addressed the significant water requirement for this project.

* Considering the global demand of 65-70k tons per annum, the company aims to establish a dominant position with a planned capacity of 15k tons per annum. With economies of scale and government support under the PLI scheme, we expect this project to contribute INR1.7b to EBITDA in FY26. Over the past 12M, it has dragged EBITDA by INR2b. Further, as production scales up, ARBP will become eligible for PLI incentive income.

Generics: Work-in-progress on differentiated offerings

* ARBP is set to have the highest number of ANDA filings in the US generics market (853). Interestingly, it will have a diversified portfolio with minimal price erosion (low single digit).

* While limited competition products (g-Xarelto/g- Sprycel) are expected to drive near-term earnings, ARBP is actively advancing in the fields of biosimilars, peptides, and oligonucleotides to enhance its offerings.

* The company is specifically working on 14 products in the biosimilar segment for the US/EU market.

* Given its biologics manufacturing capabilities, the company has secured a CMO order from Merck to manufacture Drug Substance (DS)/Drug Product (DP). Accordingly, it is also working on doubling the bioreactor capacity to 60KL/annum.

Valuation and view: Upgrade to BUY

* After a strong FY24, ARBP is expected to post a moderate 10% YoY earnings growth in FY25, partly due to: a) operational losses from the PEN-G product and b) disrupted production at Eugia III caused by regulatory issues.

* With the above issues largely behind, we expect ARBP to witness an uptrend in earnings growth, led by a) better profitability from backward integration in antibiotic products through the PEN-G project, b) the launch of niche products, and c) scale-up in injectable production.

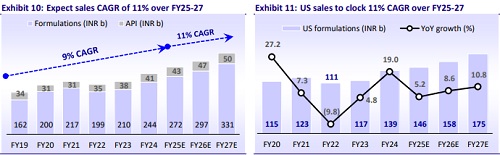

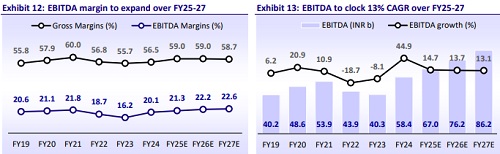

* We estimate 10%/13%/17% revenue/EBITDA/PAT CAGR over FY25-27.

* We value ARBP at 16x 12M forward earnings to arrive at a TP of INR1,360.

* Considering the earnings upside potential and recent correction in the stock price, we upgrade to BUY.

* Key Risks: Any adverse policies with respect to US tariffs on imports could impact our estimates. Additionally, delays in key approvals may keep earnings growth under check.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412