Neutral NOCIL Ltd for the Target Rs. 170 by Motilal Oswal Financial Services Ltd

Challenging operating environment hurts 2Q performance

Operating performance below our estimates

* NOCIL’s 2QFY26 was weak, with revenue declining 12% YoY to INR3.2b. EBITDA also declined 44% due to continued pricing pressure in the domestic market.

* Domestic volumes witnessed a positive traction in the quarter; however, the volumes in international markets were subdued due to global uncertainties and US tariff issues. Volumes in 1HFY26 declined in both the domestic and the international markets.

* We cut our FY26/FY27/FY28 earnings estimates by 28%/25%/19% due to sustained pricing pressure, rising competitive intensity, a global slowdown in rubber chemicals, and a slowdown in the US market. Exports are likely to be subdued in the near term. We reiterate our Neutral rating on the stock with a TP of INR170, based on 30x Dec’27 EPS.

Weak quarter hit by lower realizations and softer export demand

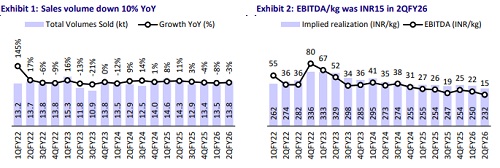

* NOCIL posted revenue of INR3.2b (est. of INR3.4b; down 12% YoY), due to a 3% YoY dip in sales volume to 13.8tmt. This was because volumes in international markets were dampened due to global uncertainties and the US tariff issues.

* Gross margin at 41.3% dipped 190bp YoY, while EBITDA margin contracted 370bp YoY to 6.5%. This was due to a 9% YoY dip in realization to INR232.3/kg (INR254.1/kg in 2QFY25), led by dumping pressure in the domestic market. EBITDA/kg also declined 42% YoY to INR15.2.

* Employee costs as a % of sales were flat YoY at ~7%, while other expenses as a % of sales stood at ~28% vs. ~27% in 2QFY25.

* EBITDA stood at INR209m (est. of INR310m), down 44% YoY, and PAT dipped 58% YoY to INR173m in 1QFY26 (est. INR245m).

* In 1HFY26, revenue /EBITDA/Adj. PAT declined 11%/34%/51% to INR6.6b/ INR505m/INR338m

* CFO stood at INR1.3b as of Sep '25 compared to INR567m in Sep'24.

Highlights from the management commentary

* Anti-dumping duty: In order to mitigate the impact of dumping in the domestic market, the company has filed anti-dumping petitions with the Indian government. These petitions are currently under investigation, with outcomes anticipated over the coming months.

* Brownfield expansion: The Brownfield expansion in Dahej is poised to commence from 1HCY26 onwards. This involves capex of INR2.5b, with 75-80% of the work already completed.

* Strategic initiatives: The company is introducing various cost savings and efficiency improvement initiatives to reduce conversion costs from 4QFY26 onwards and focusing on geographies other than the US.

Valuation and view

* NOCIL is focused on expanding its capacity, with the Dahej plant expected to start trial production by Jan’26. To mitigate the slowdown of the US market due to the tariff-related uncertainties, the management plans to increase its market share in other geographies.

* Despite the management’s focus on cost optimization and efficiency improvement, the continued pricing pressure in the global market – due to heightened competitive intensity – and the slowdown in the global market are expected to weigh on NOCIL’s operating performance in the near term.

* Consequently, we cut our FY26/FY27/FY28 earnings estimates by 28%/25%/19%. We reiterate our Neutral rating on the stock with a TP of INR170, based on 30x Dec’27 EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412