Buy Avalon Technologies Ltd For Target Rs. 970 by Motilal Oswal Financial Services Ltd

Tariff tailwinds and growing client base boost growth outlook

Avalon is uniquely placed in the Indian electronics manufacturing services (EMS) sector with its well-established manufacturing presence in the US. Moreover, the company serves various emerging and fast-growing end-user industries such as clean energy, mobility and medical technology across the globe, which cumulatively accounted for ~62% of Avalon’s total revenue as of 9MFY25 (vs. ~59% as of FY24).

* Amid the current uncertain global environment where many countries are facing a major threat to their trading prospects due to US tariffs, India is believed to be in a favorable situation.

* After the Trump administration’s decision to pause tariffs on all countries, except China, which is facing an exorbitant tariff of 245% on its exports to the US, the EMS sector may see a gradual shift of some business from China to India in the mid to long term. China exported ~20% of total electrical machinery to the US as of CY24 vs. India’s 1.7%.

* Even if India is imposed with a proposed tariff of 26%, it will be lower than the proposed tariffs on India’s key competitors, like China (245%), Vietnam (46%) and Taiwan (32%), in the EMS sector. This will present an opportunity for Indian EMS companies, especially for Avalon due to its well-established US plant.

* Along with a favorable tariff environment for India, Avalon is supported by an increase in domestic demand, stable/improving demand from the US, a healthy client mix (domestic and exports), and a favorable manufacturing presence compared to its peers.

Favorable tailwinds amid the shifting global landscape

* Amid the global uncertain trade environment due to US import tariffs, we believe that India’s EMS sector is relatively in an advantageous position.

* Scenario 1: Tariffs imposed by the US have hurt the global economy, though it might be a boon for Indian EMS companies, which enjoy a pause on tariffs until 9th Jul’25 compared to China, which is facing 245% tariffs as announced by the US on 15th Apr’25.

* Scenario 2: Even if tariffs were to be continued on other countries, India may still enjoy low tariffs of 26% compared with China (245%), Vietnam (46%) and Taiwan (32%).

* Considering both the scenarios, we find more confidence on our thesis of shift of business in this sector over mid to long term to India from China. China accounts for ~20% of the total electrical machinery exports to the US as of CY24 against India’s ~1.7%

* This trade war has created a major opportunity for Avalon, which earns the majority of its revenue from US customers (58% of total sales as of 9MFY25). Moreover, its well-established manufacturing presence in the US (~12% US manufacturing revenue) also gives Avalon an edge over peers.

* Although the company’s manufacturing mix has tilted toward India (88% as of 3QFY25 vs 70-75% as of FY23) for strategic reasons, it is in a position to shift back automated tasks to the US plants to reduce tariff exposure

* The company would not face any margin pressures due to tariffs, thanks to its cost-plus structure on products.

* The company has also recently announced the completion of phase 1 of its Chennai plant, which is primarily dedicated to exports. This will help the company cater to rising demand due to the shift in EMS business to India.

Rapid growth in operations across key clientele

* India saw significant growth in B2B and B2C Printed Circuit Board (PCB) assembly demand due to increased import duties. We expect PCB and other passive components to be locally manufactured with a component policy now in place.

* India’s electrical machinery dominates the country’s exports to the US, accounting for ~15.6% of India’s total exports as of CY24. This shows the US’ dependence on exports for EMS products.

* We therefore believe that orders from key clients may not be significantly impacted by the tariffs, as the US is dependent on electronics imports.

* Avalon reported strong 28% YoY growth in the order book in 9MFY25, taking the combined order book (including long-term contract) to INR27b as of 9MFY25, backed by customer loyalty and a healthy client mix. The order book proportion has a similar mix to the revenue proportion of India and the US, showcasing sustainable demand from the US.

* Over the recent times, Avalon has witnessed strong order flows, backed by the revival of existing US customers, the addition of new customers in the US, and increased focus on the domestic industry.

* The company has been moving from the prototype stage to the volume production stage for multiple products, i.e., for a global auto component company that specializes in motion systems, aiding the increase in share of mobility segment.

* Avalon also focuses on the high-margin rail and aerospace division, which is seeing increased traction in the domestic EMS industry.

* In Railways, the company is actively working on the anti-collision KAVACH system, which Avalon believes will offer sufficient business potential in the future. The company expects to see tremendous growth in demand for this segment in FY26.

* Moreover, the growth trajectory of Avalon’s clients also gives us confidence in the company’s growth outlook. Following are some examples of expansion activities undertaken by Avalon’s key clients:

* Ohmium International (clean energy segment client) launched a gigafactory in Doddaballapura, Bengaluru, in Jul’24. The facility will produce 2GW of fully assembled and tested PEM electrolyzer systems to meet the demands of Ohmium’s global project pipeline.

* Sunrun (clean energy segment client in the US) recently in its FY24 results mentioned its plan to increase its storage capacity by 30% YoY by 1HFY25, showcasing a strong growth trajectory.

* Collins Aerospace, one of the key aerospace clients, added a 70,000-sqft facility in Aug’24, increasing its footprint by 50% to enhance production capacity.

* Witnessing strong traction in recent quarters in terms of client addition and order book, Avalon has also raised its revenue guidance to 22-24% from 16- 20% earlier for FY25.

Valuation and view

* We believe Avalon will be in a better position in the EMS space amid the tariff war, backed by its strategic manufacturing presence, longstanding US and global clientele, and increased order flows from the domestic market.

* With the company’s US operations now witnessing a healthy recovery and the Indian business experiencing growth, we expect Avalon’s revenue and profitability to see healthy improvement going forward.

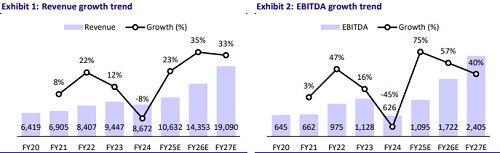

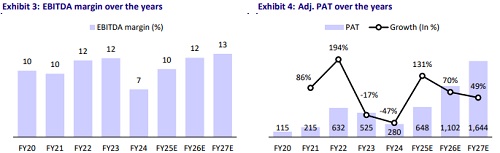

* We estimate Avalon to post a CAGR of 30%/57%/80% in revenue/EBITDA/adj. PAT over FY24-27, driven by strong growth and healthy order inflows. Reiterate BUY with a TP of INR970.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412