Buy Indostar Capital Finance Ltd for the Target Rs. 285 by Motilal Oswal Financial Services Ltd

Weak quarter; disbursements and loan growth remain muted

GS3 improved ~1pp QoQ aided by an ARC transaction; credit costs elevated

IndoStar Capital Finance (IndoStar) delivered a weak performance in 2QFY26, with muted disbursements and weak AUM growth as it continued to follow tightened underwriting norms and prioritized asset quality. However, the company expects growth momentum to pick up in 2HFY26, supported by improving business activity and a gradual revival in demand.

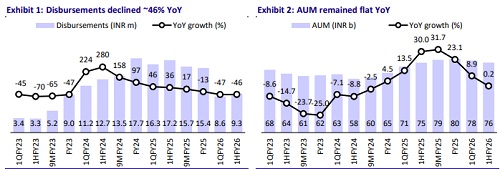

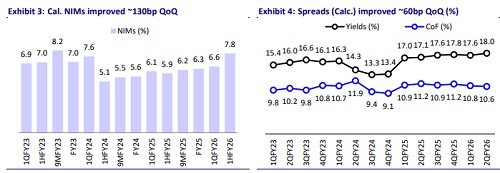

Key highlights: 1) Disbursements declined ~46% YoY and grew 8% QoQ to ~INR9.3b and standalone AUM was flat YoY and declined 3% QoQ to INR75.6b; 2) Credit costs stood at INR586m (PY: INR193m) 2) IndoStar sold a stressed CV portfolio of INR3.1b to an ARC for a consideration of INR2.2b, 3) NIM (calc.) expanded ~130bp QoQ driven by decline in CoB, and 5) opex optimization will be the most important theme in FY26, given that management targets to bring down the cost-to-income ratio to ~50% (from ~64%) over the medium term.

Financial highlights

* 2QFY26 PAT declined 67% YoY to INR105m. NII grew ~40% YoY to INR1.5b. Other income stood at INR396m (PQ: ~INR290m). Opex declined ~5% YoY to INR1.2b, translating into a cost-to-income ratio of ~64% in 2QFY26 (PY: 77% and PQ: 88%).

* PPOP grew ~86% YoY to INR692m. Credit costs stood at ~INR586m (PQ: ~INR193m), which translated into annualized credit costs of ~3% (PY: ~1%).

* AUM stood at ~INR75.6b and was flat YoY. VF AUM was flat YoY and declined 3% QoQ to INR70.3b due to weak disbursements and sale of stressed portfolio to an ARC.

* Micro-LAP AUM grew ~33% QoQ to INR1b. Disbursements in micro-LAP was flat QoQ at INR270m. LTV in this segment stood at 34.4% as of Sep’25.

* Management shared that disbursements in 2HFY26 are expected to be around 1.4-1.5x of 1H levels, indicating stronger seasonality-led momentum in the upcoming quarters. The micro-LAP segment will also likely see a rebound in 2HFY26, following a temporary slowdown after Mar’25.

* We estimate a CAGR of 11%/86% in AUM/PAT over FY25-28, aided by improvements in NIM to 8.6%/10.4% in FY26E/FY27E. Maintain BUY with a TP of INR285 (premised on 1x Sep’27E BVPS).

AUM was flat YoY; disbursements declined 38% YoY in VF

* Disbursements declined ~46% YoY and grew 8% QoQ to ~INR9.3b. Vehicle finance (VF) disbursements declined ~38% YoY to INR9b.

* Management shared that micro-LAP will be a key growth driver for IndoStar, supported by the appointment of a seasoned COO (with over 25 years of experience in the segment). The company has expanded its operations beyond Tamil Nadu by commencing disbursements in Andhra Pradesh and has strengthened its team with senior professionals possessing deep local market expertise.

* IndoStar plans to further scale its micro-LAP business in Tier-5 towns through smaller ticket sizes and a lean operating model and targets to be present across 3-4 states by the end-FY26.

GS3 declines ~1pp driven by sale of stressed CV portfolio to ARC

* Asset quality exhibited improvement, with standalone GNPA declining ~1pp QoQ to ~3.05% and standalone NNPA declining ~55bp QoQ to ~1.4%. The improvement in GNPA was primarily driven by the sale of a stressed portion of the CV portfolio to an ARC, involving a principal outstanding of INR3.1b, against which the company realized ~INR2.2b.

* Management shared that loans originated under the revised policy framework are performing much better with lower delinquency rates and with 30+dpd at nearly half the levels relative to what was seen in the past.

* Collection efficiency (including overdue) stood at ~94% (PQ: ~94%). CRAR was healthy at ~37.2% and the debt-equity ratio stood at 1.4x.

Key highlights from the management commentary

* The company is leveraging existing VF infrastructure to expand micro-LAP presence, resulting in minimal incremental capex.

* Forward flows and early delinquencies continue to trend downward, supported by proactive collection and monitoring mechanisms.

* The company plans to convert 48 micro-branches (currently operating with one sales staff) into full-fledged branches, which will result in further improvement in its growth momentum.

Valuation and View

* IndoStar delivered a weak performance in 2QFY26, with muted disbursements and weak AUM growth as it continued to follow tightened underwriting norms and prioritized asset quality. However, the company expects growth momentum to pick up in 2HFY26, supported by improving business activity, gradual revival in demand and improvement in forward flows, leading to better asset quality.

* IndoStar has prioritized the expansion of its loan book in the used CV segment and micro-LAP. A reinforced management team, enhanced processes, opex rationalization and expectations of an improvement in the economic climate will serve as catalysts for IndoStar. Maintain BUY rating on the stock with a TP of INR285 (premised on 1x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412