Neutral Nestle India Ltd for the Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

Inspiring start to the results season; adds flavor for peers

* Nestle India (Nestle) reported a 10.6% YoY revenue growth in 2QFY26, ahead of our expectations. We had highlighted in our preview note that packaged food companies have witnessed a negligible impact from the GST transition. We had also mentioned in our recent update (link), following our interaction with Nestle’s management, that the company remains optimistic about a steady growth recovery. Domestic revenue growth stood at 11%, far better than our estimates of 5%, driven primarily by underlying volume growth, which we believe was in the high single digits (~7%). Three out of four product groups delivered strong volume-led double-digit growth. Export revenue grew 14% YoY, driven by strong demand across product groups.

* GM pressure persisted, contracting 230bp YoY/80bp QoQ to 54.3% (est. 55.7%), given the inflation in key commodities. Management indicated that edible oil prices are expected to remain elevated, while milk prices are likely to cool off, with coffee and cocoa prices remaining range-bound. EBITDA margin contracted 100bp YoY to 22.2% (in-line). We model an EBITDA margin of 23.4% for FY26 and 24.5% for FY27.

* Nestle’s operating performance had been relatively weak over the past 4-5 quarters, marked by muted revenue growth and margin contraction. Following the GST 2.0 transition, we had factored in a demand recovery in our model and expected it to be reflected first in the packaged food segment, given the negligible impact from the GST transition. We also expect stronger growth acceleration for packaged food companies, supported by a higher mix of pricing packs (serve for one). We remain constructive on the overall macro demand environment and anticipate growth acceleration for FMCG companies. We model revenue/EBITDA/PAT CAGR of 11%/12%/12% over FY25-28E. The stock is trading at 76x/63x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR1,300 (based on 60x P/E Sep'27E).

Revenue beat; margins in line with expectations

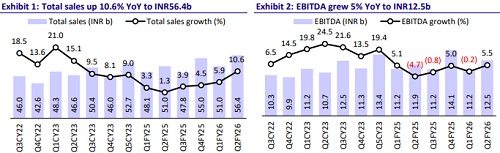

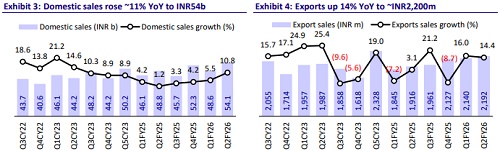

* Beat on sales: Nestle’s net sales rose 10.6% YoY to INR56.3b (est. INR53.7b) in 2QFY26. Domestic sales witnessed 10.8% YoY growth to INR54.1b, while exports grew 14% YoY to INR2.2b.

* Most categories witnessed volume-led growth: Nestle reported volume-led double-digit sales growth, with three out of four product groups delivering strong volume-led double-digit growth. The powdered and liquid beverages category remained a key growth driver in 2QFY26, posting high double-digit growth, while confectionery also recorded strong double-digit growth. The prepared dishes and cooking aids segment delivered strong double-digit growth, which was led by volume growth. Additionally, the pet food business recorded high double-digit growth. The milk products and nutrition category delivered a mixed performance, with certain segments growing while others remaining muted..

* Commodity continues to weigh on margin: The company’s gross margin contracted 230bp YoY to 54.3% (est. 55.7%), driven by elevated consumption prices across the commodity portfolio. Management indicated that milk prices are likely to soften with the onset of the flush season, while coffee prices may stabilize as upcoming harvests in Vietnam and India appear normal. Cocoa markets are expected to stabilize following a demand correction over the past two years. However, edible oil prices are likely to remain stable, with a potential rise expected due to tight global supply-demand conditions.

* Margins in-line: Employee and other expenses rose ~7% YoY each. EBITDA margin contracted 100bp YoY to 22.2% (est. 22.2%, 21.9% in 1QFY25). EBITDA grew 5% YoY to INR12.5b (est. INR 12b). PBT remained flat YoY to INR10.5b (est. INR10.1b), while Adj. PAT declined 4% YoY to INR7.4b (est. INR7.3b).

* Further, the company has added a new Maggi noodles production manufacturing line at the Sanand Factory in Gujarat in 2QFY26.

Valuation and view

* We slightly raise our EPS estimates for FY26-FY28 by ~2%.

* GST 2.0 is expected to stimulate consumption, drive affordability, and contribute to the overall growth of the FMCG sector and the economy; Nestle is likely to benefit from the same. About 85% of the company’s portfolio has benefited from the GST rate cuts.

* Mr. Manish Tiwary’s outlook on the way forward will be a key aspect to watch out for. The company’s focus on its RURBAN strategy has driven stronger growth in RURBAN markets, with most categories benefiting from improved distribution penetration. Packaged food adoption has increased in tier-2 and rural markets. The company continues to enhance its portfolio through ongoing innovation and premiumization initiatives.

* Nestle’s portfolio remains relatively safe from local competition, requiring limited overhead costs to protect market share. The company has invested ~INR39b in strengthening its manufacturing capabilities to cater to the anticipated future demand. However, this will weigh on margins and return ratios in the near term. We model revenue/EBITDA/PAT CAGR of 11%/12%/12% over FY25-28E.

* The stock is trading at 76x/63x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR1,300 (based on 60x P/E Sep'27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)