Buy Sunteck Realty Ltd for the Target Rs. 574 by Motilal Oswal Financial Services Ltd

Collections miss but financials strong

The uber-luxury and premium segment drives 87% of sales in 2Q

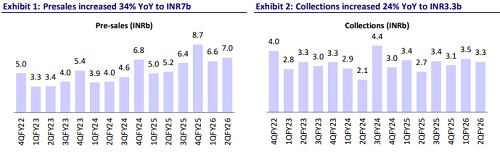

* SRIN reported pre-sales of INR7b in 2QFY26, up 34% YoY/7% QoQ (19% above estimate). In 1HFY26, presales were INR13.6b, up 32% YoY. ? Collections were up 24% YoY at INR3.3b for 2QFY26 (28% below estimate). In 1HFY26, collections stood at INR6.8b, up 12% YoY.

* The net debt-to-equity ratio rose to 0.04x in the quarter from 0.02x QoQ.

* In 2QFY26, the company entered into a joint development agreement to develop a project located at Mira Road along the Western Express Highway. The project offers a development potential of 0.55msf on a land parcel measuring around 3.5 acres, with an estimated GDV of INR12b. Overall, in 1HFY26, the company added two projects with GDV of INR23b and developable area of 0.83msf.

* P&L performance: In 2QFY26, revenue was up 49% YoY/34% QoQ at INR2.5b (13% above our estimate). In 1HFY26, revenue fell 9% YoY to INR4.4b.

* The company reported EBITDA of INR778m, up 108% YoY/63% QoQ (132% above estimate). EBITDA margin was up 873bp YoY/549bp QoQ at 31% (up 1,581bp vs. our estimates). In 1HFY26, EBITDA was up 83% YoY at INR1.3b. 1H margin surged 2x YoY to 28%.

* 2Q adj. PAT stood at INR490m, up 41% YoY/46% QoQ (80% above our estimate). PAT margin was 19.4%. In 1H, PAT stood at INR824m, up 43% YoY.

Key concall highlights

* Guidance on collections and revenue: Collections will also gain momentum once the construction phases move ahead in the coming quarters of FY26, which will lead to more projects coming up for revenue recognition such as Sunteck City – 4 th Avenue, which has received the occupation certificate.

* Launch pipeline: In 3Q-4QFY26, SRIN intends to launch projects with total GDV of INR110b, which include:

* A new phase of Sunteck City ODC (Goregaon West) with a GDV of INR15b (~0.5msf in one tower to be launched)

* Two towers in Sunteck Beach Residences, Vasai, with a GDV of ~INR5- 6b

* One tower in Sunteck Skypark in Mira Road with a GDV of ~INR10b

* The project in Bandra West with a GDV of INR10b

* Sunteck World, Naigaon, with a GDV of INR5b

* Newly added Andheri redevelopment in WEH with a GDV of INR11b

* Remaining from Nepean Sea Road with a GDV of INR54b

* Burj Khalifa Community, Dubai: The project will have only two towers with a total area of 1msf and GDV of INR90b. It would be launched in 4QFY26 or early FY27. SRIN plans to sell it in 3-4 years after the launch as guided by management.

* Business development: In 1H, the company executed two BD deals: a ~2.5-acre redevelopment project in Andheri (WEH) with 0.28msf potential (GDV: ~INR11b) and a ~3.5-acre JDA project at Mira Road (WEH) with 0.56msf potential (GDV: ~INR12b).

* Construction of 5th Avenue (residential and commercial) to start soon as the company gets approval regarding the same.

* Nepean Sea first phase demolition is nearly complete and approvals are falling in place. Construction will start soon.

Valuation and view

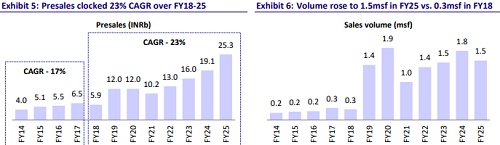

* We expect SRIN to deliver a healthy 21% presales CAGR over FY25-28E, fueled by a ramp-up in launches from both new and existing projects. Further, its sound balance sheet and strong cash flows would spur project additions and drive sustainable growth.

* We value its residential segment based on the NPV of existing pipelines and its commercial segment based on an 8% cap rate on FY26E EBITDA.

* We reiterate our BUY rating on the stock with a TP of INR574, implying a 33% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412