Neutral United Foodbrands Ltd for the Target Rs. 215 by Motilal Oswal Financial Services Ltd

Weak quarter; miss on margins

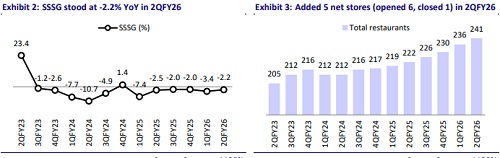

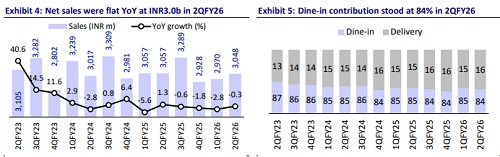

* United Foodbrands (BBQ India)’s consolidated revenue was flat YoY at INR3.0b (in line). Same-store sales growth (SSSG) remained subdued, declining 2.2% YoY in 2QFY26, primarily due to Navratri (70-75% portfolio non-veg). Ex-Navratri, SSSG stood at +0.8%, indicating an underlying improvement in demand. In Oct’25, SSSG rebounded to 6–7% at the consolidated level and ~5% for the India business, reflecting a healthy recovery post-Navratri. Dine-in revenue declined 1% YoY to INR2.6b, and delivery was up 4% to INR0.5b.

* BBQ India’s revenue declined 6% YoY to INR2.3b, led by negative SSSG and low store expansion. Same-store sales decline by 4.3%. GP margin compressed 230bp YoY to 64.3%. GP was down 9% YoY. RoM (Pre-Ind AS) margin compressed 490bp YoY to 6.1% due to operating deleverage. RoM dipped 48% YoY. BBQ India added two net stores to 195 in 2QFY26.

* BBQ International’s revenue rose 27% YoY to INR276m, supported by strong SSSG. The SSSG was at 8.4%. GP margin declined 50bp YoY to 72.5%. GP was up 26% YoY. RoM (Pre-Ind AS) margin contracted 240bp YoY to 17.8%. RoM improved 11% YoY. Mature stores delivered over 20% margins. It added one store during the quarter, bringing the total to 12 stores.

* Premium Casual Dining Restaurant’s (CDR) revenue was up 17% YoY to INR473m, led by store additions. Same-store sales rose 5.3%. GP margin contracted 220bp YoY to 72.9%. GP rose 13% YoY. RoM (Pre-Ind AS) margin contracted 310bp YoY to 13.1% lower due to new restaurant additions. RoM declined 6% YoY at INR62m. The matured portfolio (restaurants older than two years) delivered over 20% Pre IND-AS RoM.

* Consolidated GM dipped 180bp YoY to 66.2%. EBITDA margin contracted by 250bp YoY to 12.4% (est. 14.3%), at an all-time low. EBITDA Pre-Ind AS margin dipped 430bp YoY to 1.1%. RoM (Pre-Ind) contracted 420bp YoY to 8.2%.

* The company plans to open 20–25 BBQ India outlets annually, 4–6 new international stores across the Middle East and Southeast Asia in the near term, and 12–15 Premium CDR restaurants in FY26 as part of its calibrated expansion strategy. BBQN’s current valuations at 13x FY26E and 10x FY27E pre-Ind AS EV/EBITDA are comfortably positioned. However, we are watchful of BBQN’s demand recovery. We reiterate our Neutral rating on the stock as we still await clarity on earnings recovery. We have a TP of INR215, based on 10x Sep’27E Pre-Ind-AS EV/EBITDA (low valuation due to weak RoCE profile and uncertainty of earnings recovery).

Weakness persists; SSSG declines 2.2%

* Muted trajectory continues: United Foodbrands reported sales were flat YoY at INR3.0b (est. INR 3.1b) in 2QFY26. Same-store sales were down 2.2% in 2QFY26 (est. -3%). SSSG (ex-Navratri days) is +0.8%. The dine-in channel (84% of sales) declined 1% YoY to INR2.6b. Delivery channel (16% of sales) up 4% YoY to INR0.5b.

* Digital KPIs: Cumulative app downloads were 8.5m in 2QFY26 vs 7.1m in 2QFY25. Own digital asset contribution was at 42.3% vs. 29.9% in 2QFY25.

* Store additions continue: The company has added six stores and closed one store, which led to a total of 241 stores. Of the 241 stores, BBQN has 195 stores, 12 international BBQN stores, and 34 Toscano and Salt stores. Total metro and tier-1 accounted for 190 stores, and tier 2/3 accounted for 51 stores in 2QFY26.

* Margin contraction: Gross margin contracted 180bp YoY to 66.2%. (est. 68%). EBITDA declined 17% YoY to INR377m (est. INR439m). EBITDA margin contracted by 250bp YoY to 12.4% (est. 14.3%) at an all-time low. Pre-Ind AS EBITDA decreased by 80% YoY to INR33m in 2QFY26, and the margin contracted 430bp YoY to 1.1%. RoM (Pre-Ind AS) was down 34% YoY, and the margin contracted 420bp YoY to 8.2%.

* BBQN recorded a Loss after Tax of INR225m in 2QFY26 vs. a loss of INR71m in 2QFY25.

Highlights from the management commentary

* In 2QFY26, SSSG stood at 0.8% (excluding nine days of Navratri) and 2.2%, including Navratri. The non-vegetarian portfolio (70–75%) was notably impacted during Navratri.

* October SSSG improved to 6–7% at the consolidated level and ~5% for the India business, reflecting recovery post-Navratri.

* The company opened 6 new restaurants during 2Q and remains well-placed to add 9–12 outlets per quarter, targeting 300+ stores by FY27.

* In FY26, the company planned capex of INR1,250m, which includes new restaurant additions (35 stores) along with maintenance and corporate capex.

Valuation and view

* We cut our EBITDA estimates by 7-8% for FY26 and FY27.

* BBQN’s PBT margin profile is weaker than that of QSR players. Hence, despite a comfortable position on valuation, we remain watchful of its operating margin delivery. Its mid-single-digit RoCE profile is weak considering the fine dine-in format.

* BBQN’s current valuations at 13x FY26E and 10x FY26E pre-Ind AS EV/EBITDA are comfortably positioned. However, we are watchful of BBQN’s demand recovery. We reiterate our Neutral rating on the stock as we still await clarity on earnings recovery. We have a TP of INR215, based on 10x Sep’27E Pre-IndAS EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)