Neutral BPCL Ltd For Target Rs.240 by Motilal Oswal Financial Services Ltd

Rising capex and muted GRM outlook pose challenges in FY26-27

* We met with the management of BPCL recently, and it: 1) highlighted the proportion of Russian crude in the refining mix is likely to dip to ~24% in Mar’25 (from 35-40%), 2) remains hopeful of positive news from Mozambique in near future, with gas supply starting in FY29, and 3) aims for an FY28 CGD EBITDA target of INR40b. While only INR61b has been approved currently for the Andhra Pradesh refinery project, there is a possibility of another INR950b capex being incurred. The INR490b Bina refinery expansion is also underway with the majority of the spending scheduled for FY26/FY27.

* BPCL’s current 1-yr fwd. valuation of 1.3x P/B at par with the mean -1 S.D. It now trades on par with HPCL (on a 1-yr fwd. P/B basis) vs. a historical premium of 50%. While valuation appears reasonable and strong marketing performance continues, a muted mid-term refining outlook (our FY26E/FY27E PAT are 17%/18% sensitive to every USD1/bbl change in GRM) and commencement of new capex cycle emerge as key concerns. Hence, we reiterate our Neutral rating with an SoTP-based valuation of INR240/share.

Marginal impact from lower Russian crude proportion

* Russian crude utilization stood at 31% in 3Q (vs. 35-40% historically). While sufficient Russian crude cargos are available for Jan’25/Feb’25, the ratio might come down to 24% in Mar’25.

* However, the company has signed contracts with Brazilian players for crude sourcing. If the Russian crude utilization becomes nil, BPCL shall encounter a USD1/bbl GRM impact, as the USD3-USD3.5 per bbl discount shall not be available elsewhere.

* Recently, BPCL has also signed a strategic term contract with Total Energies Trading Asia Pte Ltd for Middle Eastern crude supply (media article).

* Management stated that the US crude input proportion has always been in the top 3. Further, an increase in US crude oil imports (media article) shall not result in any disadvantage to BPCL, since higher transportation costs are offset by lower crude oil costs (WTI crude is ~USD3/bbl cheaper than Brent).

* Further, reciprocal tariffs imposed by Trump shall not have any material impact on the company, due to the absence of meaningful exports to the US.

Mozambique development remains a key monitorable

* Regarding the lifting of FM, management anticipates positive developments soon, as Total Energy, the operator of the block, is actively working on it. Gas will start flowing in 24-36 months after the lifting of FM.

* In a recent media interview, BPCL’s CMD stated that the first gas from the Mozambique field is anticipated by FY29.

Other key takeaways from our meeting

* BPCL aims to achieve an EBITDA of INR40b from its CGD business by FY28. ? Management expects some LPG under-recovery compensation before 4QFY25- end.

* BPCL has established two CBG plants in Kochi and Bina and plans to set up 26 more in the near term through JVs. These plants will utilize municipal waste as feedstock, with a capital expenditure of INR1b per plant.

* Further, the company also finalized a significant LNG sourcing agreement with ADNOC Trading (tied to the Henry Hub index) on 13th Feb’25, and the LNG will be sourced for refinery use only.

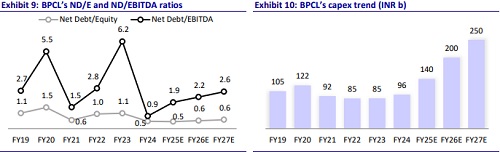

* While only INR61b has been approved currently for the Andhra Pradesh refinery project, there is a possibility of another INR950b capex being incurred. The INR490b Bina refinery expansion is also underway with the majority of the spending scheduled for FY26/FY27.

Trading at mean -1 S.D.; valuation premium vs. HPCL has disappeared

* While BPCL has generated 63% returns over the last two years, the stock has sharply corrected by 28% over the past 5 months.

* It now trades on par with HPCL (on a 1-yr fwd. P/B basis) vs. a historical premium of 50%. BPCL’s current 1-yr fwd. valuation of 1.3x P/B is close to the mean -1 S.D. The dividend yield in FY27E is attractive at ~5.2%; we assume ~50% pay-out and believe there remains risk of dividend pay-out ratio being cut given aggressive capex cycle especially if the Andhra refinery project goes ahead.

* While the commencement of a new capex cycle means cash flows and the balance sheet will face some stress, we do highlight healthy marketing business momentum and attractive valuations.

Valuation and View

* BPCL’s GRMs have been at a premium over SG GRMs due to the continuous optimization of refinery production, product distribution, and crude procurement. The use of advanced processing capabilities of the Bina and Kochi refineries allows BPCL to process 100% of high-sulfur crude and 50% of Russian crude.

* We maintain our GRM and marketing margin assumptions. While the current marketing margins remain healthy and slightly above the INR3.3/lit level, we are modeling for MS/HSD. SG GRM has been marginally down so far in 4QFY25 at USD2.7/bbl vs. USD5/bbl in 3QFY25.

* While valuation appears reasonable and strong marketing performance continues, a muted mid-term refining outlook (our FY26E/FY27E PAT are 17%/18% sensitive to every USD1/bbl change in GRM) and commencement of new capex cycle emerge as key concerns. Hence, we reiterate our Neutral rating with an SoTP-based valuation of INR240/share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412