Neutral KFin Technologies Ltd for the Target Rs. 1,150 by Motilal Oswal Financial Services Ltd

Performance in line across parameters

* KFin Technologies (KFINTECH) reported a 24% YoY growth in operating revenue to INR2.8b in 4QFY25 (in line), driven by 23%/35%/16% YoY growth in domestic MF solutions/issuer solutions/international solutions. For FY25, revenue grew 30% YoY to ~INR10.9b.

* Total operating expenses grew 30% YoY to INR1.6b (in line), resulting in 17% YoY growth in EBITDA to INR1.2b (in line), with EBITDA margin at 43.2% (45.8% in 4QFY24). For FY25, EBITDA grew 31% YoY to INR4.8b, reflecting EBITDA margin of 43.9% (43.8% in FY24).

* KFINTECH reported a net profit of INR851m, up 14% YoY (in line) in 4QFY25. For FY25, PAT rose 35% YoY to INR3.3b. PAT margins for 4QFY25 stood at 30.1% in 4QFY25 vs 32.6% in 4QFY24.

* EBITDA margins are expected to decline in FY26 due to Ascent's lower margin profile compared to KFINTECH. However, in absolute terms, management does not anticipate significant dilution.

* We have cut our earnings estimates for FY26/FY27 by 3%/5% due to lower AUM growth expected this year. We expect revenue/PAT to post a CAGR of 18%/21% over FY25-27. We maintain a Neutral rating on the stock with a one-year TP of INR1,150, premised at a P/E multiple of 40x on FY27E earnings.

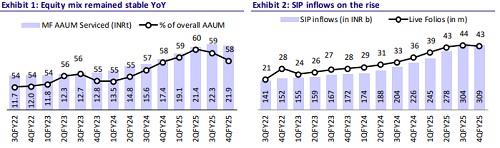

Equity AAUM constitutes 58% of overall AAUM

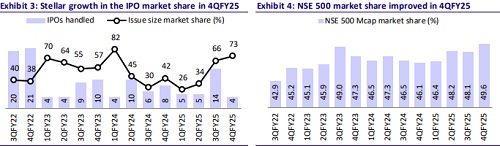

* Total MF AAUM grew 26% YoY to INR21.9t in 4QFY25. Equity MF AAUM contributed 58% to overall AAUM, up 26% YoY to INR12.7t, reflecting a market share of 33.1% (33.4% in 4QFY24).

* Strong net flows and a healthy yield of 3.6bp in 4QFY25 resulted in a 23% YoY growth in revenue from the domestic MF business, reaching INR2b (in line). This segment contributed 70% to the overall revenuein 4QFY25.

* In the issuer services business, KFINTECH’smarket share in mainboard IPOs (in terms of issue size) grew 1.74x YoY to 72.9% in 4QFY25, driven by its role inmanaging several top IPOs, with the upcoming pipeline of large IPOs also largely managed by the company. This led to a 35% YoY growth in revenue from issuer solutions to INR424m (7% miss) in 4QFY25. The revenue mix (%) comprised ~45% from folio maintenance, ~35% from corporate actions, and the balance from other corporate events like conducting AGMs, e-votings, etc.

* In the international investor solutions business, KFINTECHhas crossed over 100 contracts, with the client countreaching 76 (including 12 yet to go live), bringing the total AUM serviced to INR813b. Revenue from this segment grew 51% YoY to INR412m. Following the Ascent acquisition, management expects the international business to contribute 13-15% to overall revenues, up from the current levels of 5-6%.

* In the alternates and wealth business, market share stood at 36.8%, with an AUM of INR1.5t. KFINTECHrecently won two deals in the wealth segment, and the pipeline remains robust. The NPS market share continued to rise, reaching 9.8% in 4QFY25 (8.3% in 4QFY24), with an AUM of INR542b.

* Employee expenses grew 20% YoY to INR1b (in line) and other expenses grew 52% YoY to INR588m (in line). The cost-to-income ratio stood at 57% (54.2% in 4QFY24 and MOFSLe of 57.7%).

* Other income grew 52% YoY/10% QoQ to INR100m (5% miss).

Key takeaways from the management commentary

* Revenue growth in FY25 was primarily driven by new mandate wins, despite a decline in AUM, due to mark-to-market losses amid market volatility. Management remains optimistic about strong revenue growth going forward, supported by both continued mandate wins and AUM expansion.

* It expects the recent acquisition of Ascent Fund Services to become valueaccretive from FY27 onwards, while FY26 is anticipated to be broadly neutral in terms of its impact.

* For the KRA business, in-principle approval has been received from SEBI, and the company is now awaiting final approval. The platform is already built, and operations will commence immediately upon receiving the final go-ahead.

Valuation and view

* Structural tailwinds in the MF industry are expected to drive absolute growth in KFINTECH’sMF revenue. With its differentiated ‘platform-as-a-service’ model offering comprehensive, end-to-end solutions powered by proprietary technology, the company is well-positioned to capitalize on strong growth opportunities in both Indian and global markets.

* The recent strategic investment in Ascent Fund Services marks a significant milestone, positioning KFINTECHas the first global fund administrator based in India. This acquisition provides access to a diversified client base across multiple geographies, a seasoned leadership team, and robust growth potential.

* By leveraging Ascent’s client acquisition strengths, along with KFINTECH’s technological capabilities and strategic partnership with BlackRock’s Aladdin Provider Network, the company is well-positioned to drive sustained growth and expand market share across segments.

* We have cut our earnings estimates for FY26/FY27 by 3%/5% due to lower AUM growth expected this year. We expect revenue/PAT to post a CAGR of 18%/21% over FY25-27. We maintain a Neutral rating on the stock with a one-year TP of INR1,150, premised at a P/E multiple of 40x on FY27E earnings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412