Buy Eternal Ltd for the Target Rs. 260 by Motilal Oswal Financial Services Ltd

Blinkit profits remain elusive

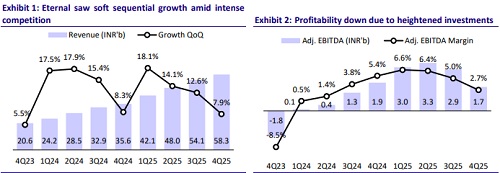

* Eternal reported 4QFY25 revenues of INR58b, up 8% QoQ, in line with our estimate. Growth was led by Blinkit (GOV up 20% QoQ/134% YoY). The food delivery business delivered 16% YoY growth in GOV with a steady increase in margins.

* Adj. EBITDA as a % of GOV margin was up 10bp QoQ at 4.4%. PAT came in at INR360m (est. INR1.8b), down 78% YoY, primarily attributed to increased investments in accelerated dark-store openings and customer acquisitions in the Quick Commerce (QC) business. For FY25, revenue/adj. EBITDA grew 67%/190% YoY vs. FY24.

* For 1QFY26, we expect revenue to grow 63% and adj. EBITDA to decline 14% YoY. Our DCF-based valuation of INR260 implies a 12% upside from the current price. We reiterate our BUY rating on the stock, supported by Eternal’s market leadership in both QC and Food Delivery, and the longterm potential of Blinkit as a generational opportunity in retail, grocery, and e-commerce disruption.

Our view: Dark store blitz and intense competition weigh on near-term profits

* Blinkit’s revenue and GOV surprise continues, but profitability gap widens: Blinkit’s NOV surged (up ~121% YoY on a like-for-like basis), supported by record store additions (294 in Q4) and 1m sq. ft. of new warehousing. However, with 40% of the store network still underutilized and intense customer acquisition spends, adjusted EBITDA losses widened QoQ. Contribution margin expanded marginally to 3.9% of NOV, but fullscale EBITDA breakeven could become worse before it becomes better.

* Preparing for intensifying competition; expect margin compression to persist: Contrary to street expectations, Zomato expects competition to rise in both grocery and non-grocery QC, including pressure from next-day delivery players accelerating their speed. As a result, marketing investments remained elevated, and EBITDA losses in Blinkit widened to INR1,790m in Q4 (-2.4% of NOV). We believe adjusted EBITDA is likely to remain under pressure through FY26 as Eternal defends its market share and to expand in this space. Our profitability assumptions are now knocked back even further, as we now expect Blinkit to just break even only in FY27.

* Exit from 10-minute food delivery could be due to Blinkit’s strategic prioritization: The company has formally exited the Zomato Quick initiative (10- minute food delivery), citing weak customer experience—limited incrementally—and operational complexity. In our view, Eternal aims to channel full organizational focus toward scaling Blinkit, and an aggressive 10-minute FD model could have diluted execution. It will be worth watching if Swiggy makes a renewed push in this space. That said, we continue to monitor the slowdown in the FD business, which remains considerably below the 20% growth guidance.

* Inventory-led model unlikely to strain working capital: With Eternal now structured as an Indian Owned and Controlled Company (IOCC), the move toward inventory ownership in Blinkit is underway. Even under a full inventory model, the company estimates working capital requirement to be sub-INR10b (5% of FY25 NOV), aided by high inventory turns. We do not expect a material change in WC intensity over the medium term.

* A note on GOV to NOV: Eternal started giving out order value net of discounts – NOV – in addition to GOV. In our view, it’s a more appropriate metric for Blinkit, as the divergence between MRP and selling price is limited in staples like fruits and vegetables but significant in general merchandise and non-grocery categories.

Valuation and change in estimates

* Eternal’s food delivery business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and e-commerce. We have reduced our estimates for FY26E/27E by ~52%/27%, driven by uncertainty arising from intense competition and the accelerated expansion of the dark store network. This expansion has led to reduced profitability due to increased investments. Eternal should report PAT margin of 2.8%/5.2% in FY26E/FY27E. Our DCF-based valuation of INR260 suggests a 12% upside from the current price. We reiterate our BUY rating on the stock.

QC GOV beats estimates, while profitability in line; Mgmt expects competition to increase in QC

* Eternal reported 4QFY25 net revenue of INR58b (8% QoQ/64% YoY), in line with our estimate of +8% QoQ.

* Food Delivery GOV came in at INR97b, slightly below our estimate of INR98b. Blinkit GOV came in at INR94b (up 134% YoY) vs. our estimate of INR87b.

* For Food Delivery, adjusted EBITDA as a % of GOV margin was up 10bp QoQ at 4.4%, missing our estimates of 4.7%.

* Blinkit reported contribution margin of 3.1% (3.0% in 3Q). Adj. EBITDA margin was -1.9%, in line with our expectations.

* The increase in losses was expected and aligns with the plan to pull-forward expansion of store network. Blinkit aims to achieve 2,000 stores by 3QFY26, one year ahead of its earlier guidance of 3QFY27.

* Management reiterated that competitive intensity will increase in QC, with further expansion and investments expected to continue. It emphasized a continued focus on market share gains, even if it meant prioritizing growth over short-term profitability.

* The company added 294 net new stores in 4QFY25, making it the highest-ever net store addition in a single quarter.

* Consol. reported EBITDA came in at INR720m (1.2% reported EBITDA margin vs. 3.0% in 3Q).

* Food Delivery revenue declined 1% QoQ/ up 18% YoY (est. -1% QoQ). FD contribution margin rose to 8.6% from 8.5% in 3Q.

* QC revenue grew 22% QoQ/122% YoY (est. 14% QoQ growth). QC contribution margin expanded to 3.1% (3.0% in 3Q).

* PAT stood at INR360m, down 78% YoY (est. INR1.8b).

* YoY adj. revenue grew 60% and continued to trend above the stated outlook of 40%+. The company remains confident of the long-term outlook of over 20% yearly FD GOV growth, given strong business fundamentals.

Key highlights from the management commentary

* Food Delivery: Growth remained below the company’s expectations. The company attributed this to several factors: a) a sluggish demand environment (especially on discretionary spends); b) a shortage (temporary) of delivery partners due to their high demand in QC; c) competition from QC platforms offering fast delivery of packaged food, leading to a decline in demand for food delivery from restaurants. 1Q is a seasonally strong quarter, and there are no surprises for this quarter.

* Blinkit: The company expects competition to extend beyond early QC players, with next-day delivery companies also investing heavily in faster delivery, particularly in non-grocery categories. Current QC platforms and new players are offering competition in various forms, including discounts, marketing activities, and store expansions. There can be a difference of more than 20% between GOV and NOV for non-grocery items, which is why NOV reporting has started. In some categories, the difference can range from 50-60% (what it sells at vs what the MRP is).

* Higher competition is evident from the lack of margin expansion, as companies are unable to charge higher fees in some geographies.

* The company has delisted 18,000 restaurant partners due to quality issues. The NOV/GOV ratio saw an uptick due to festivities in the last quarter.

* IOCC inventory model: The company may choose to own inventory in QC, alongside operating as a marketplace. Inventory days may increase to 25-26 (from 15-16). In categories where the company takes on inventory ownership, ROCE will be a key focus area. If this model is adopted, the company does not plan to launch private labels. The company is still in the early stages of evaluating the marketplace vs. inventory-led models.

Valuation and view

* Eternal's food delivery business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and e-commerce. We value the business using a DCF methodology, assuming 12.5% cost of capital. We reiterate our BUY rating with a TP of INR260, implying 12% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)