Derivative Rollover Note 01st August 2025 by Motilal Oswal Wealth Mangement

Sell off absorption to continue in August with a pause in the party at Dalal Street

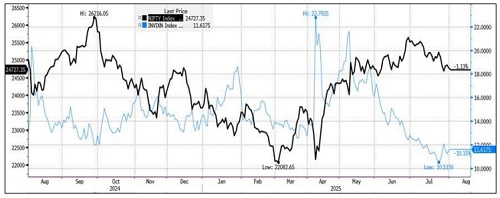

Nifty index continued the party of the bulls in the start of the series and crossed 25600 zones but was followed by profit booking for most part of the series and slipped to 24600 levels. Nifty formed a bearish candle on an expiry to expiry basis but has been forming higher highs from the last five series. Pressure is intact at higher zones but absorption of sell off was quick at key support levels.

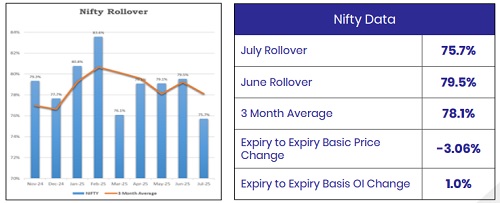

July series witnessed an increase in open interest by 1% with a decline in price by 3.06% on an expiry-to-expiry basis which indicates some short built up in the index. Rollover of Nifty stood at 75.7%, which is lower than the previous month’s and quarterly average of 78.1%.

On option front, Maximum Call OI is at 26000 then 25500 strike while Maximum Put OI is at 24000 then 24500 strike. Call writing is seen at 25500 then 26000 strike while Put writing is seen at 24000 then 24800 strike. Option data suggests a broader trading range in between 24000 to 26000 zones while an immediate range between 24300 to 25500 levels.

Nifty closed near 24750 zones and At The Money Straddle (August Monthly 24750 Call and 24750 Put) is trading at net premium of around 600 Points, giving a broader range of 24150 to 25350 levels. Considering overall Derivatives activity, we are expecting Nifty to witness volatile swings in the August series with a positional support at 24200 and then 24000 zones and a hold above 25000 will drive the next leg of rally towards 25250 and 25500 zones.

We have witnessed continuous buying interest in the Healthcare and selective Pharma stocks while fresh buying interest is witnessed in sector like FMCG with weakness in IT, PSE, Realty, Metals, Banks, Infra, Defence, Finance, Energy and Auto

India VIX decreased by 8.3% from 12.59 to 11.54 levels in the July series. Volatility sunk to 9.8 levels which caused some range-bound move but steamed higher towards the end.

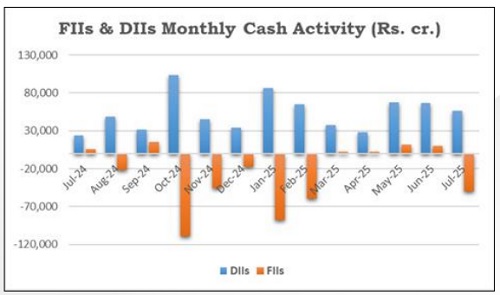

FIIs broke their buying streak of the last four months and sold to the tune of Rs 49,845 crores in July. DIIs continued their buying stance of the last twenty six months and bought to the tune of Rs 56,603 crores in July. The FIIs ‘Long Short Ratio’ in index futures steadily slipped in the entire July series and ranged in between 9.59% to 38.44% to close near its lower band. The Long Short Ratio slipped to its 28 months low which was last seen in March 2023.

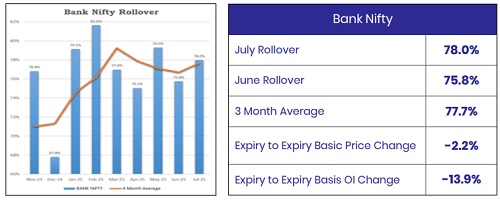

Bank Nifty started the series on a positive note and made a new life high of 57628 levels but gave up its gains and slipped by more than 2000 points near 55550 zones. Slight loss of momentum and breather can be seen after the previous series.

Long liquidation was seen as open interest decreased by 13.9% and price was down by 2.2% on an expiry-to-expiry basis. Rollover in Bank Nifty stood at 78%, which is in line with its quarterly average of 77.7%. Bank Nifty has to now hold 55000 zones for an up move towards 57500 zones while support can be seen at 55000 levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412