Sell Relaxo Footwears Ltd for the Target Rs. 375 by Motilal Oswal Financial Services Ltd

Another weak quarter; reiterate Sell

* Relaxo Footwears (RLXF) reported another weak quarter with EBITDA declining 7% YoY (6% miss) as volume (-10% YoY) was impacted by overall muted demand and restructuring of its distribution model.

* FY25 was a subdued year for RLXF, with a 6% YoY decline in EBITDA, led by a 9% YoY volume decline and a 25bp YoY margin contraction.

* Management believes FY25 was the bottom and expects modest revenue recovery from 2HFY26. Further, the company is prioritizing profitable growth in FY26, as it targets ~100bp EBITDA margin improvement driven by operational efficiency and a sharper focus on product and digital initiatives.

* We cut our FY26-27E revenue by 2-3% and EBITDA by 3-5%, reflecting a challenging market environment and the ongoing restructuring efforts. We build in a revenue/EBITDA CAGR of 8/11% over FY25-27E and await signs of demand recovery before we turn more constructive on the stock.

* We reiterate our Sell rating with a revised TP of INR375 (premised on 40x FY27E P/E). The company currently trades at ~50x 1-year forward P/E.

Volume decline continues to drag performance; EBITDA dips 7% YoY

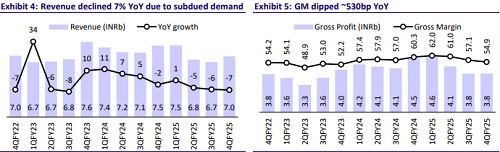

* Revenue declined 7% YoY to INR6.9b (7% miss), driven by overall muted demand in mid-range footwear.

* Volume declined 10% YoY to 4.5m pairs due to internal restructuring of the distribution model and weak demand, while ASP rose 3% YoY to INR153.

* Gross profit declined 15% YoY to INR3.8b (15% miss), with gross margins contracting 535bp YoY to 54.9% (~515bp miss) due to inventory reduction.

* The overheads decreased due to lower volumes. Employee/Other expenses declined sharply by 11%/21% YoY, with Opex as a % of sales declining to 39% (from 44% YoY).

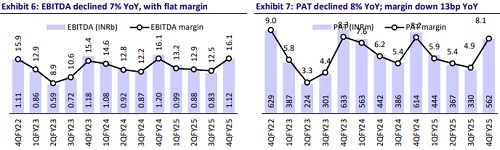

* RLXF’s EBITDA at INR1.1b declined 7% YoY (6% miss) due to weaker revenue growth. EBITDA margin was stable YoY at 16.1% (~15bp above our est.).

* PBT at INR754m dipped 8% YoY (3% miss) as lower EBITDA was partly offset by lower depreciation (-2% QoQ) and higher other income (+60% YoY).

* Reported PAT at INR562m declined 8% YoY, with margin at 8.1%.

FY25 performance: A subdued year

* Revenue at INR28b declined 4% YoY due to the muted overall demand scenario and heightened competition from the unorganized sector.

* Volume declined 9% YoY to 17.8m pairs, while ASP was up 5% YoY to INR156/pair.

* Gross profit declined ~3% YoY to INR16.4b, as margins expanded ~70bp YoY to 58.8%, largely due to price hikes implemented in open footwear.

* Nevertheless, operating deleverage led to ~6% YoY decline in EBITDA to INR3.8b, with margins contracting ~25bp YoY to 13.7%.

* FY25 reported PAT at INR1.7b declined 15% YoY.

* Inventory days declined slightly to 177 (from 179 YoY), receivable days moderated to 41 (from 45 YoY), while payable days declined sharply to 63 (from 76 YoY).

* However, OCF (incl. lease payments) almost doubled YoY to INR3.4b, largely led by the working capital release of INR0.8b (vs. -INR1.2b YoY). FCF generation stood at INR2.3b (vs. outflows of INR0.7b in FY24).

* RLXF paid a dividend of INR747m and repaid borrowings of INR185m. Overall net cash position improved ~INR1.2b YoY to ~INR1b.

Product-wise performance

* Hawaii: Volume declined ~14% YoY, while ASP grew ~3% YoY to INR80, leading to ~12% YoY decline in revenue and ~200bp decline in revenue contribution to 23%.

* Flite: Revenue declined ~4% YoY as volume declined ~6% YoY, while ASP increased ~2% YoY to INR149. Revenue contribution was stable YoY at 37%

* Sparx: It was the only bright spot for Relaxo in FY25, with ~1% YoY revenue growth, as 4% YoY volume growth was partly offset by a 3% YoY decline in ASP. Sparx’s revenue contribution was up ~200bp YoY to 40%.

Channel-wise performance: Relaxo witnessed ~4-5.5% YoY decline in general trade, modern trade, and exports, while retail business grew 6% YoY as the company added ~13 net retail outlets in FY25.

* Region-wise performance: RLXF’s performance was significantly impacted in the East (-28% YoY) and the South (-14% YoY), while it was stable YoY in the West. North was the lone bright spot, marking 7% YoY growth, with the contribution of North in RLXF’s mix rising to 51% (from 45% YoY).

Key highlights from the management commentary

* FY25 revenue decline was primarily volume-driven, reflecting weak consumer demand, especially in the low-income-focused Hawaii segment.

* While restructuring of the distribution model also temporarily disrupted volumes, the overall ASP remained elevated due to a better product mix and better performance in closed footwear.

* Looking forward, the company expects a modest revenue recovery starting 2HFY26, driven by the stabilization of its new distribution strategy and expansion in modern trade, e-commerce, and retail outlets.

* However, it does not anticipate significant volume growth, as its long-term strategy emphasizes value growth through premiumization and product mix improvements.

* Growth in revenue and profitability will be led by improvement in product mix, operational efficiencies, and better capital utilization, with a target of 100bp expansion in EBITDA margin and 2–3% improvement in RoCE.

Valuation and view

* RLXF’s recent performance has been impacted by a combination of i) elevated inflation, which led to weaker demand from its core consumer base, ii) intensified competition from unorganized players eroding market share, and iii) disruption caused by a structural overhaul of its traditional distribution network.

* While the company is focused on improving its product mix (higher closed footwear) to drive growth in the near term, volume revival in open footwear is equally crucial for growth and profitability.

* We cut our FY26-27E revenue by 2-3% and EBITDA by 3-5% and model a CAGR of 8/11% in revenue/EBITDA over FY25-27E.

* Despite sharp correction over the past few months, RLXF still trades at an expensive ~45x FY27E P/E.

* We maintain our Sell rating with a revised TP of INR375 (premised on 40x FY27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412