Neutral Data Patterns (India) Ltd for the Target Rs. 2,530 by Motilal Oswal Financial Services Ltd

Strong all-round performance

Earnings above estimates

* Data Patterns (DATAPATT) delivered a strong quarter as revenue surged 2.2x YoY, largely led by revenue growth of 2.7x YoY in the development segment and a 76% YoY jump in production revenue. However, EBITDA margins contracted 1,330bp YoY, led by low-margin strategic contracts taken up by the company.

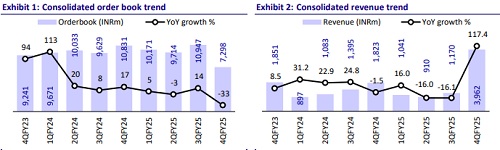

* The closing order book as of Mar’25 stood at INR7.3b, down 33% YoY, as some orders worth INR10-20b were delayed in FY25 (are expected to materialize in FY26). As a result, the company has retained its revenue growth/EBITDA margin/PAT growth guidance of ~20-25%/35- 40%/20% for FY26 despite ending FY25 with strong 36% revenue growth.

* Factoring in better than expected 4Q performance, however adjusting for company’s guidance our FY26/FY27 EPS estimates are largely maintained. We reiterate our Neutral rating with a TP of INR2,530 (We reiterate our Neutral rating with a TP of INR2,530 (premised on 40x FY27E EPS) considering the rich valuation.

Development revenue surge drives operating profit growth

* Consolidated revenue jumped 2.2x YoY to INR3.9b (est. INR3b) in 4QFY25. Service/development/production revenue stood at INR40m/INR2.3b/INR1.7b, up 9%/2.7x/ 76% YoY.

* In terms of products, Radar/EW accounted for the largest revenue mix at ~60.1%/19.7%. In terms of customers, DRDO played a significant role this quarter, accounting for ~55.3% of the mix.

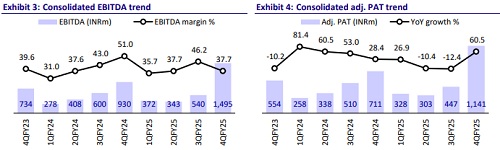

* Gross margins contracted 23pp YoY to 48.9%, led by low-margin strategic contracts taken up by the company. Employee/other expenses grew 11pp/28pp YoY to 7.5%/3.8% in 4QFY25.

* Accordingly, EBITDA margins contracted 1,330bp YoY to 37.7% (est. 40%). EBITDA jumped 61% YoY to INR1.5b (est. INR1.2b). Adjusted PAT grew 61% YoY to INR1.14b (est. INR946m).

* The order book stood at ~INR7.3b as of Mar’25 vs. INR10.95b/ INR10.8b in Dec’24/Mar’24. Development/Production/Service account for 40%/51%/9% of the total order book.

* In FY25, revenue/EBITDA/adj. PAT jumped 36%/24%/22% to INR7b/INR2.7b/INR2.2b.

Highlights from the management commentary

* R&D: Management is strategically deploying funds to accelerate product development, with a substantial portion allocated to the expansion of its R&D capabilities. As the company transitions into a full-fledged system integrator, development expenses are expected to rise.

* Inventory days: As the business transitions toward production-heavy contracts, working capital days are expected to reduce. In defense equipment, inventory levels are expected to remain elevated due to long test cycles and extended lead times. Maintaining high inventory is critical to address urgent customer requirements efficiently.

* Orders: Additional contracts under Brahmos are expected to materialize in the near term. Also, the company may be able to finalize a contract for Ashwini LLTR radar within the next three to six months. The company also plans to venture into new product categories, including spoofing technologies, airborne intelligence and electronic jamming.

Valuation and view

* DATAPATT ended FY25 on a strong note, with 56% of its revenue being generated in 4Q. While the order book came down as of Mar’25, the company is optimistic about booking higher orders in FY26.

* We expect the company to see lower growth in FY26 YoY, led by a lower order book and lower margins due to a higher mix of production revenue. However, in the medium to long term, we expect the company to continue its healthy performance. The overall macro scenario amid rising border tensions, along with management’s focus on expanding the addressable market and the shift toward complete systems, positions the company well for a positive long-term outlook.

* We estimate a CAGR of 25%/25%/27% in revenue/EBITDA/adj. PAT over FY25- 27. We reiterate our Neutral rating with a TP of INR2,530 (premised on 40x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)