Neutral Blue Star Ltd for the Target Rs.1,950 by Motilal Oswal Financial Services Ltd

Subdued demand; inventory overhang persists Focus on RAC market share improvement and better mix in the project business

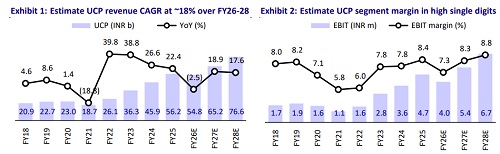

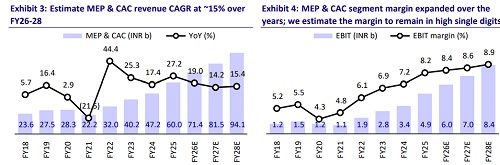

Our recent interaction with Blue Star (BLSTR) management indicates that demand for RAC has not seen a meaningful uptick post the changes in GST (from 28% to 18%) implemented from 22nd Sep’25. After an initial pick up, unseasonal rains in many parts of the country impacted secondary sales, and inventory levels remained elevated at 60-65 days vs the normal level of 30-35 days. The company increased its market share to over 14% in 1HFY26 and targets to improve it to 15% by FY27E. The ElectroMechanical Projects & Commercial Air Conditioning (EMPS & CAC) segment is structurally improving, driven by higher-margin data center EPC projects and increased CAC sales. Management expects RAC volumes to remain flat YoY in FY26 and believes that it will perform better than peers. We recently initiated coverage on BLSTR (initiating coverage) with a Neutral rating and an SoTP-based TP of INR1,950 (valued at 50x Dec’27E EPS for UCP, 40x Dec’27E EPS for MEP & CAC, and 25x Dec’27E EPS for PEIS).

UCP segment: Demand weak amid inventory overhang and energy label transition expected from 1st Jan’26

* There have not been any major changes in RAC demand post the GST rate reduction. Sales initially picked up but were impacted again due to unseasonal rains. Energy-level changes (new BEE rating norms) will be implemented from 1st Jan’26, and brands will only be able to sell old models until 31st Dec’25. Each energy-level change is expected to result in a 6-7% price increase. Distributors can continue selling old inventories even after 30th Jun’26 (there is no mandate requiring old inventories to be liquidated by that date, although it is assumed that inventories will be cleared within six months).

*RAC inventory remains high, currently at 60-65 days vs the normal inventory level of 30-35 days. Most of this inventory is held within the distribution channel. The company remains hopeful that distributors will plan for a 15- 20% YoY increase in sales next summer and will start procuring old models (as prices are lower and customers are price sensitive) as well as new models (a segment of customers is willing to pay more for energy-efficient models).

*No major schemes were rolled out in Oct-Nov, although a few brands were seen taking an aggressive approach in December. However, there has not been any aggressive discounting, and the company has reiterated its intent to protect prices. It has not provided working capital support to dealers. Primary sales are expected to pick up in the last 15 days of December.

*Improved inventory planning and cost structure helped the company perform better than most peers in 1HFY26. Segment margin in 2H is expected to be better than 1HFY26. Overall, management remains hopeful about ending the year with flat sales volumes vs last year, while outperforming the industry. The company’s RAC market share improved to over 14% in 1HFY26, with a target to increase it to 15% by FY27E.

*The company’s market share remains the highest in the South at ~19-20%, while its share in the North has reached double digits (vs below 10% a few years ago), driven by an increased distributor reach, affordable launches, and R&D-led cost optimization. Market share in the West remains at pan-India average, while it continues to be at lower levels in the East. Gains in the North were further supported by the launch of affordable premium and later, affordable products.

*Commercial refrigeration recorded modest growth in 1HFY26, with a market size of INR45b, significantly lower than the TAM of RAC. Categories such as deep freezers, visi coolers, chest freezers, and modular cold rooms were impacted by seasonal washouts, limiting growth during the year. ? Overall, the company continues to guide for an 8-8.5% margin for the UCP segment, though FY26 is likely to witness a YoY decline.

EMPS & CAC: Growing data center exposure and disciplined execution

*The EMPS & CAC segment comprises EPC projects, solution-oriented CAC product sales, maintenance (AMC), and export-linked opportunities. Over the past few years, the company has improved the quality of its order book by reducing exposure to large infrastructure projects, which earlier accounted for ~35%–40% of orders but now stand at ~20%–25%. The company has also become more selective in project execution, focusing on shorter-duration projects of 18–24 months vs over 30 months earlier, leading to better capital efficiency and improved margins.

*Data centers have emerged as a key growth driver within the project business, contributing ~25% of the project order book. The company executes EPC work for data centers, including HVAC, fire safety, MEP layouts, and specialized chillers, under strict technical specifications. In a typical 1 MW project, equipment accounts for ~15%–20% of the cost and land ~15%–20%, while MEP accounts for ~45%–50%. Management expects the EPC business to grow at ~15% YoY over the medium term, while maintaining capital employed at under ~10% of total capital.

*The CAC business, with an estimated market size of around INR50b, continues to grow as a solutions-focused offering. The company is a market leader in ducted ACs with a market share of over 45%. It also leads in the chillers segment and holds the second position in VRF systems, with a market share of ~20%. Increasing contribution from CAC sales, along with a selective approach in EPC execution and a higher share of data center projects, has structurally improved segment profitability. Management has guided for margins of ~7%–7.5%, with quarterly fluctuations driven by the mix between the EPC, products, and services businesses.

Exports and capital allocation: Steady progress amid tariff challenges

*The export business is being developed primarily through an ODM-led model. Field trials have been completed in the US, and a couple of customers have been onboarded. However, export remains unviable due to high tariffs as of now. Over time, management expects export margins to be similar to domestic product margins.

*The company has guided for capex of INR3b–3.5b for FY26 and FY27, directed towards capacity additions, international manufacturing capabilities, R&D, repair and maintenance infrastructure, and IT systems.

*The company also holds around INR2b in cash while maintaining profitability in its professional electronics and industrial systems business, which comprises testing equipment and refurbished medical machinery. This segment’s revenue declined in FY25 and 1HFY26 due to the government’s regulations on the import of used medical equipment.

Valuation and view

* We estimate a CAGR of ~16%/23%/28% in revenue/EBITDA/PAT over FY26-28, fueled by continued healthy growth in the MEP and CAC businesses and a recovery in the UCP business. We project OPM to expand ~40-50bp in FY27E/FY28E (each), led by positive operating leverage and cost-saving initiatives. We estimate EBITDA margins at 7.5%/8.0%/8.4% in FY26/27/28 vs 7.3% in FY25. RoE/ROCE is expected at ~20% (each) in FY28 vs ~19% (each) in FY25.

*BLSTR trades at 49x/39x FY27/FY28E EPS (vs. an average of 46x in the last 10 years). We value it at an SoTP-based TP of INR1,950 (valued at 50x Dec’27E EPS for UCP, 40x Dec’27E EPS for MEP & CAC, and 25x Dec’27E EPS for PEIS). Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412