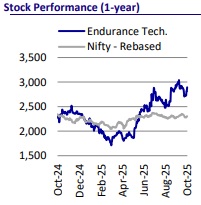

Buy Endurance Technologies Ltd for the Target Rs. 3,311 by Motilal Oswal Financial Services Ltd

Multiple growth drivers in place

Possible ABS mandate in 2Ws provides a huge growth opportunity

Endurance (ENDU) has consistently outperformed core industry growth, both in India and Europe, over the last five years. Given its healthy order backlog of INR36.1b worth of new orders, we expect ENDU to sustain its outperformance over FY25-27. Management aims to ramp up its 4W mix to 45% of consolidated revenue from 25% currently. To achieve this target, ENDU is setting up a new plant in AURIC (Maharashtra) to fulfil new orders and has tied up with a Korean partner to foray into 4W suspensions. It has also received its first orders for drum brakes and drive shafts. MoRTH’s proposal to mandate ABS on all 4Ws can increase ENDU’s addressable market by 10x, and ENDU targets a 25% share of this higher base going forward. This proposal, if finalized, can alone boost ENDU’s revenue. Its Europe performance has demonstrated commendable resilience, and we expect it to sustain this healthy performance on the back of new orders and the recent integration of Stoferle. Considering these growth drivers, we estimate ENDU to deliver a CAGR of ~18%/21%/20% in consolidated revenue/EBITDA/PAT over FY25-27. We reiterate our BUY rating with a TP of INR3,311 (based on 36x Sep’27E consolidated EPS).

New order wins to continue to drive outperformance

ENDU has recorded a strong 14% revenue CAGR in the domestic business over the past five years and has outpaced the 2W industry by ~11.5pp. Given its order backlog of INR36.1b worth of new orders, which is expected to reach peak revenue by FY27, we expect ENDU’s 2W segment to continue to outperform industry growth going forward.

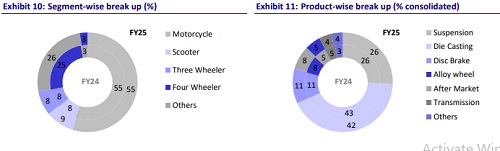

Focus on ramping up 4W mix to be amongst the key growth drivers

Management plans to increase its 4W mix to 45% from the current 25% of consolidated revenue. Critical progress made in this segment include: 1) new order wins in die-castings, 2) first drum brake order; work ongoing on advanced braking solutions; 3) first drive shaft order and JLR Al forgings order SOP in Jan’26. Apart from this, ENDU has tied up with a Korean partner to foray into 4W suspensions. Its Stoferle acquisition in Europe would also help to boost 4W mix along with synergy benefits.

ABS regulation a boost for ENDU

MoRTH has proposed new safety requirements mandating 100% use of ABS for all 2Ws w.e.f. Jan’26. On the back of its backward integration capabilities and its recent experience in ABS in >125cc motorcycles, ENDU feels confident of ramping up to a 25% market share on a much higher base (TAM of INR 44.2b) from the current share of ~11%. Further, the ABS mandate would mean increased disc brake requirements, which would again be beneficial for ENDU. Thus, the ABS mandate, as and when it comes, would be a major growth driver for ENDU going forward.

Europe business showcases commendable resilience

Over FY22-FY25, ENDU has delivered a commendable CAGR of 12% / 18% / 17% in revenue / EBITDA / PAT CAGR in Europe at a time when industry volumes have recorded a much lower 4% volume CAGR and has seen severe inflationary pressures in the region. Further, on the back of its healthy order backlog and the Stoferle acquisition, we estimate ENDU to deliver 17% revenue CAGR over FY25-27E.

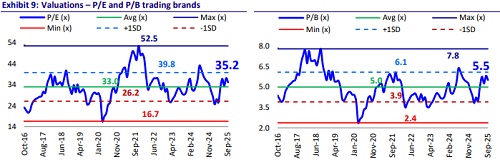

Valuation and View

We estimate a CAGR of ~18%/21%/20% in consolidated revenue/EBITDA/PAT over FY25-27 on account of healthy new order wins and its focus on ramping up presence in 4Ws in a meaningful way going forward. We have not factored in the ABS opportunity yet. The stock trades at 40x/34x FY26E/FY27E consolidated EPS. We reiterate our BUY rating with a TP of INR3,311 (based on 36x Sep’27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412