Buy Cummins India Ltd for the Target Rs. 4,500 by Motilal Oswal Financial Services Ltd

Multiple growth levers in place

Key takeaways from our interaction with the management

We hosted Cummins' management for our Annual Global Investor Conference and discussed the growth opportunities across its segments. The company has witnessed demand improvement across the powergen segment following lower industry volumes in 2HFY25. Cummins is also experiencing strong growth in select industrial segments and continues to expect a healthy growth potential in the distribution segment. Its export market presence is well diversified geographically, with limited exposure to the US. We retain our positive stance on the stock, as we expect Cummins to benefit from these positive levers and its diversified portfolio across segments. We reiterate our BUY rating with a TP of INR4,500 based on 42x Sep’27E earnings.

Powergen market witnessing a broad-based demand revival

Cummins’ powergen segment has experienced a broad-based demand revival since the beginning of FY26. Demand is coming from the manufacturing, real estate, quick commerce, hospital, and hotel sectors. This resurgence has resulted in volumes reaching pre-emission levels. The powergen market has also witnessed price stabilization. Certain lower kVA nodes remain commoditized, while higher kVA nodes command better prices. On the HHP front, the company has seen a steady demand from data centers, hospitals, and other power-sensitive segments, and management expects this steady demand trend to continue. Though competition is catching up across nodes in the domestic powergen market, we believe that Cummins stands far ahead of competition in terms of its substantial market share in high-kVA nodes as well as a strong product portfolio and distribution network for low- and mid-kVA nodes. Over the last few quarters, our assessment of powergen revenue indicates that Cummins has gained market share. We retain our powergen revenue estimates and expect this segment to clock a 15% CAGR over FY25-28.

Industrial business to grow, led by demand revival and new products

Management indicated that industrial demand trends have remained mixed. Cummins’ industrial segment has grown at a strong pace over the past two years, driven by a sharp growth in the railways, mining, and compressor segments. Within this, the company has experienced a steady demand in DETC and is also waiting for orders from HLC for railways. Mining is witnessing slower tendering, and the compressor market has also faced a notable growth moderation over the past two years. In the near term, the construction market activity is also likely to be low. However, over the medium to long term, the industrial segment growth drivers are likely to come from new products for railways and improved demand from the construction and mining segments. We expect the industrial segment to record an 18% CAGR over FY25-28.

Distribution segment poised to benefit from the other segments’ growth

In distribution, management highlighted that Cummins’ positioning as both a reliable product and service provider remains intact. With newer, more sophisticated gensets under CPCB IV+, integrated telematics is allowing better customer insights and aftermarket opportunities. Price hikes of 5-10% have been implemented in parts, while growth is likely to come from both powergen and industrial segments, with powergen likely to lead. We believe the combination of technology-led servicing, a strong asset base, and general product acceptance post norm change in the market positions distribution as a steady growth driver. Continued penetration in the aftermarket should also support margins even if equipment volumes remain cyclical. We expect distribution to clock a CAGR of 19% over FY25-28.

Exports to benefit from global demand tailwinds

Exports continue to benefit from global demand, particularly in data centers and the LHP segment across multiple regions. Europe, Africa, and the Middle East are witnessing steady demand, while Cummins’ exposure is limited to the US market. The company’s QSK60 product is largely made for the domestic market, where it is largely made in India, and some components are sourced from CTIL. The US markets mostly use QSK95, which is currently not relevant for the domestic market and hence is not made in India. The European market mostly used QSK78. Thus, QSK60 is largely used in India. Exports offer both scale and margin benefits, with data center demand being a key structural tailwind. We project exports to post a 17% CAGR over FY25-28.

Will capitalize on BESS demand with its newly launched product

The company had already launched a product on BESS and expects to capitalize on demand coming from individual establishments in storing surplus renewable power. Though key components of BESS are currently not made in India, Cummins designs and assembles them here and has demand originating from various segments of the industry.

Financial outlook

We maintain our estimates and expect a revenue/EBITDA/PAT CAGR of 16%/16%/ 17% over FY25-28; we also model an EBITDA margin of 19.7%/19.7%/19.8% for FY26/FY27/FY28. Our estimates factor in a gross margin of 35% in FY26/FY27/FY28 vs. 36% in FY25.

Valuation and recommendation

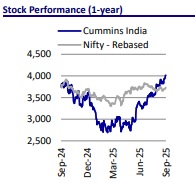

The stock currently trades at 48.2x/40.9x/35.2x on FY26/FY27/FY28E EPS. We reiterate our BUY rating on the stock with a TP of INR4,500 (based on 42x Sep’27E earnings).

Key risks and concerns

Key risks to our recommendation would come from lower-than-expected demand for key segments, higher commodity prices, intensified competition, and lowerthan-expected recovery in exports.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412