Neutral Piramal Enterprises Ltd for the Target Rs.1,315 by Motilal Oswal Financial Services Ltd

Balanced performance with strong growth and controlled risk

Retail opex ratio continues to improve; credit cost declined in growth business

* Piramal Enterprises (PIEL) reported 1QFY26 net profit of ~INR2.76b (PQ: ~INR1b). There were no recoveries from AIF this quarter (compared to ~INR1b in 1QFY25), except for some recoveries from written-off accounts.

* NII in 1QFY26 rose ~25% YoY to ~INR9b. PPOP grew ~63% YoY and stood at ~INR3.9b (PY: INR2.4b). Opex to AUM for the company’s retail business declined to ~4.2% (PQ: 4.3%). Mix of growth and legacy AUM improved to 93%:7% in Jun’25 (from 34:66% as of Mar’22).

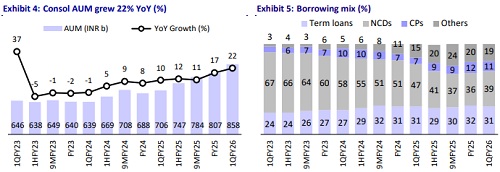

* Total AUM grew 22% YoY and 6% QoQ to INR858b. Wholesale 2.0 AUM grew ~47% YoY to INR104b, while Wholesale 1.0 AUM declined ~51% YoY/9% QoQ to INR63b. The company reiterated that it would look to run down its legacy wholesale book to INR30-35b by FY26.

* Management highlighted stress in two key retail segments: the MSME unsecured portfolio and the used car finance business. Within MSME, which constitutes ~6% of total AUM, the stress was largely confined to loans sourced from the open market, while the cross-sell sourced portfolio continued to perform well. In the used car segment, the stress was in refinance loans (particularly those taken by self-employed customers).

* PIEL further shared that the small-ticket LAP segment remains under pressure, with the company observing similar challenges as seen across the industry. LAP loans of

Highlights from the management commentary

* There should be no negative surprise in the financials when the merger of PIEL and Piramal Finance (PFL) is completed. While there will be some merger expenses (INR1b) in 2QFY26, they have already been factored into the FY26 PAT guidance of INR13-15b.

* PIEL expects RoA improvement to be driven by: 1) benefits in the opex ratios, and 2) improvement in the fee income. Additionally, further improvement in margins is likely to come from increasing the share of unsecured loans at the appropriate time and realizing benefits from a decline in the cost of borrowings.

Healthy retail loan growth of ~37% YoY; retail mix stable QoQ

* Retail AUM grew ~37% YoY to INR690b with its share in the loan book remaining stable QoQ at ~80%. Management shared that it is now more confident of growing digital loans (sourced through partnerships), as there has been a sharp improvement in 90+dpd in its digital loans.

* Retail disbursements grew ~28% YoY to INR87b. Disbursements in unsecured business loans (UBL) and digital loans increased sequentially. Additionally, the company is highly selective in the BNPL business (~10-15% of the originations) and has increased the proportion of salaried customers in digital loans (which still remains dominated by self-employed customers).

Retail asset quality stable; decline in credit costs in growth business

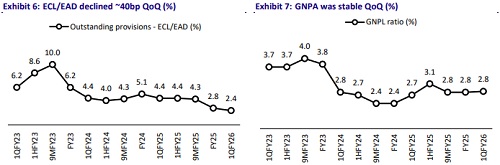

* GS3 was stable QoQ at ~2.83%, while NS3 rose ~10bp QoQ to 2%. Stage 3 PCR declined ~6pp QoQ to ~29.4%. PIEL carries out ECL rebalancing in the first quarter of every fiscal year. In 1QFY26, this led to a positive impact of INR1.05b, compared to a negative impact of INR450m in 4QFY25.

* 90+ dpd remains steady at 0.8% for overall retail AUM. Growth business (Retail and Wholesale 2.0) gross credit costs declined ~50bp QoQ to 1.5% (PQ: ~2%). Total ECL/EAD declined ~40bp QoQ to ~2.4% of the AUM.

* Capital adequacy (CRAR) declined to ~19.3% (vs ~23.6% at Mar’25) due to the re-classification of PFL to an NBFC (from HFC earlier). The completion of the PIEL and PFL merger will reverse ~245bp of this CRAR reduction.

Valuation and view

* PIEL reported a healthy operational performance during the quarter, led by strong growth in its retail loans and continued scale down of the legacy wholesale book, which now accounts for just ~7% of total AUM. Asset quality remained broadly stable across key product segments (except MSME and used cars). Credit costs in the growth portfolio declined sequentially, while improving branch and employee productivity resulted in better opex ratios. With rising retail traction and a better funding mix, NIM expanded further, reinforcing the shift toward a more stable and profitable lending model.

* Our earnings estimate for FY26 and FY27 factor in gains from the AIF exposures, deferred consideration of USD120m from the sale of Piramal Imaging, and zero tax outgo in the foreseeable future. Due to the uncertainty and unpredictability surrounding the monetization timing of the stake in Shriram Life and General Insurance, we have not factored it into our estimates yet. However, the eventual monetization is expected to provide one-off gains, which could help offset credit costs associated with the disposal of the residual stressed legacy AUM (of ~INR63b).

* While we anticipate greater earnings stability and an improved outlook going forward, its return metrics remain modest, with RoA and RoE estimated at 1.9% and 8%, respectively, for FY27. We value the lending business at 0.8x Mar’27E P/BV and reiterate our Neutral rating on the stock with a revised TP of INR1,315 (premised on Mar’27E SOTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412