Neutral One 97 Communications Ltd for the Target Rs.1025 by Motilal Oswal Financial Services Ltd

Cost control drives maiden operational profits

Revenue in line; contribution profit expands sharply

* One 97 Communications (PAYTM) reported a net profit of INR1.2b in 1QFY26 (vs. our estimate of INR24m). PAT came in higher than our estimate owing to lower expenses related to default loss guarantee (DLG), collections, and ESOP. Payment revenue stood flat QoQ at INR10.4b, while financial services revenue increased by 3% QoQ to INR5.6b.

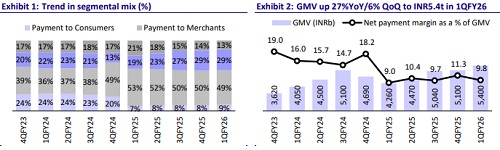

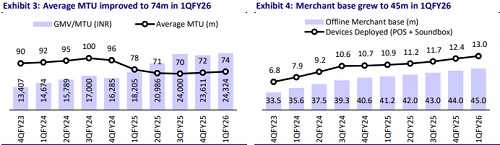

* Total revenue was flat QoQ (up 28% YoY) at INR19.1b (in line), while GMV grew by 6% QoQ to INR5.4t (up 27% YoY). Payment devices grew 5% QoQ (19% YoY) to 13m, while registered merchants increased by 2% QoQ (9% YoY), leading to healthy subscription and payment revenue.

* Net payment margin declined 8% QoQ (up 38% YoY) to INR5.3b/10bp of GMV vs. 11bp in 4QFY25. Lower DLG-related costs led to 7% QoQ growth in contribution profit to INR11.5b (up 53% YoY).

* We maintain our contribution profit estimates and project PAYTM to turn EBITDA positive by FY26. We value PAYTM at INR1,025 based on 21x FY27E EBITDA, which corresponds to 6.8x FY27E sales. We reiterate our NEUTRAL rating on the stock.

Merchant expansion on track; focus remains on cost optimization

* PAYTM reported a net profit of INR1.2b in 1QFY26 (vs. our est. of INR24m), aided by lower costs related to DLG, collections and ESOP. GMV increased by a healthy 6% QoQ (up 27% YoY) to INR5.4t.

* For FY26E, we expect EBITDA to break even at INR0.6b and PAT at INR4b.

* For 1Q, PAYTM’s DLG business had a trail revenue, whereas DLG-related costs were absent as DLG-related loan disbursements were low.

* Total revenue was flat QoQ (up 28% YoY) at INR19.1b (in line). Payment revenue was flat QoQ/up 18% YoY, while financial services revenue grew 3% QoQ. As a result, payment and financial services revenue grew 1% QoQ (up 38% YoY).

* Marketing services revenue declined 7% QoQ/23% YoY to INR2.5b.

* Payment processing margin stood comfortably above the guided range of 3bp. Net payment margin declined 8% QoQ (up 38% YoY) to INR5.3b/10bp of GMV vs. 11bp in 4QFY25.

* Going ahead, the company expects a higher share of non-DLG disbursements, which will reduce the upfront DLG cost and lifetime revenue by corresponding amount, thus growth in financial services will be lower sequentially.

* Direct expenses declined 9% QoQ (up 3% YoY), due to the absence of DLGrelated cost. Contribution profit rose 7% QoQ (up 53% YoY), with contribution profit margin up 60.1% (vs. 56.1% in 4QFY25) due to the absence of DLGrelated cost. EBITDA stood at INR0.7b (vs. our est. loss of INR0.7b). ESOP costs of INR300m came in below our est. of INR955m.

* PAYTM has stopped giving the loan disbursement data. In 1Q, the company saw robust growth in ML disbursements under the non-DLG model. In personal loans, the company saw early signs of recovery in the credit cycle, leading to higher disbursements sequentially.

Highlights from the management commentary

* Contribution margin stood at 60% in 1QFY26, which PAYTM expects to maintain in the high-50s in FY26.

* In consumer lending, the company has faced challenges, though it expects better monetization in the next 6-12 months.

* AUM of its partner portfolio business was down by 40%, as there was a reduction in FLDG disbursements.

* The company expects better retention in the soundbox segment amid increasing features and offerings. PAYTM continues to focus on refurbishments, which will help in cost rationalization going ahead.

Valuation and view

* PAYTM reported a steady quarter with in-line revenue, while tighter cost control led to a healthy profit for the company.

* Disbursement commentary was steady, while MTU witnessed a steady-state recovery. GMV recovery too was better than expected.

* PAYTM is making steady progress toward profitability, underpinned by its strategic shift toward financial services and disciplined cost management.

* Contribution margin expanded to 60.1% thanks to cost control. Disbursement growth is expected to remain healthy going ahead given improving tailwinds in unsecured lending. We estimate a 35% CAGR in disbursements over FY25-28, with healthy take rates expected.

* PAYTM’s INR161b cash cushion offers comfort; consistent delivery is critical for sustainable shareholder returns.

* We maintain our contribution profit estimates and project PAYTM to turn EBITDA positive by FY26. We value PAYTM at INR1,025 based on 21x FY27E EBITDA, which corresponds to 6.8x FY27E sales. We reiterate our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412