Buy Mahanagar Gas Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

EBITDA margin below est.; medium-term outlook healthy

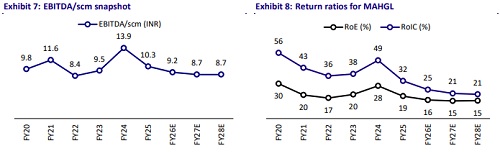

* Mahanagar Gas (MAHGL)’s 2QFY26 EBITDA margin of INR8/scm was below our est. of INR8.7/scm. Total volumes for MAHGL (ex-UEPL) were in line at 4.4mmscmd. On a sequential basis, EBITDA/scm (adjusted for one-off items in 1QFY26) declined INR1.6, as 1) gas costs grew INR1.4/scm QoQ to INR32.1/scm; 2) realization declined INR0.1/scm QoQ, and operating costs rose INR0.1/scm.

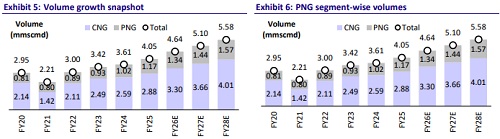

* Management guided a robust double-digit growth trajectory, with volumes likely to rise over 10% YoY and EBITDA margins sustaining at INR8-9/scm over the medium term. Incorporating the amalgamation of UEPL, we now forecast 11% CAGR in volumes over FY25-28 (vs. 9% earlier). However, we have marginally trimmed our EBITDA/scm estimates to INR9.2/8.7/8.7 for FY26/27/28, reflecting a more conservative margin outlook. Consequently, our EBITDA estimates for FY26- 28 are lower by 2-3%, while PAT estimates have been revised down by 5-8%, factoring in higher depreciation post-amalgamation and a reduction in other income assumptions.

* We model MAHGL’s volumes to clock an 11% CAGR over FY25-28 and estimate an EBITDA margin of INR8.7-9.2 per scm during the period. MAHGL currently trades at 11.2x FY28E SA P/E. We now value MAHGL at 15x Dec’27 P/E (15x FY27 P/E earlier), resulting in a TP of INR1,700. Reiterate BUY.

Focus remains on volume growth; plans to add 80 CNG stations in FY26

* Management guided a robust 10%+ YoY growth in volumes and a stable EBITDA/scm margin of INR8-9 in the medium term.

* FY26 capex guidance: MAHGL has guided for a consolidated capex of INR10.5-12b in FY26. Of this, INR9-10b will be deployed across MAHGL’s three geographical areas (GAs), while INR1.5-2b will be incurred towards network expansion and infrastructure development in UEPL’s GAs.

* Gas sourcing split (MAHGL-ex UEPL): MAHGL’s total gas requirement is met through: 1) APM gas: ~1.68mmscmd, 2) New well gas: 0.35mmscmd, 3) HHlinked term contracts: 1.45mmscmd, 4) HPHT term contracts: 0.5mmscmd, and 5) IGX: 0.3-0.4mmscmd.

* CNG stations: For FY26, MAHGL targets commissioning around 80 new CNG stations, of which 17 have already been added.

* On the cost front, APM gas continues to offer the lowest landed cost at INR24-25/scm, while NWG HPHT gas is priced at INR32-37/scm and R-LNG at INR40-42/scm.

Miss on EBITDA/scm margin; stable volume growth

* MAHGL’s total volumes stood at 4.6mmscmd (+3% QoQ).

* CNG/D-PNG volumes grew 2% QoQ, while I&C-PNG volumes grew 8% QoQ.

* EBITDA/scm came in at INR8 (vs. adjusted EBITDA/scm of INR9.6 in 1QFY26).

* On a QoQ basis, adj. EBITDA/scm margin declined by INR1.6, as 1) gas cost increased INR1.4/scm QoQ to INR32.1/scm; 2) realization declined INR0.1/scm QoQ, and operating cost increased INR0.1/scm QoQ.

* Reported EBITDA came in at INR3.4b (-18%/-33% YoY/QoQ).

* MAHGL’s PAT stood at INR1.9b (-33%/-39% YoY/QoQ) for the quarter.

* UEPL was amalgamated with MAHGL during the quarter. Accordingly, the comparative financials for 1QFY26 and 2QFY25 have been restated to reflect the impact of the amalgamation, and other quarters are not comparable. Due to the unavailability of data, we assume UEPL’s EBITDA/PAT of INR160m/ INR50m for 2QFY26 (similar QoQ) and total volume of 0.21mmscmd (up 30% YoY). Comparison of MAHGL SA estimated numbers vs. actuals is as below:

* EBITDA came in 8% below our estimate at INR3.2b, as EBITDA/scm stood 8% below our estimate of INR8/scm.

* APAT stood 21% below estimates at INR1.9b.

* Total volumes came in line with our estimate at 4.4mmscmd.

Valuation and view

* We expect an 11% CAGR in volume over FY25-28, driven by multiple initiatives implemented by the company. These initiatives include collaborating with OEMs to drive conversions of commercial CNG vehicles and providing guaranteed price discounts to new I/C-PNG customers.

* MAHGL currently trades at 11.2x FY28E SA P/E. We now value MAHGL at 15x Dec’27 P/E (15x FY27 P/E earlier), resulting in a TP of INR1,700/sh. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412