Buy Page Industries Ltd for the Target Rs. 47,500 by Motilal Oswal Financial Services Ltd

Uninspiring performance; growth recovery awaited

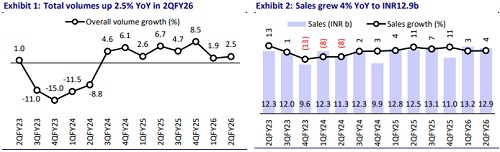

* Page Industries (PAGE) reported muted revenue growth of 4% YoY, with volume growth of 2.5% (est. 4%; 2% in 1QFY26) to 56.6m units. With trade inventory normalized, volume growth was expected to acceleration from 2Q onward. However, since the consumption environment was mostly subdued during the quarter, growth delivery was uninspiring. Festive demand was healthy, and we would monitor if these demand trends are sustained. The GST rate rationalization in Sep’25 had boosted consumer sentiment. Almost 90% of PAGE sales are from the below-INR1k price category. PAGE expects 2HFY26 to be better than 1HFY26.

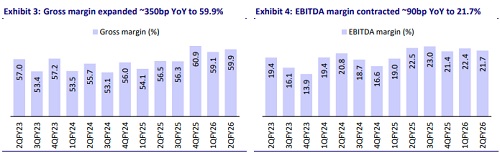

* GM expanded 350bp YoY to 59.9% (beat), whereas EBITDA margin contracted 90bp YoY to 21.7% (miss) as operating expenses rose. An efficient raw material and product sourcing strategy and focused marketing initiatives aided EBITDA margins to an extent. PAGE did not increase prices in 2Q. It expects ad spends to be ~4-5% in FY26. That said, management has maintained its EBITDA margin guidance of 19-21% for FY26 despite achieving 21.5% in FY25.

* PAGE has launched a new product line with bonded technology in bras and men's innerwear in Sep’25, which are priced at a premium compared to Jockey’s range. The initial consumer response has been encouraging.

* Although 1HFY26 recovery was below expectation, we believe that volume growth can improve in 2HFY26, backed by the festive season, wedding demand and expectations of consumption growth. Initiatives for products, marketing (particularly on social media platform) and new channel expansion are encouraging. Amid improving consumer sentiment, we continue to believe that PAGE will be able to capitalize on its growth opportunities. Benign input costs and cost efficiencies are likely to offset higher marketing/digital spending, which will help PAGE sustain its margin going forward. We reiterate our BUY rating on the stock with a TP of INR47,500, premised on 55x Sep’27E EPS.

Muted quarter; profitability flat on a high base

* Volume up 2.5%: Sales grew 3.7% YoY to INR12.9b (est. INR13.1b) in 2Q. Sales volume was up 2.5% YoY (est. 4%, 2% in 1QFY26) at 56.6m pieces. Consumption environment remained mostly subdued in 2Q, while green shoots were visible in Sep’25 end. Product realization was up 1% YoY at INR228/piece, backed by premiumization and an increasing share of ecommerce. PAGE continues to focus on product innovation, cost optimization and various marketing initiatives without any price hikes.

* Strong gross margin expansion: Gross margin expanded ~350bp YoY to 59.9% (est. 59.7%), whereas EBITDA margin contracted to 90bp YoY 21.7% (est. 22.7%) given high operating expenses. Employee/other expenses rose 21%/14% YoY. An efficient raw material and product sourcing strategy, effective resource deployment and focused marketing initiatives aided EBITDA margins.

* Profitability remained flat YoY: EBITDA was flat YoY at INR2.8b (est. INR3b). PBT was flat YoY at INR2.6b (est. INR2.7b). Adj. PAT was flat YoY at INR2b (est. INR2.1b). Overall the profitability remained flat YoY, albeit on a high base.

* In 1HFY26, revenue/EBITDA/PAT grew 3%/10%/10%.

Highlights from the management commentary

* Consumption remained subdued through most of the bygone quarter. However, with the start of the festive season, we did see a good uptick in primary sales during latter half of Sep’25.

* The GST rate rationalization in Sep also boosted consumer sentiment. PAGE has passed on the rate benefit to consumers as applicable. Almost 90% of PAGE sales are from the below-INR1k category.

* The festive season has been better than the first half of 2QFY26. PAGE expects 2HFY26 to be better than 1HFY26.

* Over last year, PAGE reduced inventory at the partner level; hence, it saw some volume volatility between quarters. In addition, seasonality impacts quarterly volumes. That said, the company has stabilized now (in terms of ARS, etc.) and thus volume volatility is likely to normalize.

* FY26 EBITDA margin guidance remains broadly unchanged at 19-21%.

* Capex-linked incentives of INR500m will be realized in FY27 in P&L as subsidy received.

Valuation and view

* We cut our EPS estimates by 2-3% for FY26 and FY27.

* Although 1HFY26 recovery was below expectation, we believe that volume growth can improve in 2HFY26, backed by the festive season, wedding demand and expectations of consumption growth.

* Initiatives for product, marketing (particularly on social media platform) and new channel expansion are encouraging. Given improving consumer sentiment, we continue to believe that PAGE will be able to capitalize on its growth opportunities. PAGE maintains its double-digit revenue growth guidance in the medium term.

* Inventory optimization through the ARS system, new product launches, capacity expansion, and digitalization initiatives will support growth, in our view. PAGE’s brand equity keeps evolving into a lifestyle brand from only an innerwear brand. It will fit the brand across product lines. Benign input costs and cost efficiencies are likely to offset higher marketing/digital spending, which will help PAGE sustain its margin going forward.

* We reiterate our BUY rating on the stock with a TP of INR47,500, premised on 55x Sep’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)