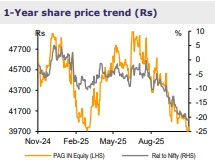

Reduce Page Industries Ltd for the Target Rs.39,450 By Emkay Global Financial Services Ltd

Weak Q2; physical channels dragging growth; Reduce

We retain REDUCE on PAG and Sep-26E TP of Rs39,450 (45x P/E), as sub-par growth trends continued in Q2. PAG’s Q2 EBITDA was 6-18% lower than street’s/our estimates, on a 2-6% revenue miss and 100-300bps lower EBITDA margin. Muted trends persisted, with 3-4% growth in Q2/H1; however, growth picked-up toward end-Q2, aided by early festive, per the mgmt . PAG attributed the sluggish trends to weak macros and gave assurance on nil market share loss, based on retention of shelf space/feedback from modern trade channels. Growth impact related to ARS mismatch is also largely behind. New innovations kicked off well, with JKY Groove executing better than PAG’s internal expectations and healthy sell-throughs to the recently-launched bonded tech innerwear. EBITDA margin declined by 90bps at 21.7% in Q2, on wage hikes, employee hiring, and higher marketing, while gross margin improved by ~350bps to ~60%. Among channels, E-com still leads growth, while physical channels (EBO/MBO) are seeing muted LFL trends. We believe growth revival in GT channel (high salience) is key to growth recovery for PAG. We would keep a look out for any initial signs of recovery in the GT channel as well as ramp-up of new launches (JKY Groove/Bonded tech IWs), as value fashion (though a new ball-game for PAG) is gaining healthy traction in the apparel space.

Weak operating performance; revenue growth muted at ~4%

PAG saw a modest ~3.6% topline growth in Q2 (~2-6% miss on street/our estimates), led by a low single-digit (~2.5%) volume growth and ~1.1% realization growth. Distribution expansion was largely EBO-led, with 37 additions in Q2 taking the EBO count to 1,527. Net MBO expansion has been muted over the last few quarters (added 149 MBO outlets), as PAG is currently focusing on improving the quality of outlets; however, such expansion is expected to pick up, with 8-10k additions expected on a base of ~110,600 outlets. Despite no major pricing action, gross margin was up by ~350bps, at 59.9%, led by favorable raw material prices, improved operational efficiency, and inventory management. EBITDA margin at 21.7% was down by ~90bps in Q2, as grossmargin gains were more than offset by higher employee/other expense (up by ~270bps/~170bps). Despite the 21.7% EBITDA margin in Q2, PAG maintained its EBITDA guidance of 19-21%, as it expects marketing/tech costs to inch up going ahead.

Strong traction in women's innerwear; new product launched with bonded tech

The women’s innerwear segment continues to gain strong traction, steadily narrowing the gap with the men’s category in both, reach and revenue contribution. Its performance has outpaced that of the men’s segment in recent years, supported by an independent team and dedicated distribution network that underline its growing scale. The mgmt highlighted that the offline retail experience remains crucial for this category, given the greater consumer emphasis on product touch and feel. The company has launched a new product line with bonded technology in men’s and women’s innerwear, in Sep-25; both have received encouraging initial response, providing confidence on expanding distribution further.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354