Add ICICI Lombard General Insurance Ltd For Target Rs. 2150 By Yes Securities Ltd

Our view – Rise in industry CoR and OEM sales slowdown are concerns

Combined Ratio – CoR improved 180 bps QoQ, driven by a 560 bps improvement in loss ratio:

The combined ratio for the company was 102.7% for 3QFY25 compared with 104.5% for 2QFY25. The loss ratio has declined from 71.4% in 2QFY25 to 65.8% in 3QFY25, driven by material improvement in loss ratios for Motor, Health and Crop segments. The company would like to operate within an overall motor segment loss ratio of 65-67%. Some market participants had been aggressive in the past but there has been an element of calibration in their MoM numbers. For the retail indemnity book, the loss ratio range of 65-70% is comfortable and the company is within this range. If warranted, price hikes can be effected. Notably, the overall combined ratio for the industry was at 113.3% in 1HFY25 vs 111.9% in 1HFY24.

GDPI Growth – Overall GDPI growth for the quarter was flat YoY but was positive when adjusted for 1/n accounting:

In 3Q, GDPI for the company de-grew -0.3% YoY compared with a growth of 9.5% for the industry. Excluding the impact of 1/n accounting, GDPI of the company grew by 4.8% YoY for Q3 FY25. In 3Q, from a segmental perspective, Commercial Segment GDPI de-grew by -8.6% YoY. The Motor segment GDPI grew by 9.4% YoY and the Health Segment GDPI de-grew by -4.6% YoY. Excluding the impact of 1/n accounting, in 3Q, Health Segment GDPI grew by 10.3% YoY. Motor segment growth remains a monitorable given general OEM sales slowdown in the motor industry.

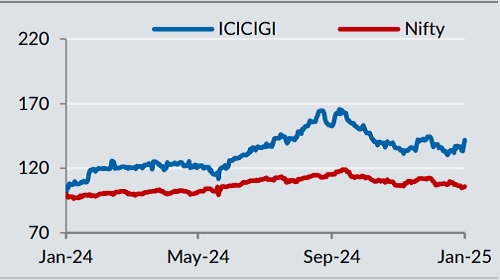

Stock performance

We maintain ADD rating on ICICIGI with a revised price target of Rs 2150:

We value ICICIGI at 38x FY26 P/E for an FY24-27E EPS CAGR of 20%. At our target, the implied FY26E P/B is 6.7x for an FY25/26/27E RoE of 17.2/17.4/17.6%.

Other Highlights (See “Our View” above for elaboration and insight)

* Net premiums earned: Net premiums earned grew 0.4%/17.2% QoQ/YoY, driven higher sequentially by growth in Marine and Motor segments.

* Loss ratios: Overall loss ratio has improved by -560 bps QoQ to 65.8%, where except Fire and Marine all segments have evolved positively QoQ

* Expense control: Expense ratio rose 490bps QoQ to 34.7% where opex fell - 5.6% QoQ but commission and brokerage rose 37.6% QoQ

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

.jpg)