Neutral Mahindra Lifespaces Ltd for the Target Rs. 447 by Motilal Oswal Financial Services Ltd

Strong operations with muted financial performance

No competitions in 1HFY25

* Mahindra Lifespaces (MLDL) achieved bookings of INR7.5b, rising 89% YoY and 67% QoQ (in line with estimates). In 1HFY26, presales stood at INR12b, declining 15% YoY.

* Sales volume in 2QFY26 stood at 1.2msf, rising 121% YoY and 102% QoQ. In 1HFY26, the booking area stood at 1.8msf, rising 3% YoY.

* Blended realization in 2QFY26 declined 14% YoY and 17% QoQ to ~INR6,427psf.

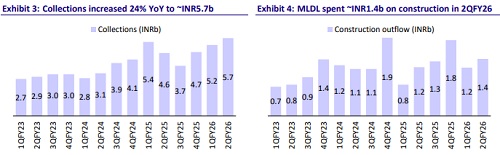

* Quarterly collections rose 24% YoY and 10% QoQ to INR5.7b.

* In 2QFY26, MLDL added projects with a GDV of INR17b, rising 2.6x YoY. In 1HFY26, the company added projects with a GDV of INR52b, rising 2.5x YoY.

* Revenue from the IC&IC business stood at INR990m, declining 11% YoY. Total leased area stood at 16.9 acres.

* MLDL is a net cash company, and the net cash-to-equity ratio stands at 0.17x.

* P&L performance: Revenue came in at INR176m, rising 131% YoY but declining 45% QoQ (80% below estimate). In 1HFY26, revenue came in at INR495m, declining 75% YoY.

* In 2QFY26, operating loss was INR525m vs. a loss of INR478m in 2QFY25. In 1HFY26, operating loss came in at INR1.1b vs. a loss of INR893m YoY.

* PAT stood at INR479m (4x above the estimate), against a loss of INR141m YoY due to a higher share of profit realization from its JV’s at IC & IC business. In 1HFY26, PAT came in at INR991m vs. a loss of INR13m YoY.

Key highlights from the management commentary

* MLDL is strengthening its presence in MMR, Pune, and Bengaluru with a focus on large-scale, high-impact projects like Bhandup.

* The company is pursuing outright land buys, JDAs, and redevelopment while enhancing brand positioning and execution capacity.

* In 1QFY26, the company launched New Haven (Bengaluru) and Citadel (Pune) with a combined GDV of INR4.5b, both ~80% sold.

* In 2QFY26, the company successfully launched Marina64 (MMR, 50% sold) and Lakewoods (Chennai, 100% sold).

* Upcoming launches include Hopefarm (Bengaluru, INR18b), Mahalaxmi (INR16.5b), Citadel Phase 3 (INR9.8b), and Bhandup Phase 1 (~INR25-30b).

* The Saibaba Nagar redevelopment project in Borivali (INR18b) is facing a road alignment issue and is now expected to be launched by 2HFY27.

* MLDL added six new projects in FY26 with a total GDV of INR95b, bringing its total pipeline to INR463b as of Oct’25.

* Of this, INR200b relates to Bhandup/Thane, INR145b to redevelopment, INR35b to Rajasthan and Murud, and ~INR83b to outright projects.

* The company remains net cash positive with a cash/equity ratio of 0.17x, OCF of INR4.3b, and land spends of INR3.8b in 1HFY26.

* The balance sheet remains healthy post the rights issue, and MLDL is targeting cumulative sales of INR95b over the next five years.

Valuation and view

* MLDL posted strong booking growth and is well-positioned to improve this momentum, given the healthy project pipeline across its key markets.

* We have incorporated the recent rights issue proceeds of INR15b and accordingly adjusted the equity, debt, and cash components.

* We value the residential business on a DCF basis, with a WACC of ~14%, translating into INR66b. The valuation reflects recent BD additions and lowerthan-expected cash deployment toward land.

*We reiterate our Neutral rating on the stock with a TP of INR447, reflecting a 10% upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412