Sell Deepak Nitrite Ltd for the Target Rs. 1,530 by Motilal Oswal Financial Services Ltd

Muted operating performance amid macro challenges

Operating performance in line with estimate

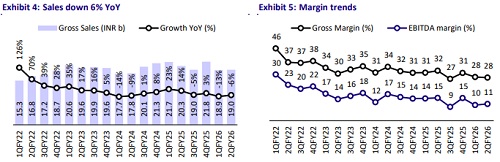

* Deepak Nitrite (DN) reported a weak operating performance, with EBITDA declining 31% YoY to INR2b in 2QFY26. Gross margin contracted 440bp YoY to 27.6% and EBITDA margin contracted 390bp, driven by macro headwinds, pricing trends, and tariff developments.

* Amid a volatile geopolitical environment and shifting global trade dynamics, we expect a recovery in 2H, led by the ramp-up of new capacities, improved volumes from market seeding of new products and SKUs, and the company’s strategic initiatives to pivot into non-traditional geographies and debottleneck certain capacities.

* We broadly retain our estimates for FY26/FY27/FY28 and estimate a CAGR of 6%/12%/8% in revenue/EBITDA/PAT over FY25-28E. We value the stock at 25x FY27E EPS to arrive at our TP of INR1,530. Reiterate Sell.

Phenolics and Intermediates segments continue to face margin headwinds

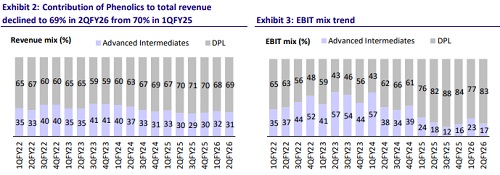

* 2Q revenue declined 6% YoY to INR19b (est. INR19.3b), primarily due to a 3% and 8% decline in the Advanced Intermediates and Phenolic segments to INR5.9b/INR13.3b.

* Gross margin came in at 27.6% (down 440bp YoY), while EBITDAM stood at 10.7% (down 390bp YoY). Employee costs as a % of sales stood at 5.2% (vs. 4.8% in 2QFY25), while other expenses stood at 11.6% (vs. 12.6% in 2QFY25).

* EBITDA declined 31% YoY to INR2b (our est. INR2b), while EBIT for the Advanced Intermediates/Phenolic segments declined 47%/52% YoY to INR1.1b/INR230m.

* EBIT margins for Advanced Intermediates/Phenolic contracted 390bp/630bp to 3.9%/8.6% in 2QFY26.

* Reported PAT declined 39% YoY to INR1.2b (in line with est.), down 39% YoY. ? In 1HFY26, its revenue/EBITDA/Adj. PAT declined 10%/35%/42% to INR38b/INR4b/INR2b.

Highlights from the management commentary

* Guidance and outlook: The global environment remains difficult due to rising geopolitical tensions and trade barriers. While near-term conditions are challenging, the company expects 2H performance to be better, led by the ramp-up of new capacities and the launch of new products. Key projects are progressing well, with the Nitric Acid unit and Methyl isobutyl ketone (MIBK) and Methyl Isobutyl Carbino (MIBC) unit expected to be operational by 4QFY26.

* Strategic initiatives: The company is addressing the macro headwinds by expanding into new geographies, increasing its focus on the Indian business, investing in upstream capabilities, debottlenecking capacities, and protecting wallet share. Profitability pressures are being contained through diversified energy sourcing, overhead control, and continued cost optimization.

* Polycarbonate: The company’s fully integrated Polycarbonate complex (India’s first) is progressing as planned and is targeted for commissioning in Jan-Mar’28, supported by Petronet LNG tie-ups and strong regulatory tailwinds. While upstream capacity is being built, the company is already supplying polycarbonate-based compounds to electronics and auto customers to secure early validation. This will enable a seamless, cost-efficient integration once domestic polycarbonate production comes online.

Valuation and view

* Despite capacity expansion, new projects, process optimization, and a focus on innovation and sustainability, we expect DN’s performance to be weighed down by industry-wide challenges. Persistent oversupply from China and rapidly evolving geopolitical developments continue to exert pricing pressure and weigh on operational performance.

* We broadly retain our estimates for FY26/FY27/FY28 and estimate a CAGR of 6%/12%/8% in revenue/EBITDA/PAT over FY25-28E. We value the stock at 25x FY27E EPS to arrive at our TP of INR1,530. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)