India Strategy : 2QFY26 earnings review – Steady quarter by Emkay Global Financial Services Ltd

Earnings broadly held up in the just concluded 2QFY26 earnings season, with some acceleration in PATg. It was, however, skewed toward low-PE sectors like Energy and Materials. We expect an earnings recovery in 2HFY26 on the back of consumption bounce-back, and one key positive is that the asking rate for Nifty is a moderate 9%. Valuations are now stretched with the Nifty PE of 20.6 trading at +1sd above LTA, and a worrying 45% of the consensus universe trading at >+1sd above LTA. We maintain our Nifty target of 28,000 for Sep26E and see moderate returns from here. Sector and stock selection will be key, and our top OW remains Consumer Durables. We add Radico Khaitan to our model portfolio and replace Bajaj Finance with Bajaj Finserv.

Earnings growth – greenshoots visible

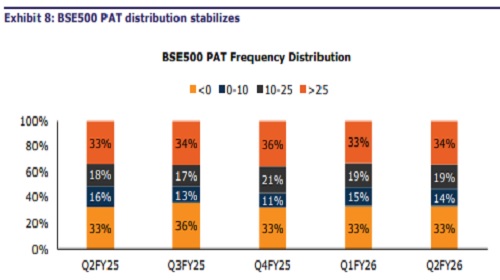

Overall trends remain mixed, with some positive trends. Nifty earnings growth remains anemic at ~9%, with some sequential improvement. Greenshoots are, however, stronger for the broader market, with the BSE-500’s PATg jumping to 17% YoY (vs 11% in Q1FY25). The frequency distribution for PATg in the BSE-500 keeps its barbell shape with little sequential change, with ~34% of the companies delivering +25% and 33% delivering negative growth.

Strong internals

The good news is that BSE-500’s topline growth (ex-BFSI) bounced to 9%, the highest print in 9 quarters. EBITDA margins were stable sequentially at 17.4%, with no direct positives from the weak WPI and commodity prices coming through. A low base drove a 160bp YoY EBITDAM improvement, driving 20% EBITDA growth. The Nifty followed similar trends – topline growth accelerated from 5.4% to 8.9%; EBITDA margins jumped by 100bps YoY (though down by 6bps sequentially), driving a strong 15.2% YoY EBITDAg. BSE500’s H1FY26 OCF/EBITDA fell from 73% to 68% (YoY), driven by Energy (107% to 91%). FCF/PAT fell from 66% to 49% (YoY), again driven by Energy. Capex (ex-BFSI) declined 3% YoY.

Sectoral skew pads aggregate numbers

Materials, Energy, Discretionary, and Healthcare were the standout performers. The issue for the broader market is that the top performing sectors are low PE and that growth is a one-off, driven by a low base. Staples, Financials, and IT remained the key laggards, with 2-7% YoY PATg. Industrials delivered a weak 7% YoY decline, but this was skewed by Indigo’s one-off forex losses – the rest of the sector delivered 13% YoY growth. The sectoral skew remains a worry for the broader market, as the high-growth sectors in 2QFY26 (Materials and Energy) are low-PE sectors with low long-term sustainability.

Positive outlook remains

Forward earnings revisions reflect significant optimism. For the first time in 12M, consensus estimates for FY26/FY27 were revised up (0.8% from 31-Oct-25). Moreover, the implied PATg for H2FY26 is an undemanding 7.8% vs 9.5% in 1HFY26. We are expecting a strong 2H consumption recovery, which is an incremental positive for earnings – however, it is likely to impact only a narrow segment of the market (Consumer Discretionary, mainly).

Valuations remain challenging for the market. The Nifty PER at 20.6 trades at ~+1sd above LTA, after the recent 4.3% rally since 1-Oct-25. A worrying 45% of the consensus universe (stocks with 5+ analyst coverage) now trades at >+1sd, up from 37% in May25. This is more moderate for the BSE-200 at 32%, indicating that the valuation froth is more in the SMID space. The SMID PE ratios remain elevated, with the NSE SmallMidCap 400 trading at a TTM PE of 40.4, 19% above LTA.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354