Nifty immediate support is at 26050 then 25950 zones while resistance at 26250 then 26325 zones - Motilal Oswal Wealth Management

Nifty Technical Outlook

NIFTY (CMP : 26146)

Nifty immediate support is at 26050 then 25950 zones while resistance at 26250 then 26325 zones. Now it has to hold above 26100 zones for an up move towards 26250 and 26325 zones while supports can be seen at 26050 then 25950 zones

Bank Nifty Technical Outlook

BANK NIFTY (CMP : 59711)

Bank Nifty support is at 59500 then 59250 zones while resistance at 60000 then 60114 zones. Now it has to hold above 59500 zones for an up move towards 60000 then 60114 marks while on the downside support is seen at 59500 then 59250 levels.

Sensex Technical Outlook

Sensex (CMP : 85188)

Sensex support is at 84800 then 84600 zones while resistance at 85500 then 85700 zones. Now it has to hold above 85000 zones for an up move towards 85500 then 85700 zones while on the downside supports are seen at 84800 then 84600 levels.

Midcap100 Index Technical Outlook

* Bounce up from 50 DEMA support zones and formed a small bodied candle with long lower shadow.

Smallcap250 Index Technical Outlook

* Hovering around 50 DEMA hurdle zones.

Technical Stocks On Radar

TVS Motor Company Ltd

* Range breakout at “ATH” zones.

* Respecting 50 DEMA support zones.

* High volumes on up moves.

* RSI indicator positively placed.

* Immediate support at 3600.

PNB Housing Finance Ltd

* Range breakout on daily chart.

* Strong bodied bullish candle.

* Surge in traded volumes.

* RSI momentum indicator rising.

* Immediate support at 930.

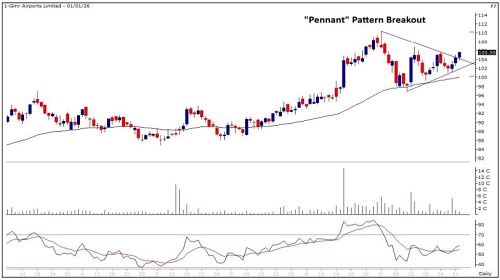

Technical Chart Pattern for the Day

* Bullish “Pennant” pattern formation; Support : 101 , Resistance : 110

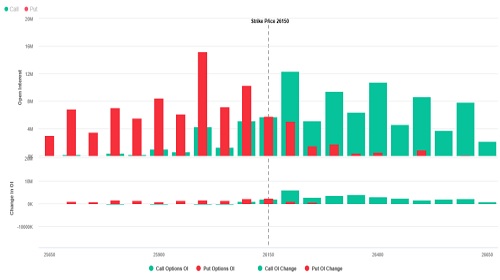

Nifty : Option Data

* Maximum Call OI is at 26200 then 26300 strike while Maximum Put OI is at 26000 then 26100 strike.

* Call writing is seen at 26200 then 26250 strike while Put writing is seen at 26150 then 26100 strike.

* Option data suggests a broader trading range in between 25700 to 26500 zones while an immediate range between 26000 to 26300 levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 26050 then 25950 zones while resistance at 26250 then 26325 zo...