Bank Nifty ends slightly higher at 59,700 amid mixed global cues - ICICI Direct

Nifty :26146

Technical Outlook

Day that was…

Indian equity benchmarks kicked off the first trading session of the calendar year 2026 on a positive note, closing marginally higher at 26,159 (+0.13%), despite muted global cues. Broader markets outperformed the frontline index, with the Nifty Midcap gaining 0.45%, reflecting selective risk appetite. Sectorally, barring FMCG, all indices ended in positive territory, with Auto, Realty, and Metals emerging as key outperformers.

Technical Outlook:

* The index opened with mild optimism and remained confined within a narrow ~80-point range throughout the session amid subdued volume participation. Consequently, the daily price action formed a small bear candle while maintaining higher high-low structure, indicating positive bias. This pause comes after the index swiftly retraced nearly 80% of its preceding four-day decline in a single session, supported by a sharp rebound from the rising trendline, highlighting an accelerated pace of recovery.

* Going ahead, we expect the index to gradually resolve higher and challenge the 26,300 mark, which could open the door for a move towards 26,800 in the month of January, being the measured target of the ongoing consolidation range (25,700-26,300).

* However, volatility is likely to persist amid evolving global developments and the onset of the Q3 earnings season. In this environment, buy-ondips remains a prudent strategy, as the index is expected to hold its strong support base near 25,700, which coincides with the 50-day EMA and the previous swing low, offering a favourable risk-reward for incremental accumulation in quality stocks.

Our constructive bias is outlined on the basis of following observations:

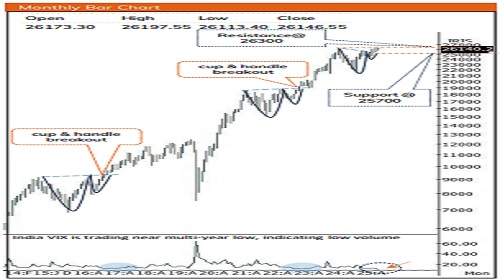

1. The US Dollar Index (DXY) has decisively slipped below 98 after failing to sustain above 100, easing currency-led headwinds. This has fuelled a sharp up-move in base metals, with Copper scaling fresh (all-time highs on MCX), while Aluminum breaks out from a three-year base, signalling the start of a structural uptrend. 2. Historically, since 2017 there have been two such instances when VIX slipped below the 9 mark, and on both occasion the Nifty has formed cup & handle formation and witnessed a positive breakout. In the current scenario too India VIX has fell around 9, with a formation of cup & handle pattern in Nifty, mirroring a similar past rhythm.(as shown in graph) 3. On expected line, USD/INR has retreated from the upper band of rising wedge. Historically, there have been five instances where a retreat in USD/INR from the upper band of this wedge averaging a ~4% decline (with a maximum drawdown of ~7%) over a two-month period was followed by the Nifty delivering average gains of >10% over the subsequent two months.

Key Monitorable for the next week:

* Quarterly earnings

* US and India trade deal

Intraday Rational:

* Trend- consolidating within the 25,700-26,300 range for the past seven weeks, highlighting a phase of range-bound activity

* Levels: Buy near 50% retracement level of its preceding two days up-move (26130-26339)

Nifty Bank : 59711

Technical Outlook

Day that was:

Bank Nifty concluded the session on a mildly positive note, settling at 59,700 (+0.2%), amid mixed global cues. The broader banking space remained supportive, with the Nifty PSU Bank Index and Nifty Private Bank Index advancing 0.4% and 0.2%, respectively, reflecting sustained sectoral strength.

Technical Outlook:

* The index kicked off the first trading session on a positive footing and oscillated within a narrow ~200-point range throughout the session. As a result, the daily price action formed a small bullish candle with a lower shadow, indicating buying interest emerging at lower levels and offering downside support.

* Importantly, the index continues to hold firmly above its recent consolidation zone of 58,500-59,500, signifies ongoing bullish stance remains intact

* Structurally, the retracement over the past four weeks has been shallow, with only 38% of the preceding four-week rally retraced, highlighting inherent strength and a healthy pause within the ongoing uptrend. Going ahead, we expect the index to gradually resolve higher and challenge its alltime high near 60,100 in the coming week.

* Within the banking space, the Nifty PSU Bank Index continues to outperform after breaking above last week’s high. The formation of higher highs-lows, along with sustained trading above its 20-day EMA, reflects strong follow-through buying and robust demand at elevated support levels. This constructive setup is likely to propel the index towards a retest of its all-time high around 8,650 in the coming weeks

Intraday Rational:

Trend- short term range breakout(58500-59500)

Levels: Buy near 50% retracement level of its previous two day up-move (59,600-60,043)

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Views on Morning Market 30 September 2025 by Dr. VK Vijayakumar, Chief Investment Strategis...