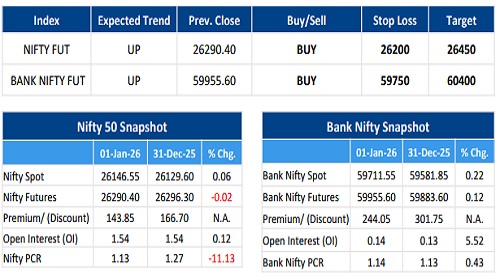

Nifty Open Interest Put Call ratio fell to 1.13 levels from 1.27 levels - HDFC Sescurities Ltd

Nifty : On The Verge Of A Breakout; Expect Fresh Momentum Above 26237

Nifty Infra Index : Triangle Breakout On The Daily Charts; Expect Further Gains

F&O Highlights

LONG BUILD UP WAS SEEN IN THE NIFTY& BANK NIFTY FUTURES

Create longs with the SL of 26200 levels.

* Nifty extended its winning streak for the second straight day, adding 16 points to close at 26,146.

* Long Build-Up was seen in the Nifty Futures where Open Interest rose by 0.12% with Nifty rising by 0.06%.

* Long Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 5.52% with Bank Nifty rising by 0.22%.

* Nifty Open Interest Put Call ratio fell to 1.13 levels from 1.27 levels.

* Amongst the Nifty options (06-Jan Expiry), Call writing is seen at 26400-26500 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26400-26500 levels. On the lower side, an immediate support is placed in the vicinity of 26200-26300 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 344 cr with their Open Interest going up by 88 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133