Macro Strategy : Emerging Markets - Poised for a Breakout by Elara Securities India

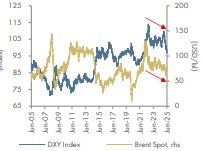

Weak dollar and soft oil prices fuel optimism: The backdrop for emerging markets (EM) assets is turning favorable with the US dollar (the DXY Index) at 96.86, sliding to its lowest level in more than 3 years. We expect DXY to be in the range of 95-99 in the next 2 quarters, putting CY25E average at 100 vs 105 projected in January. Our analysis suggests that since calendar year 2000, bearish DXY cycles have lasted 2–4 years. With a year into the downcycle, US fiscal challenges mounting, and question over Fed’s independence, we expect the weak DXY phase to last at least another 1.5 years

What makes this cycle unique is the concurrence of a weak US Dollar and soft crude oil prices. Since CY2000, a 1% fall in the DXY Index and the Brent led to ~1.5% and ~0.2% rise in the MSCI EM Index, respectively. As historical correlations break, rising US yield has had limited impact on EM assets due to rising Treasury-specific risk premium. The current conjunction of falling USD and moderating crude oil prices is a perfect milieu for EM economies, especially India. In the past 25 years, during episodes of DXY being below 100, India’s equities (MSCI India) have outperformed every other asset class, including Nasdaq and gold.

US dollar down 10% CYTD

Rotation from the US to EM equities could get fillip from further rate cuts in EM: Overall EM assets have better tailwinds than developed markets (DM). Easier financial conditions due to a softer USD with comfortable inflation outlook has provided a window for the EM central banks to cut rates. Data of the past 25 years indicates when the USD has been in the range of -1 to +1SD vs its long-term average and oil prices were lower than their historic average, on average 40% of EM central banks have cut rates by 175bp. As sentiments turn with eventual trade deals, the attractiveness of EM is expected to rise. The rising risk premium of US treasuries amid rising US fiscal deficit has led to a break in historical correlation. As such, rising US yield is no longer adversely affecting EM asset classes. A softer USD is a proxy of loosening financial conditions globally, which is evident in the returns of risk assets – EM equities (MSCI EM TRI) CYTD (Jan-June) have returned 15.3% outperforming global equities MSCI World TRI (9.5%).

Rising uncertainty to keep the USD under pressure: Given the unsustainable fiscal path of the US (as per the Senate version of the One Big Beautiful Bill Act [OBBBA]), underlying risks to US growth, the Fed staying on the rate cut path, the BoJ staying on the rate hike path, positivity surrounding the EU, we expect downside pressure to continue on the USD. However, positive news on trade deals and tariffs can arrest the one-way decline to some extent. Taking these factors into account, we expect the DXY to be in the range of 95-99 for the next two quarters, putting CY25E average at 100 vs 105 in January 2025. For the next 18 months, we do not expect any meaningful upside in the USD, as we expect the Fed to undertake 100-125bp of rate cut. For CY26E, there is a lot of uncertainty -- if the new Chair is a political-appointee -- we expect the USD to remain on sustained downside and below 100 (DXY Index).

Concurrence of falling crude and a falling dollar is rare

Historically, DXY weakness supports India’s outperformance: In each of the 8 years when the DXY fell more than 5%, the Nifty posted positive returns—with a median gain of +34%. To date in 2025, despite a 9% DXY decline and a –0.9 correlation, the Nifty is up a mere 7.5% YTD. If past patterns hold, an additional 8–10% upside appears plausible. Historically, mid and small caps have outperformed in similar setups, reflecting broader risk appetite and liquidity rotation. With FII shareholding near low since Sept 2017 and a macro backdrop resembling prior recovery cycles — rate cuts, benign inflation, and external stability — the environment remains supportive. We expect this to play out through selective high beta rally. We identify 19 large- and mid-cap stocks that combine high bull beta dynamics with supportive fundamentals and alignment to the current macro theme.

Above views are of the author and not of the website kindly read disclaimer