Sell Relaxo Footwears Ltd for the Target Rs. 370 by Motilal Oswal Financial Services Ltd

Tepid performance continues; hopeful of recovery from 4Q

* Relaxo Footwears’ (RLXF) 2QFY26 results reflect persistent volume pressure amid muted demand trends and transient impact from the GST implementation. However, margins remained resilient, with EBITDA margin stable YoY on the back of robust cost controls.

* Management indicated that the GST transition impact could continue till Dec’25, with distributors focusing on clearing old inventory. However, it remains hopeful of recovery from 4Q onward as GST rationalization improves the company’s price competitiveness (vs. unorganized players).

* We cut our FY26-28 EBITDA by 8-9% and EPS by 10-11%, considering continued weaker performance.

* Overall, we build in a CAGR of 3%/7%/12% in revenue/EBITDA/PAT over FY25-28E, but note downside risks from prolonged demand weakness.

* Despite recent corrections, valuations remain rich at ~50x FY27E P/E. We reiterate Sell with a revised TP of INR375, based on 40x Dec’27E EPS.

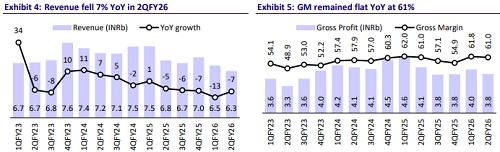

Weak performance with 7-8% decline in revenue and EBITDA

* Revenue declined ~8% YoY to INR6.3b (8% miss) in 2Q, owing to persistent weakness in mass market segments and transitory impact of the GST 2.0 implementation.

* Volume declined ~5% YoY to 41m pairs, while ASP was stable QoQ (-3% YoY) at INR151.

* Gross profit declined ~8% YoY to INR3.8b (8% miss) and gross margin was stable YoY at 61% (~25bp miss).

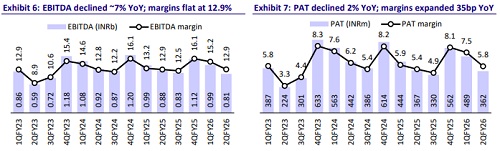

* Employee costs and other expenses declined by 6% and 8% YoY, respectively.

* EBITDA at INR812m declined ~7% YoY (13% miss). EBITDA margin was stable YoY at 12.9% (~85bp miss) due to operating deleverage.

* Other income grew 85% YoY to INR123m (25% ahead of our est. of INR98m).

* As a result, PBT at INR488m declined by a modest ~2% YoY (15% miss).

* Reported PAT at INR362m declined ~2% YoY (16% miss), with margins expanding ~35bp YoY to 5.8%.

1HFY26 performance remains disappointing

* Revenues at INR12.8b declined 10% YoY as volume fell ~10% YoY to 84m pairs, while ASP declined ~1% YoY to INR151.

* Gross profit fell ~10% YoY to INR7.9b as margins were largely flat at 61.4%.

* However, tighter cost control, employee (-5% YoY) and other expenses (- 16% YoY) cushioned profitability.

* EBITDA at INR1.8b declined by a modest 3% YoY, with margins at 14.1% expanding 100bp YoY.

* Pre-Ind AS EBITDA stood at INR1.5b (down 5% YoY), with margins at ~11.5% (up ~60bp YoY).

* Reported PAT at INR851m grew 5% YoY, as lower EBITDA was offset by higher other income (up 95% YoY) and flat depreciation YoY.

* Inventory/receivable days were stable at 85/39, while payable days increased to 37 (from 32 YoY). Core WC stood at 87 days (vs. 94 days in 1HFY25). In absolute terms, CWC declined 17% YoY to INR6b, led by 11% decline in Inventory.

* OCF (after lease payments) increased 80% YoY to INR2b, largely owing to working capital release of INR0.8b (vs. build-up of INR0.2b YoY).

* Capex rose ~20% YoY to INR782m.

* FCF generation stood at INR1.2b (vs. modest INR0.4b in 1HFY25), driven largely by favorable WC movement.

* For 2HFY26, we estimate a revenue/EBITDA/PAT growth of 3%/6%/12%.

Key highlights from the management commentary

* The GST rationalization on footwear (to 5% for INR2.5k) improved competitiveness of organized players such as Relaxo (vs. the unorganized market) in the mass and mid-market segments.

* However, the general trade (GT) channel was impacted by distributor downstocking to clear out old inventory. Management expects this slowness in GT to be transitory.

* EBITDA margins were stable, supported by operational efficiencies and disciplined cost control.

* Management expects demand to strengthen over the next 2-3 quarters as distribution expands and revised price inventory flows through.

* The company continues to focus on volume-led growth to regain its market share while maintaining sustainable profitability.

Valuation and view

*RLXF’s operating performance remained subdued due to weak demand in the mass and mid-market segments and transient impact of GST implementation, particularly in general trade.

* However, over the medium term, GST rationalization should improve RLXF’s competitiveness vs. the unorganized players. Further, the company’s steady focus on backend efficiencies and cost optimization should support operating margin improvement going forward.

* While the company is focused on improving its product mix (higher share of closed footwear) to boost growth in the near term, the volume revival in open footwear is equally crucial for growth and profitability.

* We cut our FY26-28E EBITDA by 8-9% and EPS by 10-11%, driven by continued weaker performance.

* Overall, we build in a CAGR of 3%/7%/12% in revenue/EBITDA/PAT over FY25- 28E, but note downside risks from prolonged demand weakness.

* Despite recent corrections, valuations remain rich at ~50x FY27 P/E for relatively subdued growth prospects. We maintain Sell rating with a revised TP of INR375 (earlier INR400), based on 40x Dec’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)