Neutral Info Edge Ltd for the Target Rs. 1300 by Motilal Oswal Financial Services Ltd

Ltd.jpg)

Steady growth amid patchy demand recovery

Margin gains likely to plateau due to continued investments

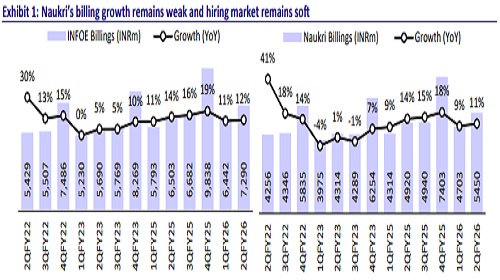

* Info Edge’s (INFOE) standalone revenue stood at INR7.4b in 2QFY26, up 13.7% YoY/1.3% QoQ, in line with our estimate of ~INR7.4b. EBITDA margin came in at 39.6% (up 6.3% QoQ/7.7% YoY), above our estimate of 37.8%. Total billings rose 12% YoY to INR7.3b. Adj. PAT was up 10% YoY to INR2.6b (vs. our est. of INR2.6b). In 1HFY26, revenue/EBITDA/adj. PAT grew 14.5%/9.4% /10.8% YoY. In 2HFY26, we expect its revenue/EBITDA/adj. PAT to grow 13.1%/8.6%/9.2% YoY. We reiterate our Neutral rating with a TP of INR1,300, implying a 6% downside.

Our view: Recruitment trends remain selective; Jeevansathi sustains breakeven

* INFOE delivered a stable 2QFY26 with revenue up 14% YoY and billings up 12%, led by broad-based growth across segments. Management highlighted no major change in underlying business momentum. Recruitment billings improved sequentially despite a still-cautious hiring environment. Tech and IT hiring remains soft, but non-tech sectors such as Retail, Manufacturing, and GCCs continue to show steady growth, with GCC hiring up ~18% YoY.

* Naukri Gulf remained a bright spot, while IIM Jobs and Naukri FastForward saw softer trends due to GTM realignments. Hiring sentiment remains lukewarm in India, though continued traction in non-tech sectors and Tier2/3 markets should help cushion some of this weakness. Overall, we believe the hiring environment (particularly in the India business) continues to be patchy.

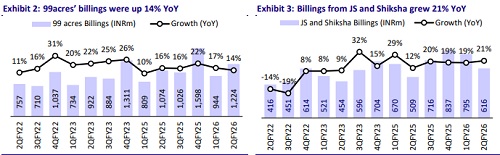

* 99acres sustained its growth momentum, supported by higher customer additions and better realization per customer. We note that broker and channel partner billings grew faster than developer billings, while traffic share improved to ~49% vs. mid-20s for peers. We think the platform’s continued investments in marketing and AI-driven matching tools may weigh on near-term profitability but should further strengthen its market leadership. We expect the recent traffic share gains to start translating into billings over the next 3-4 quarters.

* Jeevansathi maintained positive cash flow and operating breakeven for the second consecutive quarter, with healthy engagement and disciplined marketing spends. We believe the business can deliver steady profitable growth through its AI-led product upgrades and freemium model. Marketing expenses are being kept in check, allowing INFOE to pursue 20-25% growth in FY26E while sustaining breakeven profitability.

* EBITDA margin improved to 39.6% (up 190bp QoQ), aided by moderation in marketing spends. We believe margin expansion may be limited in the near term, as growth-led investments are likely to continue and are contingent on a rebound in recruitment demand. We forecast the company’s EBITDA margin at 38.0%/39.3% for FY26/FY27.

Valuations and changes to our estimates

* Our estimates are broadly unchanged. While INFOE’s businesses exhibit steady growth in recruitment and real estate, limited near-term profitability upside weighs on the outlook. In our opinion, the current valuations already reflect much of the expected growth, leaving little room for re-rating.

* We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,300. Reiterate Neutral.

Revenue in line with our estimate and beat on margins; billings up 12% YoY

* Standalone revenue stood at INR7.4b, up 13.7% YoY/1.3% QoQ, in line with our estimate (~INR7.4b).

* Total billings rose 12% YoY to INR7.3b. Billings for recruitment/99acres came in at INR5.4b/INR1.2b vs. INR4.9b/INR1b in 2QFY25.

* EBITDA margin was 39.6% (up 6.3% QoQ/7.7% YoY), above our est. of 37.8%.

* Naukri’s PBT margin was up 330bp QoQ at 55.8%, while 99acres’ PBT loss percentage increased 340bp QoQ to 20.3%.

* Adj. PAT was up 10% YoY to INR2.6b (vs. our est. of INR2.6b). This quarter included an exceptional MTM gain of INR52b (with corresponding deferred tax of INR7.4b), arising from the merger of Makesense Technologies with PB Fintech, as approved by NCLT on 9th Aug’25.

* The board has declared an interim dividend of INR2.4/share.

Highlights from the management commentary

* Revenue trajectory remains lumpy, with a significant portion of sales recognized in the final month of the quarter.

* Management noted no major changes in underlying business activity in 2Q.

* Recruitment business: Recruitment billings improved sequentially; engagement levels remained healthy despite a cautious hiring environment. Naukri India continues to be the largest contributor, accounting for ~75-80% of recruitment revenue, though hiring sentiment in this market remains lukewarm.

* Marketing spends moderated sequentially; however, the company continues to invest in ‘Job Hai’, its blue-collar platform (burn rate of ~INR400m annually).

* New business development in Tier-2/3 cities continues, though ARPU remains lower compared to Tier-1 markets.

* 99acres: Secondary market demand was strong, while primary segment showed modest growth. Traffic-time share reached 49% (vs. mid-20s for peers), reinforcing INFOE’s market leadership. Management expects traffic share gains to translate into billings with a 3-4 quarter lag.

* 99acres’ profitability remains contingent on continued high marketing spends aimed at market share gains; management expects profitability once growth accelerates to 20-25% (vs. current mid-teens).

Valuation and view

* We expect near-term recruitment growth to remain range-bound, as macro uncertainty and client caution – particularly in IT and consulting – keep overall hiring demand muted. Management’s disciplined investments in growth businesses such as 99acres and Jeevansathi are already showing progress, and we believe these businesses could scale up meaningfully over the medium term, adding to the group’s long-term value.

* We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,300. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)