Buy IRB Infrastructure Ltd for the Target Rs. 52 by Motilal Oswal Financial Services Ltd

Steady operating performance; outlook improves

* Revenue grew 10% YoY to INR17.5b in 2QFY26 (in line). Revenue included a gain from InvITs & related assets as per fair value measurement and dividend/interest income from InvITs & related assets.

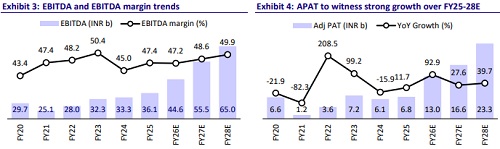

* EBITDA margins came in at 52.8% (vs. our estimate of 48.5%) in 2QFY26 (+450bp YoY and +740bp QoQ). EBITDA grew ~21% YoY to INR9.2b (8% above our estimate). APAT rose 41% to INR1.4b (in line).

* Construction revenue stood at INR8.2b (-18.4% YoY); BOT revenue stood at INR6.27b (+8% YoY). InvIT & related assets revenue stood at INR3b (INR1.3b in 2QFY25). IRB declared an interim dividend of INR0.07 per equity share.

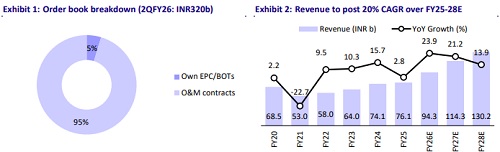

* IRB’s order book stood at INR320b (excl. GST) as of end-Sep’25, of which the O&M order book was INR305b and the EPC order book was INR15b.

* IRB posted decent results, and its emphasis on InvIT investments and asset monetization ensures a stable income stream and supports long-term value creation. A robust order book, increasing toll collections, and marquee projects such as the Ganga Expressway underpin growth. Although order inflows are currently subdued, the company anticipates a pickup in ordering momentum in 2HFY26. With recent asset monetization, IRB is now in a far better position to undertake more projects. We maintain our estimates for FY26/FY27 and roll forward our valuation to FY28. Backed by attractive valuations, a strong order book, and a robust tender pipeline driven by BOT projects, we expect revenue to register a CAGR of 20% over FY25-28E. We upgrade our rating to BUY with an SoTP-based target price of INR52.

Steady execution with resilient toll growth; strong order pipeline and capital release enhance bidding outlook

* In 2QFY26, IRB reported steady operational performance, as EBITDA growth was supported by resilient toll collections and stable contributions from its BOT and InvIT portfolios.

* The order book stood at INR320b as of Sep’25, largely led by O&M (INR305b). Further asset monetization to the Public InvIT has released capital of ~INR49b, allowing enhanced bidding capacity in the sector with the upcoming opportunity of ~INR550b.

* BOT assets and InvIT investments continued to deliver robust profitability, while construction margins moderated as some projects got completed.

* The Vadodara-Mumbai Expressway (Package 7) HAM project achieved its provisional commercial operation date (PCOD) on 31st May’25. The first annuity payment from NHAI is due in Nov’25. The project is now eligible for biannual annuity payments for the next 15 years, generating INR1.7-1.8b annually.

Key takeaways from the management commentary

* The next two years’ executable order book (EPC + O&M) is ~INR43b.

* While NHAI awarding activity remains muted, BOT bidding is expected to pick up by Dec’25.

* Construction revenue for FY26 is expected to be INR43-45b, with EPC margins of 20-23%, including O&M. The order book stands at INR320b, and the company is evaluating a bid pipeline of INR550b by Dec’25.

* The contribution from O&M revenue is expected to rise. O&M execution is likely to rise to 50% of the order book in the future (from ~25-30% currently).

* IRB aims to maintain its 25-30% market share in BOT and TOT projects, despite intense competition in EPC and HAM segments. The company is not looking to add projects from other infrastructure sectors.

Valuation and view

* The government’s focus on BOT and TOT projects presents significant opportunities. IRB’s strong order book and strategic asset monetization position it well to capture these opportunities. Moreover, NHAI’s tightened RFP norms now emphasize awarding projects to technically and financially strong contractors, thus reducing competition in the industry.

* We retain our estimates for FY26/FY27 and roll forward our valuation to FY28. Backed by attractive valuations, a strong order book, and a robust tender pipeline driven by BOT projects, we expect revenue to register a CAGR of 20% over FY25-28E. We upgrade our rating to BUY with an SoTP-based TP of INR52.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412