Buy KEI Industries Ltd for the Target Rs. 4,700 by Motilal Oswal Financial Services Ltd

Strong growth positioning; capex well-funded

Capacity boost sets stage for sustained growth

KEI Industries (KEII) has embarked on a robust expansion trajectory to consolidate its position in both domestic and export markets. The company is setting up a greenfield facility at Sanand, Gujarat, with a total investment of ~INR18b. Phase-I is likely to be commissioned in Sep’25, with full expansion scheduled for completion by 1QFY27. Once operational, the Sanand plant is expected to add a capacity of INR55-60b, driving incremental revenue of ~INR6.0b in FY26 and INR20-25b in FY27, with growth of ~20% thereafter. Following the completion of the Sanand Project, the company is committed to an annual capex of INR7.0-8.0b for the next phase of expansion in low and medium-voltage cables, which will be funded through internal accruals. The company has acquired 18 acres of land at Salarpur, Rajasthan, for these expansions and is in the process of acquiring a sizeable land at Kheda, Nadiad, Gujarat. With these investments, the company targets ~19-20% revenue CAGR over the next five years.

Retail mix increases; expansion helps to scale exports

KEII has strengthened its retail division through promotional campaigns, outdoor marketing, and sponsorships, boosting brand visibility. The share of B2C sales in overall revenue grew from ~29% in FY20 to ~52% in FY25, improving cash flow and reducing receivable periods. With a PAN-India retail presence, its network includes 26 depots, 38 marketing offices across the country and four overseas offices in the UAE, South Africa, Nepal, and Gambia, and over 2,090 active dealers/distributors as of Jun’25. Its advertising and promotion spending increased 18% YoY to INR478m in FY25, and the company spent 0.5% of its revenues on ads in FY25. We estimate ad spending to be at 0.5% of revenues over FY25-28 (19% CAGR over FY25-28E). Additionally, exports are a key focus area for driving diversification and growth. The company is strengthening its capabilities to cater to high-value international markets through direct sales, enhanced capacities, and globally recognized product certifications. Its Sanand facility will play a critical role in meeting long-length export demand, particularly for EHV cables. In FY25, exports grew 15% YoY to INR12.7b, driven by a sharp 40% rise in cable exports. The company’s export order book stood at INR7.0b as of Jun’25. Exports accounted for 13% of sales in FY25, and the company targets to increase this share to ~15-18% over the next three years.

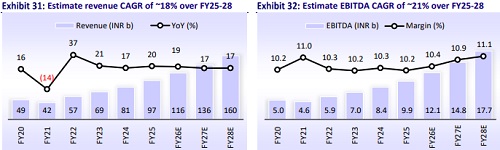

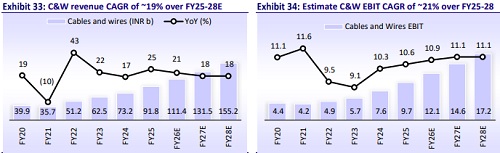

Strong growth ahead; capex well-funded through healthy cash flows

We estimate revenue CAGR at ~18% over FY25-28, led by ~19% growth in the C&W segment and ~5% growth in the SSW segment. However, EPC revenue is likely to decline ~12% p.a. during the same period, as the company is selective and has recalibrated its EPC business. EBITDA is estimated to clock ~21% CAGR, with margins expanding ~90-100bp to ~11% by FY28. PAT is estimated to post a 21% CAGR over FY25-28. We estimate a cumulative OCF of INR22.1b over FY26-28 vs. INR10.9b over FY23-25, backed by robust revenue growth and efficient working capital management, which also support its annual capex requirement of INR6-7b. Cumulative FCF is estimated at INR3.4b over FY26-28E vs a net cash outflow of INR1.0b over FY23-25. We estimate the company’s net cash to improve to INR20.9b by FY28 vs. INR15.0b as of Jun’25.

Valuation and view

KEII delivered strong performance in 1HCY25, with over 25% growth and stable margins supported by a robust demand environment, a diversified customer base, and a significant presence across domestic and international markets. Its growing focus on the retail segment and capacity expansion would continue to drive growth for the company. We value KEII at 40x Sep’27E EPS to arrive at a revised TP of INR4,700 and upgrade the rating to BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)